New York, February 10, 2026, 17:43 EST — Trading after the bell.

Lumentum Holdings Inc shares dropped 2.8% to $561.13 in late trading Tuesday, following a volatile day session. The stock hit a peak of $579 and dipped to $531, with volume reaching roughly 4.8 million shares.

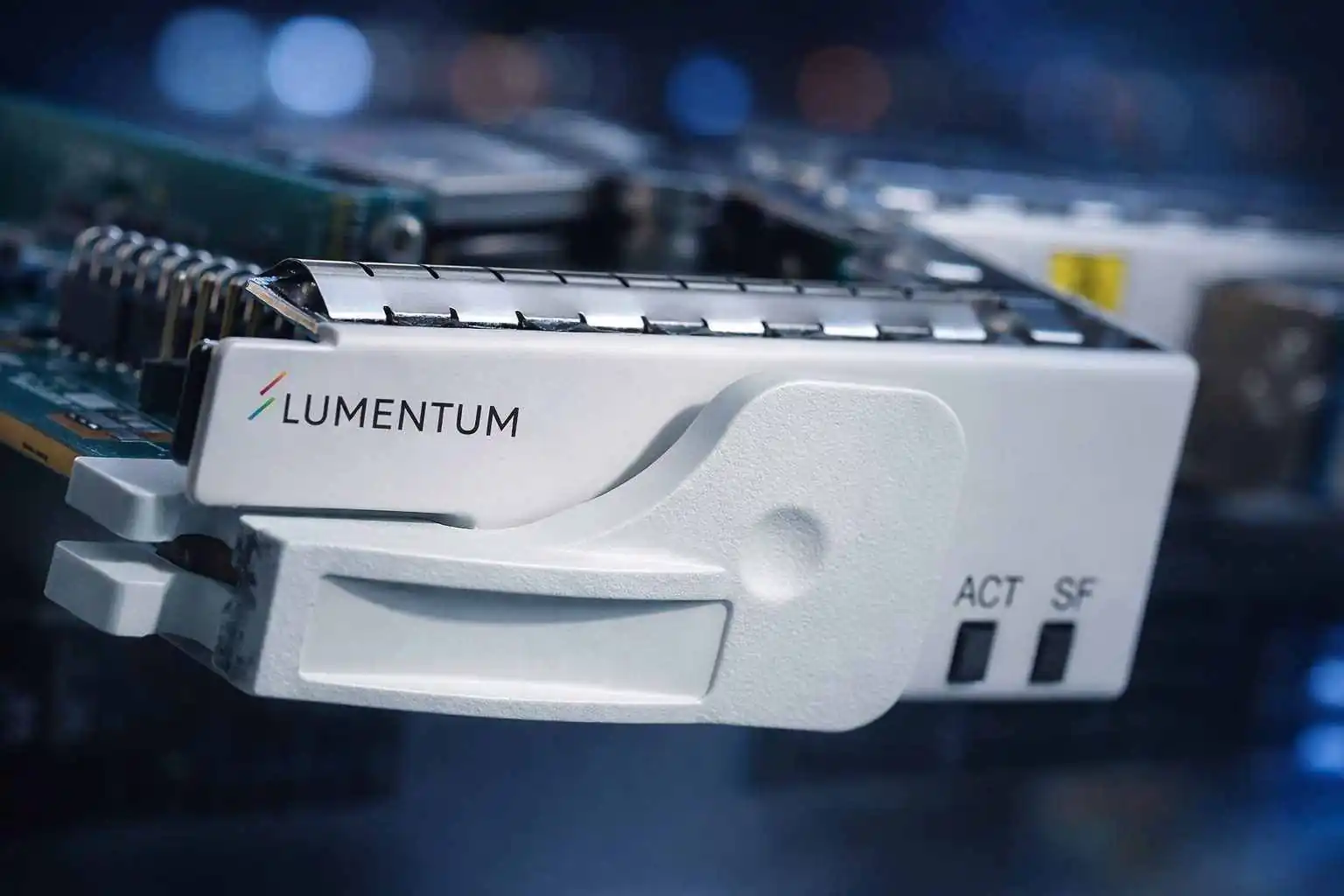

This shift carries weight: Lumentum acts as a high-beta proxy for AI-driven data-center construction, where even minor changes in order timing can quickly sway expectations. The stock, still working through a hefty rally, leaves investors wanting more detail on demand trends, supply, and pricing.

This comes right before a run of conference appearances, where management Q&A often carries more weight than any press release. For traders, these sessions double as live gut-checks on whether the growth narrative still holds up—or if it’s starting to run away from reality.

Lumentum said Tuesday its management will join Susquehanna’s 15th Annual Technology Conference on Feb. 26 for meetings, then move on to Morgan Stanley’s Technology, Media & Telecom Conference on March 2. The latter event includes a webcast, with Lumentum set for an 11:30 a.m. Pacific slot. Business Wire

Last week, the company posted fiscal Q2 revenue of $665.5 million, with adjusted earnings coming in at $1.67 per share. For the third quarter, they’re projecting revenue between $780 million and $830 million, and adjusted EPS ranging from $2.15 to $2.35. CEO Michael Hurlston pointed out that revenue landed at the top end of their target, highlighting strength in optical circuit switches—gear that directs data using light within networks—and co-packaged optics, which bring optics closer to chips to help reduce power use. Business Wire

During the earnings call, Hurlston described the company as “recognized as a foundational engine of the AI revolution,” a line that’s been pivotal in reframing the stock’s sharp re-rating in the last few sessions. Investing.com

Tuesday saw Coherent drop 5.9% in the optical and AI infrastructure sector. Broadcom gave up 1.0%, and Marvell Technology ticked 0.4% lower.

The setup isn’t one-sided. When everyone’s counting on breakneck growth, even a whiff of weaker demand, supply hiccups, or squeezed margins can hammer the shares—regardless of the bigger-picture thesis holding up.

Next session, eyes will be on whether the stock finds its footing post-pullback and if trading continues to track the broader AI-infrastructure names, instead of being driven by company news.

Eyes now turn to management’s upcoming conference appearances, with Susquehanna hosting meetings on Feb. 26. Then comes the Morgan Stanley webcast—March 2, set for 11:30 a.m. Pacific. investor.lumentum.com