A new analysis of NASA’s Cassini data finds excess heat at Enceladus’ north pole, balancing previously known heat loss in the south. The results, published Nov. 7, 2025 in Science Advances, suggest the icy moon’s global ocean has remained stable over geologic time—strengthening its habitability. Science+3SciTechDaily+3Space+3

Publish date: November 7, 2025

What’s new

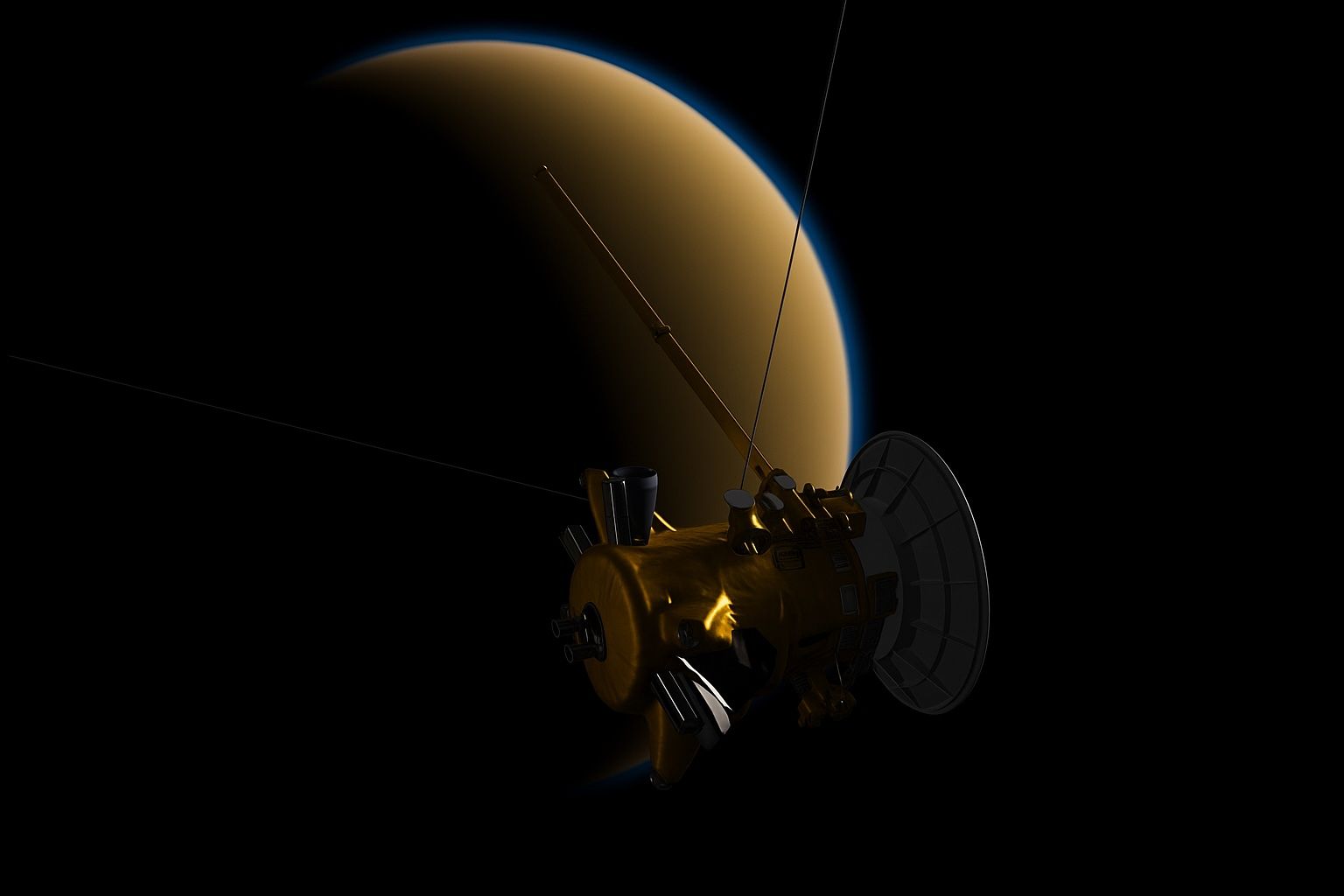

A peer‑reviewed study released today in Science Advances reports the first clear evidence of endogenic (internal) heat flow at Enceladus’ north pole. Until now, direct heat loss had only been measured at the south pole, where Cassini discovered dramatic plumes in 2005. The new result indicates heat is leaking from both poles—bringing Enceladus’ total heat loss into close balance with its tidal heating input and pointing to a thermally stable, long‑lived ocean beneath the ice. SciTechDaily+1

Why it matters

Habitability needs time. A sustained, energy‑balanced ocean below the ice makes Enceladus one of the most promising places in the solar system to search for life. The study constrains the moon’s global heat budget and shows that the energy Enceladus loses (~54 gigawatts) closely matches what models predict it gains from tidal flexing by Saturn—precisely the kind of long‑term stability biochemistry likes. SciTechDaily+1

How scientists found the hidden heat

Researchers compared Cassini’s Composite Infrared Spectrometer (CIRS) measurements of Enceladus’ north polar region during polar winter in 2005 and summer in 2015. The surface was about 7 kelvin warmer than expected, a telltale sign of heat leaking from the ocean below through the ice shell. The team derived a north‑polar conductive heat flow of ~46 milliwatts per square meter, which—when combined with the south‑polar loss—yields a global heat loss of ~54 GW, in line with 50–55 GW expected from tidal heating. SciTechDaily

Key numbers at a glance

- North‑polar heat flow: ~46 mW/m² (surface ~7 K warmer than passive models predict). SciTechDaily

- Total global heat loss: ~54 GW (north + south poles). Space

- Ice thickness:20–23 km at the north pole; ~25–28 km global average. SciTechDaily+1

- Journal & DOI: Science Advances, “Endogenic heat at Enceladus’ north pole,” 10.1126/sciadv.adx4338 (Nov. 7, 2025). SciTechDaily+2Phys.org+2

What this says about habitability

Enceladus already checks the big boxes: liquid water, chemistry (including phosphorus and organics previously detected in ejected ice grains), and energy. Today’s heat‑budget result adds the crucial fourth: stability. With energy input and output in balance, the subsurface ocean can plausibly remain liquid over geologic timescales—extending the window in which life could emerge or persist. SciTechDaily+1

Voices from the research

Lead author Georgina Miles (Southwest Research Institute / University of Oxford) emphasized that understanding Enceladus’ long‑term energy availability is key to evaluating whether it can support life. Corresponding author Carly Howett (Oxford / Planetary Science Institute) called the result “really exciting” because it supports Enceladus’ long‑term sustainability—a prerequisite for biology. Phys.org+1

Method details and new constraints

- Thermal remote sensing: The team used seasonal temperature changes to isolate the tiny “excess warmth” from conductive heat rising through the ice rather than day‑night effects. SciTechDaily

- Independent ice‑thickness estimates: From the thermal signal, researchers inferred ice‑shell thickness (20–23 km north; ~25–28 km global)—numbers that align with, but are independent of, estimates from gravity and libration modeling. That matters for planning future missions that might sample plume jets or even access the ocean. SciTechDaily+1

Context: from south‑pole plumes to a global picture

Cassini’s 2005 discovery of south‑polar plumes made Enceladus the archetype of an “ocean world.” The new north‑polar heat detection closes the loop: heat isn’t just blasting out at the south; it also bleeds quietly through the north, indicating a global energy balance that could keep the ocean from freezing—or boiling—over immense spans of time. Space

What’s next

A European Space Agency mission concept targeting Enceladus in the 2040s is under consideration, with scientists weighing the trade‑offs between sampling south‑polar plumes and attempting riskier surface work. The fresh thermal constraints and ice‑shell thickness estimates provide a sharper roadmap for instruments and trajectories aimed at habitability and biosignature detection. Space

Media coverage & primary sources (Nov. 7, 2025)

- SciTechDaily (University of Oxford post): Overview with figures on heat flow, energy budget, and ice thickness. SciTechDaily

- Space.com: News analysis confirming the 46 mW/m² heat flow, ~54 GW global loss, and 20–23 km / 25–28 km ice‑thickness estimates; includes mission context. Space

- Phys.org: Summary linking to the Science Advances paper and quoting the lead researchers on long‑term ocean stability. Phys.org

- Science Advances (abstract): “Endogenic heat at Enceladus’ north pole,” DOI: 10.1126/sciadv.adx4338. Science

- The Independent: Evening coverage highlighting the habitability implications and publication details. The Independent

Bottom line

Heat leaking from both poles means Enceladus’ ocean is likely stable—not a fleeting puddle under ice, but a persistent sea with energy and chemistry to match. That significantly strengthens the case for habitability and raises the stakes for the next generation of missions to this small moon with outsized potential. SciTechDaily+1

Editor’s note: This article synthesizes research findings and coverage published on November 7, 2025, and is formatted for Google News/Discover distribution.