New York, January 15, 2026, 12:06 (EST) — Regular session

- ISRG slipped roughly 1% following Intuitive’s warning on slower da Vinci procedure growth in 2026

- The company preannounced $2.87 billion in revenue for the fourth quarter and projects $10.06 billion for 2025

- UBS maintained its Neutral rating, with investors turning their attention to the Jan. 22 results for clearer guidance

Intuitive Surgical shares dropped once more on Thursday, continuing a selloff sparked by the company’s weaker growth forecast for procedures involving its da Vinci surgical robot.

The stock slipped roughly 1% to $541.08 in midday trading, following a 2.7% drop on Wednesday.

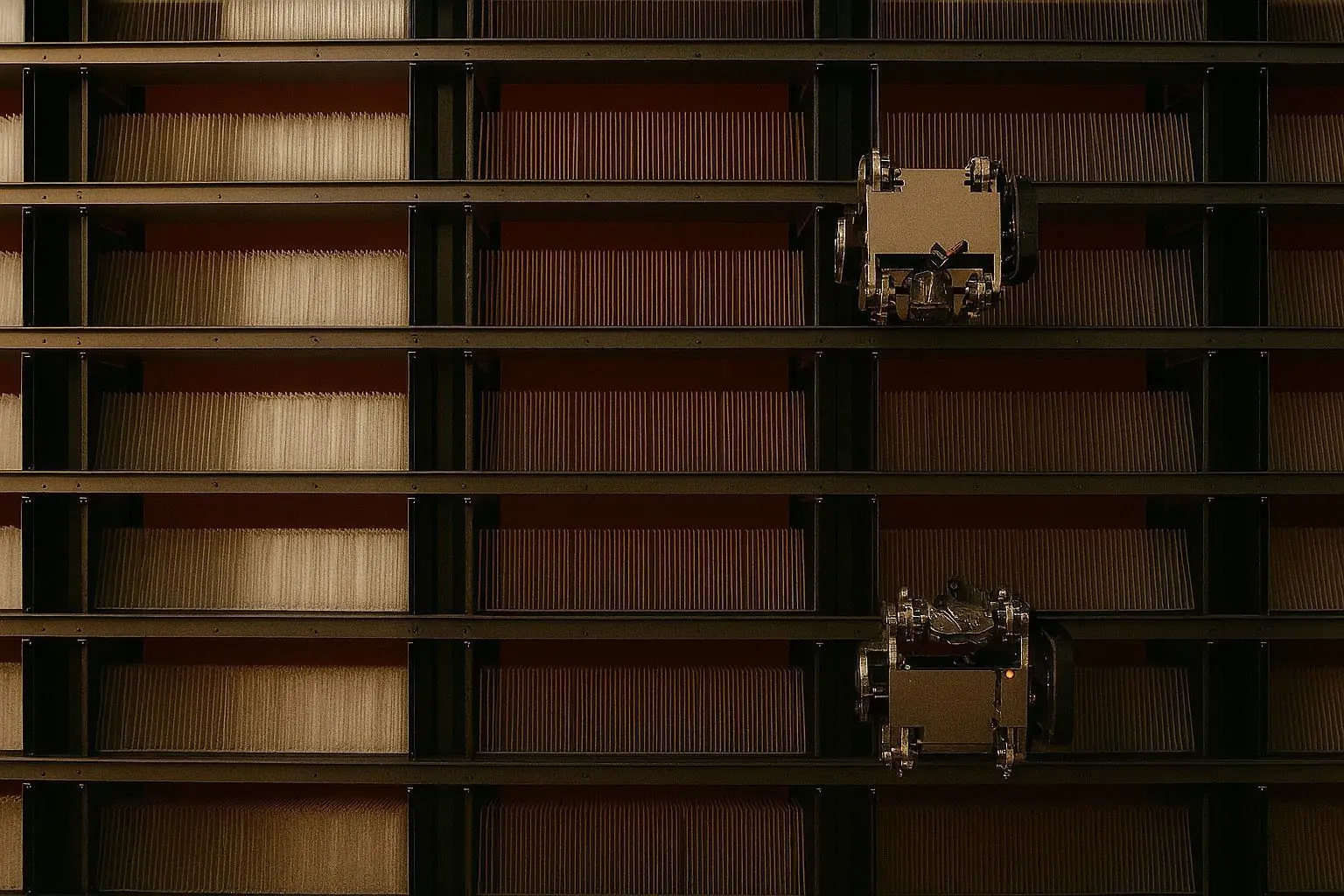

The procedure forecast is crucial because every da Vinci surgery drives repeat sales — the single-use instruments and accessories hospitals need for each operation. If that volume dips, the growth story shrinks, even if robot deliveries remain steady.

Investors are weighing how quickly Intuitive can roll out its latest da Vinci 5 system amid rising competition as rivals ramp up their robotic-surgery programs. The company’s full fourth-quarter report is set for release next week.

Intuitive projects global da Vinci procedures will climb roughly 13% to 15% in 2026 compared to 2025. The company also revealed preliminary Q4 procedure growth near 18% across both da Vinci and its Ion platform, with da Vinci procedures rising about 17% and Ion surging 44%. During the quarter, Intuitive placed 532 da Vinci systems, including 303 of the da Vinci 5 models. https://www.nasdaq.com/press-release/intui…

The company estimated preliminary fourth-quarter revenue at roughly $2.87 billion, marking a 19% increase from last year. For full-year 2025, it expects revenue around $10.06 billion, up 21%. Instruments and accessories revenue — the consumables linked to procedure volume — reached about $1.66 billion in the quarter, while systems revenue came in near $786 million. Intuitive also highlighted a $70 million foundation contribution included in fourth-quarter expenses. https://markets.businessinsider.com/news/s…

Chief Executive Dave Rosa said the company was “pleased with our strong performance in the final quarter of 2025 and the full year,” highlighting that over 3.1 million da Vinci procedures were performed during 2025. https://www.globenewswire.com/news-release…

ISRG slipped 2.68% to close at $546.76 on Wednesday. Its medtech rivals, Medtronic and Stryker, ended the day with gains. https://www.marketwatch.com/data-news/intu…

UBS held firm on its Neutral rating and $600 price target for ISRG. Analyst Danielle Antalffy described the 2026 da Vinci procedure guide as “conservative given ISRG’s historical track record,” even though system placements exceeded expectations. https://www.investing.com/news/analyst-rat…

That said, the outlook isn’t without risks. Procedure growth could falter if hospitals cut back spending, case volumes dip, or pricing pressures from competitors hit systems or consumables. The company also noted these results are preliminary and unaudited.

Intuitive’s next big date is Jan. 22, when it reports full Q4 results. Investors will zero in on 2026 procedure drivers, margins, and the pace at which da Vinci 5 adoption is boosting utilization.