New York, Jan 17, 2026, 13:22 EST — Market closed.

- Rosenblatt Securities kicked off Buy ratings on Rigetti (RGTI) and Quantum Computing Inc (QUBT), according to a report.

- IonQ (IONQ) jumped 6.8% Friday. Rigetti climbed 3.7%, while QUBT increased 4.0%. D-Wave Quantum (QBTS) edged up 0.5%.

- With a holiday-shortened week ahead, investors face thin liquidity—a common issue in these small-cap stocks.

Rosenblatt Securities analyst John McPeake kicked off coverage on Rigetti Computing and Quantum Computing Inc, handing both Buy ratings, Barron’s reported. The quantum computing sector stays under the spotlight, despite ongoing skepticism about extended timelines and scant near-term revenue. “Rigetti does indeed need to get their error rates down to be more competitive,” McPeake noted. Barron’s

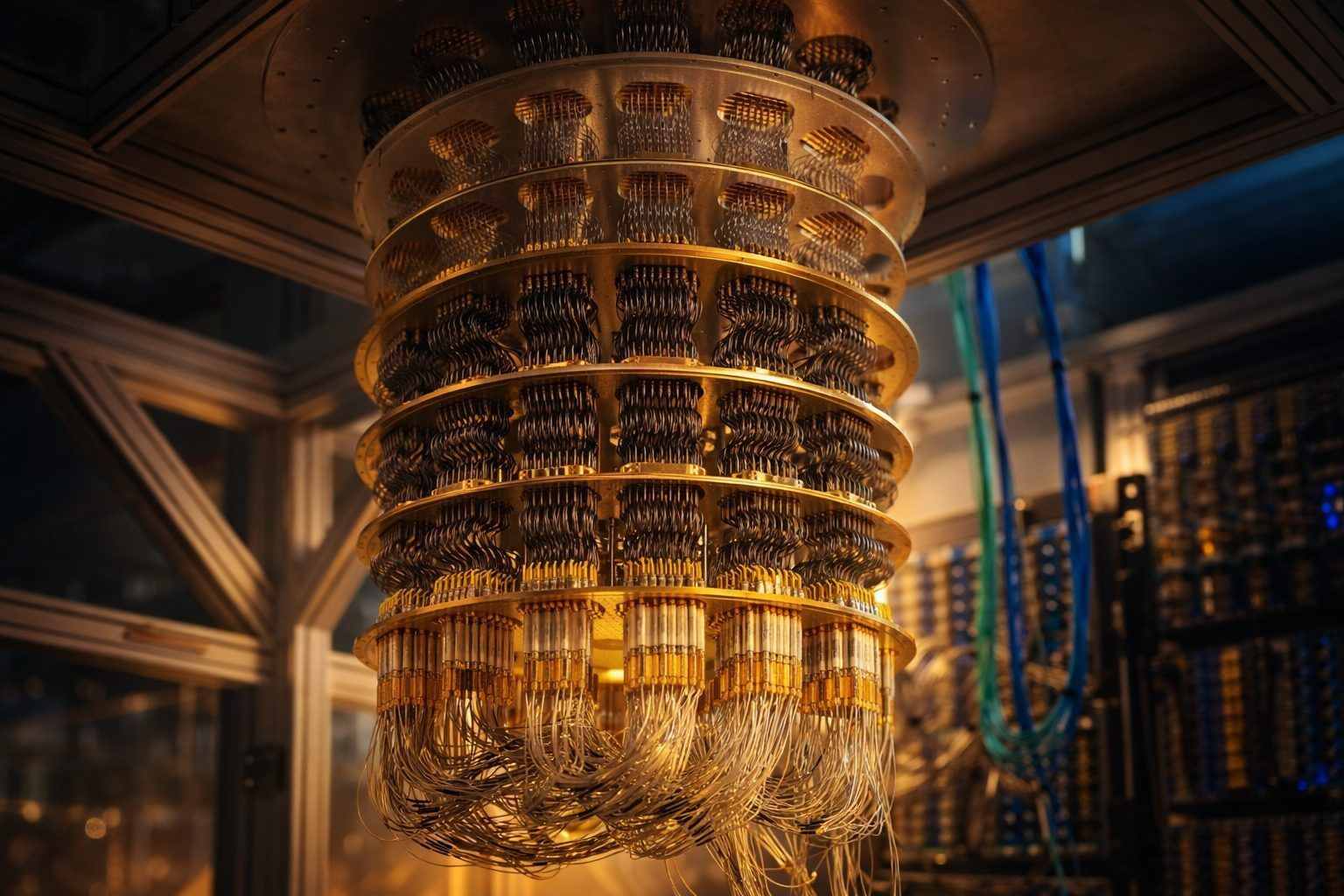

Quantum computing uses quantum bits, or qubits, to tackle problems beyond the reach of classical computers. But in the market, that potential is tough to value. Stocks in this space usually move on technical breakthroughs and funding rounds, rather than consistent profits.

It matters now since these stocks react sharply to minor cues. A research note, a slight change in a product timeline, or even one customer mention in a press release — all can hit harder than in larger tech firms.

On Friday, IonQ jumped 6.8% to close at $50.80. Rigetti climbed 3.7%, finishing at $25.62. Quantum Computing Inc pushed higher by 4.0%, ending the day at $12.70, while D-Wave Quantum inched up 0.5% to $28.83.

Rigetti has flagged delays with its next milestone. On Jan. 9, the company announced it now expects general availability for its 108-qubit Cepheus-1-108Q system around the end of Q1 2026. The hold-up comes as it focuses on achieving a higher “two-qubit gate fidelity,” which gauges the precision of quantum operations. Nasdaq

Quantum Computing Inc is making a push to secure more immediate commercial assets. On Jan. 12, it announced it had been named the stalking horse bidder — meaning it sets the minimum price — for certain remaining Luminar Technologies assets, valued at roughly $22 million, pending court approval and an auction. CEO Yuping Huang said this move highlights the company’s “conviction in the strategic fit” of those assets. Quantum Computing Inc.

The analyst call came amid a packed investor-marketing schedule. Rosenblatt’s “Quantum Computing Series” on Friday featured sessions with IonQ, Rigetti, and Quantum Computing Inc execs, all moderated by McPeake, per the firm’s agenda. rblt.com

Yet the downside risk looms large with this group. Delays tend to pile up, capital demands resurface fast, and court-supervised sales often attract higher bids that can alter both terms and timing.

Next week’s watch list is tight and unforgiving: track follow-through on the broker call, any new filings, and if companies stick to or tweak their timelines once they face investors again. The initial test is straightforward — do the moves hold up when volume picks back up.

U.S. markets will be closed Monday, Jan. 19, in observance of Martin Luther King Jr. Day. Trading resumes Tuesday. Yahoo Finance