London, Jan 14, 2026, 09:03 GMT — Regular session

- GSK shares rose about 0.4% in early London trading.

- Summit said it will test its ivonescimab with GSK’s experimental B7-H3 cancer drug in new studies.

- Focus now shifts to GSK’s Feb. 4 results and any pipeline updates.

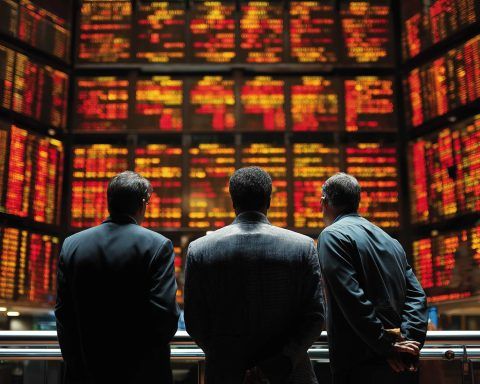

GSK shares rose in early London trade on Wednesday after Summit Therapeutics said it struck a clinical trial collaboration with the British drugmaker to test a new cancer combination. MarketScreener

The move lands as investors look for signposts on how much growth GSK can squeeze from its oncology pipeline before it reports full-year results next month. GSK has pencilled in Feb. 4 for its full-year and fourth-quarter update. GSK

Big drugmakers have been under pressure to refill pipelines as a wave of patent expiries looms for the industry, helping drive a renewed focus on deals and late-stage assets. Financial Times

Summit said the companies will evaluate its investigational ivonescimab — a so-called bispecific antibody that targets two proteins — with GSK’s risvutatug rezetecan, also known as GSK’227. Business Wire

Risvutatug rezetecan is an antibody-drug conjugate, or ADC — a targeted cancer therapy that links an antibody to a cell-killing payload — aimed at B7-H3, a protein found on some tumour cells. Business Wire

The studies will span multiple solid tumours, including small cell lung cancer, with patient dosing expected to start in mid-2026, Summit said. It said GSK will run day-to-day clinical operations and the deal is non-exclusive, with each side keeping rights to its own product. Business Wire

Summit co-CEOs Robert W. Duggan and Dr. Maky Zanganeh said the collaboration is meant to “swiftly advance” ivonescimab and broaden its combination strategy. Business Wire

GSK’s research chief Tony Wood also spoke to investors this week at the annual J.P. Morgan Healthcare Conference, pointing to a run of late-stage trial readouts and recent approvals as the company pushes for more launches. Seeking Alpha

Separately, a U.S. securities filing showed several senior managers acquired small numbers of GSK shares through dividend reinvestment and company share plans, at prices around 18.93–18.95 pounds per share. Stock Titan

Even so, the new oncology work is early and the first dosing is months away. Any safety signal or weak efficacy could cool enthusiasm quickly, and crowded cancer markets can turn on small differences in data.

For now, traders are likely to keep one eye on any further detail from the collaboration and the other on Feb. 4, when GSK is due to lay out its latest guidance and talk through near-term catalysts.