NEW YORK — Dec. 26, 2025 — With U.S. markets shut for the weekend after a thin, post-holiday trading session, Lumentum Holdings Inc. (NASDAQ: LITE) is heading into the final three trading days of 2025 as one of the market’s standout AI-infrastructure plays—while also facing the kind of valuation and volatility questions that often follow a parabolic run. Reuters+1

Lumentum shares last traded around $390.77, down roughly 1.3% on the day, in a broader tape that barely moved: the S&P 500 slipped 0.03% to 6,929.94, the Dow dipped 0.04% to 48,710.97, and the Nasdaq Composite eased 0.09% to 23,593.10. Reuters

The market backdrop matters for Lumentum. Trading volumes have been light, and strategists continue to talk up the seasonal “Santa Claus rally” window—conditions that can exaggerate price moves in high-momentum names. Reuters

Why Lumentum stock is in focus right now

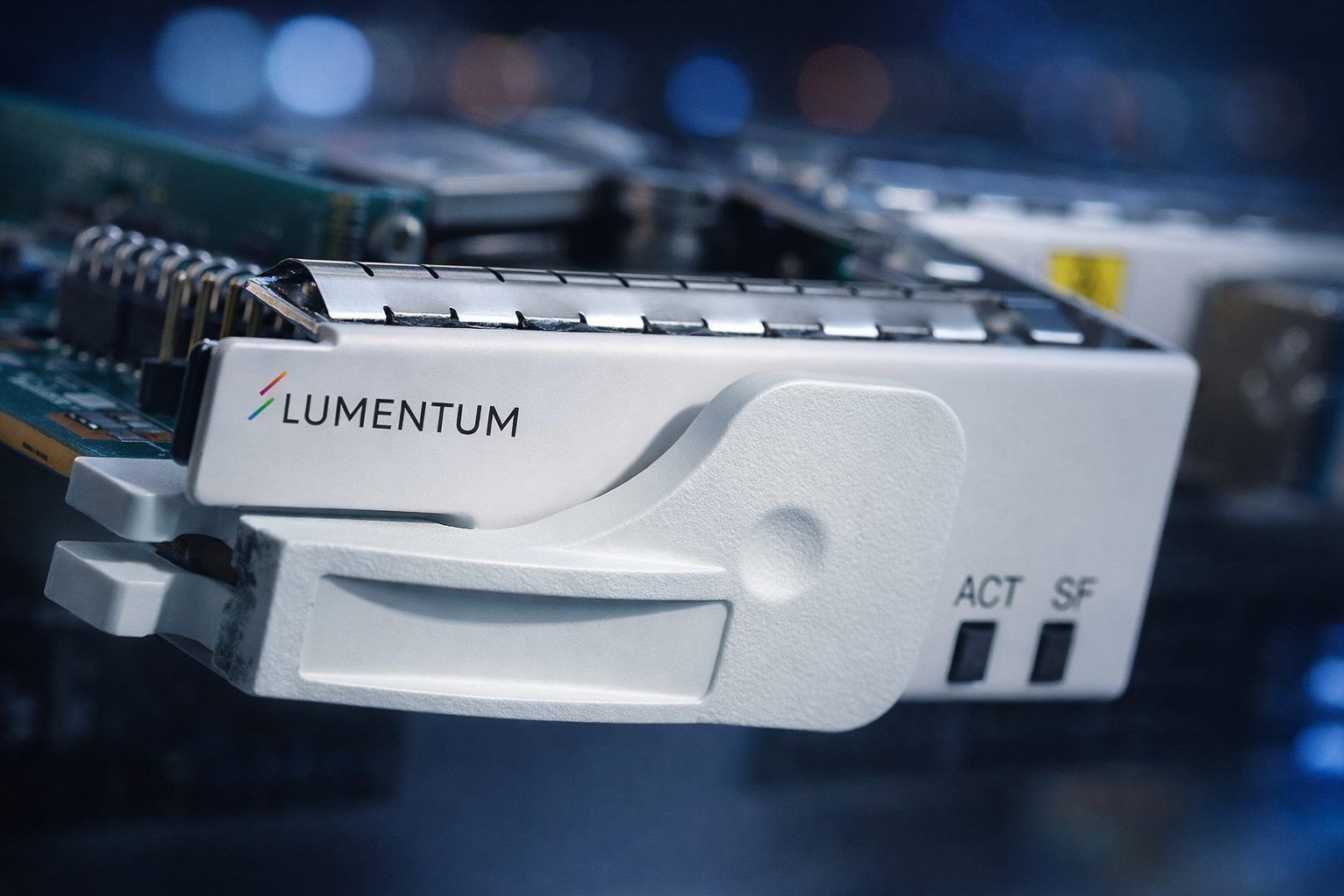

Lumentum is an optical and photonics company whose components sit in the plumbing of modern connectivity—telecom networks, enterprise networking, and increasingly, cloud and AI data centers. The company also sells lasers used in manufacturing and sensing applications. investor.lumentum.com

That positioning has turned into a major narrative in 2025: as AI workloads scale, data centers need more bandwidth, better energy efficiency, and faster interconnects—tailwinds that can flow directly into demand for optical components and next-gen networking architectures.

The result has been extraordinary share-price performance. Market trackers have listed Lumentum among the top performers of 2025, with year-to-date gains north of 370% cited by recent sector performance roundups. Seeking Alpha+1

The fundamental catalyst: a blowout quarter and big guidance

A large part of the current bullish case traces back to Lumentum’s most recent earnings and outlook.

In its fiscal Q1 2026 (quarter ended Sept. 27, 2025), Lumentum reported:

- Net revenue: $533.8 million

- Non-GAAP EPS: $1.10

- Non-GAAP operating margin: 18.7%

- Cash, cash equivalents & short-term investments: $1.1218 billion (up $244.7 million sequentially) SEC

Management framed the quarter as a momentum confirmation. CEO Michael Hurlston said revenue and profitability metrics landed at the high end of guidance and highlighted strength across data center, data center interconnect, and long-haul markets. SEC

What really got traders’ attention, though, was the next-quarter outlook. For fiscal Q2 2026, Lumentum guided to:

- Revenue: $630 million to $670 million

- Non-GAAP operating margin: 20% to 22%

- Non-GAAP EPS: $1.30 to $1.50 SEC

Investor’s Business Daily (IBD) described the guidance as a major beat versus estimates and noted management commentary around three growth “drivers”—including cloud transceivers—plus future contributions from optical circuit switches and co-packaged optics. Investors.com

“Picks-and-shovels” AI: what the Street is underwriting

The bull thesis is essentially this: while AI headlines often focus on GPUs, the infrastructure around compute—including optics—must scale too, and Lumentum is positioned in the high-performance parts of that optical stack.

That framing is showing up in analyst notes and price-target revisions.

Morgan Stanley: bullish on optics… cautious on multiples

A widely circulated note attributed to Morgan Stanley analyst Meta Marshall raised Lumentum’s price target to $304 from $190 while maintaining an Equal-Weight rating. The note argued that the AI trade has broadened from semiconductors into infrastructure—especially optics—into the first half of 2026, while also warning investors will “need to get more selective… given multiples.” TipRanks

JPMorgan: “scale-across” and multi-rail tailwinds

JPMorgan analyst Samik Chatterjee raised the firm’s target to $350 from $235 and reiterated Overweight, pointing to “scale-across and multi-rail opportunities” that could extend strong growth rates for optical names over a longer period. TipRanks

Mizuho: a Google TPU-driven optics angle

Mizuho lifted its price target to $325 from $290, citing potential benefits from Google’s expanding TPU deployments (and knock-on AI infrastructure spending) as supportive for Lumentum’s opportunity set. Investing.com

Needham: “Top Pick” framing and supply constraints

Needham raised its target to $290 from $235 and reiterated Buy after meetings with company executives, describing Lumentum as a “Top Pick” tied to data-center optics opportunities and highlighting ongoing shortages in certain laser products. Investing.com

CFRA: a new high-end target appears

A separate research item distributed through broker/newswire channels said CFRA raised its 12-month target by $100 to $450 and increased EPS forecasts for fiscal 2026 and fiscal 2027, citing valuation multiples against longer-term averages. Webull

Key takeaway for investors: price targets are moving rapidly—but they are not moving in lockstep. Depending on the data source, consensus targets can still appear well below where LITE trades now, simply because the stock has run faster than some models refresh. MarketWatch+1

Valuation and risk: the part of the story bulls don’t ignore

When a stock becomes one of the year’s biggest winners, the next question becomes whether fundamentals can keep pace with expectations.

Recent valuation commentary highlights that Lumentum has moved into premium territory versus parts of the communications components peer group. A Zacks/Nasdaq analysis pointed to a forward price-to-sales multiple notably above the broader industry and flagged a low “Value Score,” even while maintaining a bullish ranking. Nasdaq

Morgan Stanley’s caution about being “selective… given multiples” underscores the same issue: even in a strong secular trend, optics stocks can be sensitive to sentiment shifts, guidance nuances, or any sign of AI capex slowing. TipRanks

Company news: a board move tied to manufacturing and finance experience

Beyond earnings and analyst notes, Lumentum also made a governance headline in mid-December: the company appointed Thad Trent, the CFO of onsemi, to its board, expanding the board to nine members. Board Chair Penelope Herscher cited his experience in corporate finance, M&A, and manufacturing/process efficiency, while Trent pointed to Lumentum’s “foundational optics” role in AI and cloud infrastructure build-outs. investor.lumentum.com

If you’re watching LITE this weekend: what matters before the next session

Because the U.S. stock market is closed now, Lumentum won’t have a fresh “cash session” price until the next open. That doesn’t mean nothing happens—weekend positioning often gets shaped by what investors learn before Monday’s bell.

Here are the practical watch-items that could matter most for Lumentum stock (LITE) into the next session:

1) Broader market tone into the final three trading days of 2025

Reuters noted just three trading days remain in the year and described Friday’s action as a “catch your breath” pause after a strong rally, with attention on the Santa-rally period. Thin liquidity can amplify moves in momentum names. Reuters

2) Any incremental AI capex headlines

Lumentum’s rally has been tightly linked to the AI infrastructure narrative. Reuters has highlighted that continuing market upside into 2026 is widely tied to AI spending and earnings strength—supportive if it persists, risky if the story wobbles. Reuters

3) Analyst follow-through and “target chase” dynamics

Recent price target changes—from Morgan Stanley and JPMorgan to Mizuho and Needham—show how quickly Street framing can evolve as optics demand expectations rise. Another round of upgrades (or any high-profile downgrade) can move a stock like LITE quickly in low-volume conditions. Investing.com+3TipRanks+3TipRanks+3

4) Next earnings timing and what investors will demand next

Multiple market calendars currently peg Lumentum’s next earnings report for early February 2026 (often listed as Feb. 5, 2026, estimated). Investors will be watching whether Lumentum delivers on the strong $630–$670 million revenue guidepost it already set for fiscal Q2—and whether the company’s longer-run growth engines (like optical circuit switches and co-packaged optics) show tangible progress. MarketBeat+2SEC+2

The bottom line for Lumentum stock heading into Monday

Lumentum is ending 2025 with two things that rarely coexist at this scale: strong fundamental acceleration (as shown by the latest quarter and guidance) and one of the market’s most powerful AI-linked momentum trends. SEC+1

But the weekend setup also brings the classic year-end challenge for investors: liquidity is thinner, volatility is often sharper, and the stock has already moved so far—so fast—that valuation, expectations, and execution risk matter more than ever. www.reuters.com