Nvidia stock (NASDAQ: NVDA) closed Monday’s session just under $180 per share, logging a gain of roughly 1.5–1.7% on the day and holding near that level in early after‑hours trading. That move came even as major U.S. indexes slipped and many “Magnificent Seven” tech names traded lower, making Nvidia one of the few mega‑caps to finish in the green. Investopedia+1

The catalyst: a $2 billion equity stake in Synopsys, a deepening web of AI partnerships (including with HPE in Europe) and a fresh round of analyst upgrades and big‑picture debates about whether Nvidia is powering an AI revolution or inflating an AI bubble. Axios+4Investopedia+4Investing.com+4

Below is a detailed after‑the‑bell wrap‑up of today’s Nvidia stock move, the latest forecasts and the key arguments from both bulls and bears as of December 1, 2025, 10 p.m. EST.

How Nvidia Stock Traded Today

- Regular session close: Multiple real‑time feeds show Nvidia finishing just shy of $180, with one widely used data provider recording a $179.98 close at 4:00 p.m. EST, up about 1.7% on the day. StockAnalysis+1

- After‑hours action: Immediately after the bell, Nvidia ticked slightly higher to about $180.14 in thin trading, indicating no major after‑hours shock tied to new headlines. StockAnalysis

- Volume and range: Nvidia traded in a $173.68–$180.30 intraday range with volume around 140–150 million shares, close to its already heavy average daily volume. Investing.com+1

- Where NVDA sits in the bigger picture:

- 52‑week range: roughly $86.62–$212.19. Investing.com+1

- One‑year gain: about 30% despite recent volatility. Investing.com+1

- Market cap: around $4.3 trillion, keeping Nvidia in the running for the world’s most valuable publicly‑traded company. Finviz+1

In a session where the Dow, S&P 500 and Nasdaq all slipped and crypto‑linked stocks were hit hard, Nvidia stood out: it rose about 1.5% after announcing its expanded Synopsys partnership and equity investment. Investopedia+1

The Big Catalyst: A $2 Billion Synopsys Stake and a Deeper Design‑AI Alliance

The main headline driving Nvidia stock higher today was its deal with Synopsys (NASDAQ: SNPS), the leading chip‑design software company:

- Nvidia is taking a $2 billion equity stake in Synopsys as part of a broader, multi‑year partnership. Investopedia+3Investing.com+3Bloomberg+3

- The goal is to embed Nvidia’s accelerated computing, CUDA, Omniverse and AI models directly into Synopsys’ electronic design automation (EDA) and engineering tools, speeding up everything from chip layout to complex physics simulations. Benzinga+2Investing.com+2

- Synopsys stock jumped roughly 4–8% on the news, underscoring how investors view the tie‑up as a win for the broader AI design ecosystem. Investing.com+2Investopedia+2

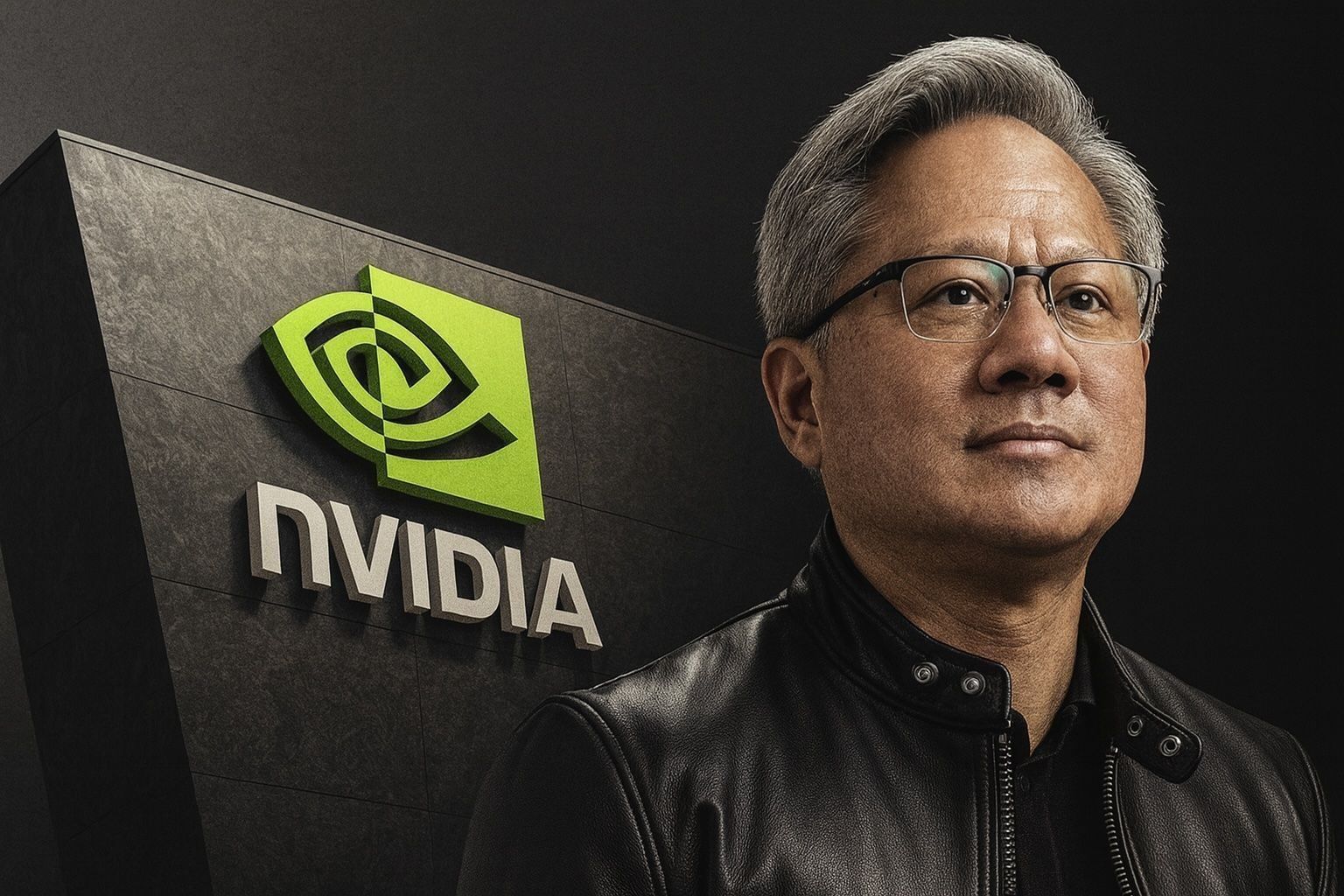

In an appearance on CNBC’s “Squawk on the Street,” Nvidia CEO Jensen Huang and Synopsys CEO Sassine Ghazipitched the partnership as a way to “re‑invent” one of the most compute‑intensive industries by moving more of the design and simulation workloads onto Nvidia’s GPU platforms. Huang stressed that accelerated computing makes it possible to run previously impractical simulations at scale, which could shorten product cycles and expand AI use cases in everything from chip design to drug discovery. Benzinga+1

Why this matters for NVDA’s stock:

- It deepens Nvidia’s moat at the very start of the semiconductor value chain: chip design.

- It creates another long‑term demand flywheel: tools optimized for Nvidia hardware make customers more likely to keep buying Nvidia GPUs.

- It complements Nvidia’s broader strategy of investing in and partnering with key players across the AI stack, from data centers to software and now EDA. Axios+1

HPE “AI Factory” Lab in Europe: Another Piece of Nvidia’s Global AI Infrastructure Push

Beyond Synopsys, Nvidia also expanded its AI relationship with Hewlett Packard Enterprise (HPE):

- A new AI factory lab in Grenoble, France, will let customers test and refine AI workloads using HPE servers and networking coupled with Nvidia accelerated computing, in a “sovereign” environment that respects European data rules. TradingView

- HPE is also planning a Private AI lab in London and broadening its Unleash AI partner program, with Nvidia GPUs forming the core compute engine. TradingView

This “AI factory” branding mirrors Nvidia’s messaging from recent earnings calls, where the company has argued that entire data centers are becoming AI factories purpose‑built around Nvidia’s architecture. Deals like the HPE lab help Nvidia:

- Show regulators that AI workloads can be deployed in controlled, region‑specific environments.

- Make its stack the default in enterprise and government AI pilots across Europe.

Investors rewarded the news: one short note on TradingView highlighted that Nvidia shares edged roughly 1.5% higher Monday morning on this partnership alone, before the Synopsys headlines added further fuel. TradingView+1

Huang Pushes Back on AI Bubble Fears and Custom‑Chip Competition

Today’s move also reflects a broader sentiment shift after a bruising stretch for AI names in November.

On CNBC, Huang addressed two big worries that have been hovering over Nvidia:

- “Is this an AI bubble?”

- Huang argued that the surge in spending from cloud “hyperscalers” isn’t speculation, but a structural shift away from CPU‑centric data centers toward GPU‑accelerated computing, driven by the limits of Moore’s Law.

- He portrayed accelerated computing as the next foundational platform for the industry, not a passing fad. Benzinga+1

- Will custom chips (like Google’s TPUs) erode Nvidia’s moat?

- Huang acknowledged that Nvidia has always faced specialized rivals but noted that EDA and complex engineering tools need a broad, programmable platform like CUDA, not single‑purpose ASICs.

- He emphasized Nvidia’s ubiquity across every major cloud provider, OEMs, on‑premise deployments and edge devices, arguing this breadth makes the company’s opportunity “much larger” than narrow AI accelerators. Benzinga+1

These remarks came after Nvidia slumped as much as 7% last week on reports that Meta is exploring more Google‑designed chips for AI workloads. Today’s bounce suggests Huang’s defense of Nvidia’s business model helped calm some of those fears, at least in the short term. Benzinga+1

Wall Street’s December 1 Verdict: Targets Move Higher, “Strong Buy” Holds

If you’re looking at Nvidia stock forecasts, today delivered a clear message from traditional Wall Street analysts: they’re still overwhelmingly bullish.

Morgan Stanley and Friends: Targets in the $250–$275 Range

A new note from Morgan Stanley raised its NVDA price target from $235 to $250 while maintaining an “overweight”rating. Based on Monday’s prior close, that implies about 42% upside. MarketBeat+2StockAnalysis+2

Other recent actions highlighted in today’s coverage include: MarketBeat+2StockAnalysis+2

- Citigroup: Buy, target lifted from $220 to $270.

- Barclays: Overweight/Buy, target raised from $240 to $275.

- JPMorgan: Buy, target increased from $215 to $250.

- Jefferies: Strong Buy, target nudged from $240 to $250.

Data compiled by StockAnalysis and MarketBeat now show:

- Average 12‑month price target: roughly $248–$259 per share, depending on the dataset. StockAnalysis+2MarketBeat+2

- Consensus rating: “Strong Buy” from around 39–50 analysts, with only a handful rating the stock Hold and just one or so on the Sell side. StockAnalysis+2MarketBeat+2

Valuation: “Almost Historically Cheap” — for Nvidia

Even some valuation‑focused commentary leaned positive today:

- A MarketWatch analysis described Nvidia as “almost historically cheap” on an earnings‑multiple basis, arguing that history suggests the stock’s valuation could expand from here if growth continues. Morningstar+2MarketWatch+2

- Finviz data show Nvidia trading around 50x trailing earnings with a PEG ratio near 1.5, which many growth investors view as reasonable given expectations for EPS to rise more than 50% this year and 40%+ next year. Finviz+1

In other words, even after an extraordinary multi‑year run, much of Wall Street still sees Nvidia as undervalued relative to its growth profile.

Fundamentals: Q3 Blowout and Aggressive Growth Forecasts

The bullishness isn’t happening in a vacuum. Nvidia’s third‑quarter fiscal 2026 results, released in November, were once again eye‑popping:

- Q3 revenue: about $57.0 billion, up ~62.5% year over year.

- Net income: roughly $31.9 billion, with a net margin above 50% — levels more typical of software monopolies than chipmakers. NVIDIA Investor Relations+1

- Non‑GAAP operating income and free cash flow also soared, powered mainly by Nvidia’s data center businessas AI training and inference demand remained intense. NVIDIA Investor Relations+1

Forward‑looking estimates from analysts compiled by StockAnalysis show that Wall Street expects the growth story to continue: StockAnalysis

- Revenue this fiscal year: forecast around $211 billion, up about 62% from last year.

- Revenue next year: projected at roughly $289 billion, another ~37% increase.

- EPS: expected to climb from about $2.94 last year to $4.61 this year and $6.73 next year, implying 56–46% annual EPS growth over the next two years.

This is the core of the bull argument: even if Nvidia’s multiple compresses somewhat, earnings are growing so fast that the stock could still have room to run.

The Bear Case: Circular Financing, AI Bubble Talk and Massive Capex

Today’s news cycle wasn’t all positive. Several pieces highlighted concerns from high‑profile skeptics.

Michael Burry, Jim Chanos and “Vendor Financing” Fears

An AI‑driven forecast piece from Pintu/Finbold recapped the debate around alleged circular financing in Nvidia’s AI ecosystem:

- Short‑seller Michael Burry and veteran bear Jim Chanos have questioned whether Nvidia’s investments in its own customers may be artificially boosting reported sales, by effectively funding purchases of Nvidia hardware. Pintu+1

- In response, Nvidia reportedly sent a memo to Wall Street analysts rejecting the idea that it’s running a vendor‑financing scheme and stressing that underlying demand for AI GPUs remains robust. Pintu+2Axios+2

These concerns were echoed in a 24/7 Wall St. piece, which asked whether it might be “time to sell” Nvidia now that Burry has “taken aim” at the name, even as the company simultaneously announces deals like today’s $2 billion Synopsys stake. 24/7 Wall St.+1

Axios: Nvidia’s AI Investment Portfolio Fuels Bubble Debate

An in‑depth Axios report today put hard numbers around Nvidia’s investment spree: Axios+1

- 117 investments totaling about $62.24 billion over 2024 and 2025 through Nvidia and its NVentures arm.

- A $15 billion investment package in Anthropic (about $10 billion from Nvidia) and a headline‑grabbing $100 billion partnership with OpenAI, structured as a performance‑based commitment tied to building at least 10 gigawatts of AI data centers using Nvidia hardware.

Critics worry that such deals blur the line between customer and investor, while supporters argue they’re a rational way to seed demand for Nvidia’s chips and ensure CUDA remains the standard platform for AI.

AI Bubble — or Early‑Stage Industrial Build‑Out?

Even some bulls acknowledge real risks:

- Macro risk: AI capex is enormous and dependent on the spending plans of a few hyperscalers and sovereign buyers. A pause in budgets or a shift to in‑house silicon, especially at Google, Amazon or Meta, could hit Nvidia’s growth. Axios+2Nasdaq+2

- Competition: A Nasdaq/Motley Fool piece noted that another trillion‑dollar giant (think big cloud and in‑house accelerators) is emerging as a serious rival to both Nvidia and AMD in AI compute. Nasdaq

- Valuation & cyclicality: At roughly 50x earnings and after a near‑1000% three‑year run, Nvidia is extremely sensitive to any perception that AI demand is slowing or that customers are double‑ordering. Finviz+2Investopedia+2

These points form the backbone of the bear case — one that was actively discussed in today’s commentary even as the stock moved higher.

AI vs. AI: Machine‑Generated Price Targets for December 1

Interestingly, one of the more meta stories circulating today involves large language models (LLMs) forecasting Nvidia’s own stock price.

A Pintu/Finbold project had three major AI models (ChatGPT, Claude Sonnet 4 and Gemini) predict where NVDA would trade on December 1: Pintu

- Average AI‑predicted price: $178.25, implying only a ~1.1% dip from the then‑current price of $180.26.

- Individual model calls:

- One model projected a 6.4% drop to about $168.75,

- while the others saw modest upside toward $182–$184.

In reality, Nvidia ended today almost exactly where those AI forecasts clustered — just under $180. Of course, that doesn’t mean AI can reliably call future prices; if anything, the project underscores how even sophisticated models mostly anticipated sideways trading into early December, rather than a violent breakdown or melt‑up.

SoftBank’s Masayoshi Son: “I Cried” After Selling Nvidia

Sentiment was further colored today by comments from Masayoshi Son, founder of SoftBank:

- Son said he only sold SoftBank’s Nvidia stake because he needed cash to fund massive new AI projects, including data centers and more exposure to OpenAI — not because he lost faith in Nvidia.

- He admitted he “didn’t want to sell a single share” and was “crying” over the decision, a striking comment given SoftBank’s long history with Nvidia. TipRanks

- Son also dismissed AI‑bubble talk, arguing that if AI ultimately generates around 10% of global GDP, today’s multi‑trillion‑dollar investment wave will look justified in hindsight. TipRanks+1

TipRanks’ recap of his remarks also highlighted that, based on its dataset, analysts give Nvidia a “Strong Buy” rating with an average target around $257.72, implying roughly 43% upside from current levels — broadly consistent with MarketBeat and StockAnalysis figures. TipRanks+2MarketBeat+2

What Today’s After‑the‑Bell Picture Means for Investors

For short‑term traders:

- Momentum: Today’s action shows Nvidia can still outperform on negative index days when it has company‑specific catalysts like the Synopsys deal and high‑profile CEO media appearances. Investopedia+2Benzinga+2

- Key levels: With NVDA back near $180, traders will be watching the $170s as short‑term support and the $200–$212 zone as major resistance tied to its 52‑week high. Investing.com+2Finviz+2

- Event risk: Nvidia’s next earnings report in February 2026, plus any new AI‑investment announcements or regulatory headlines, remain potential volatility triggers. TradingView+2NVIDIA Investor Relations+2

For long‑term investors:

The bull case after today looks like this:

- Nvidia remains embedded at every layer of the AI stack, from GPUs and networking to software platforms like CUDA and Omniverse.

- Partnerships like Synopsys and HPE deepen its integration into design, engineering and sovereign AI infrastructure, expanding its total addressable market. Investing.com+2Yahoo Finance+2

- Wall Street still expects 60%+ revenue growth this year and nearly 40% next year, with EPS growth to match, and consensus targets in the mid‑$250s. StockAnalysis+2MarketBeat+2

The bear case emphasizes:

- Concentration risk in a handful of hyperscalers and AI labs that could eventually diversify away from Nvidia’s hardware. Axios+2Nasdaq+2

- Ongoing questions about circular financing, vendor‑financing‑style arrangements and whether Nvidia’s gigantic ecosystem investments might be pulling forward demand. Pintu+224/7 Wall St.+2

- A still‑lofty valuation that leaves little room for disappointment if AI capex slows or margins normalize from current elite levels. Finviz+2NVIDIA Investor Relations+2

Bottom Line: After the Bell, Nvidia Is Still the Center of the AI Storm

As of 10 p.m. EST on December 1, 2025, Nvidia stock is quiet in after‑hours trading, but the narrative around it is anything but.

- Bulls see today’s Synopsys stake, HPE AI lab expansion and relentless analyst upgrades as proof that Nvidia is still consolidating its role as the core infrastructure provider of the AI era. StockAnalysis+4Investopedia+4Investing.com…

- Bears point to the enormous scale of Nvidia’s investments, fears of “circular” revenue and AI bubble talk as warning signs that the company may be “too good to be true” at these levels. Axios+3Axios+3Pintu+3

For now, the market’s verdict is cautious optimism: Nvidia is holding near $180, comfortably below its highs but far above where it started the year, while investors digest whether today’s deals will translate into sustainable, high‑quality growth — or simply inflate the debate around the most important stock in AI.

Note: This article is for information and news purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Always do your own research and consider consulting a qualified financial adviser before making investment decisions.