Nvidia’s stock is limping into December after a volatile November, even as CEO Jensen Huang insists the artificial intelligence boom is not a bubble. Meanwhile, data center spending, short sellers, and macroeconomists are all treating Nvidia as a proxy for the future of the U.S. economy itself. Here’s what the latest reporting and analysis up to December 1, 2025 tell us about Nvidia, AI chips, and the risk of an AI-driven crash.

Nvidia’s Rough November — and Why December Still Matters

Nvidia shares finished November on the back foot. A recent Barron’s piece notes that the stock fell again on Friday, ending a “rough month” for the AI-chip leader, with the shares down about 1.4% in that session around the $178 mark — but also points out that, historically, December has often been kinder to Nvidia investors. Barron’s

That weak finish follows a broader pullback: Business Insider reporting on Michael Burry’s short position in Nvidia and Palantir highlights that Nvidia is down roughly 14% from its November 3 high, as investors question whether AI spending has leapt ahead of the technology’s real-world payoffs. Business Insider+1

Yet under the surface, the operational picture looks very different from a classic bubble top:

- Nvidia’s Q3 FY2026 revenue hit about $57 billion, up 22% quarter‑on‑quarter and 62% year‑on‑year.

- The data center division alone generated roughly $51.2 billion, up 25% from the previous quarter and 66% from a year earlier.

- Management guided Q4 revenue to about $65 billion, with gross margins near 75%. Upstox – Online Stock and Share Trading

Those results helped soothe immediate AI bubble fears and sparked a relief rally when they were released in late November, with several outlets describing the earnings as a “pulse check” that showed demand for AI infrastructure is still running hot. Upstox – Online Stock and Share Trading+1

So we enter December with a paradox: the stock is under pressure, but the business is still printing record numbers.

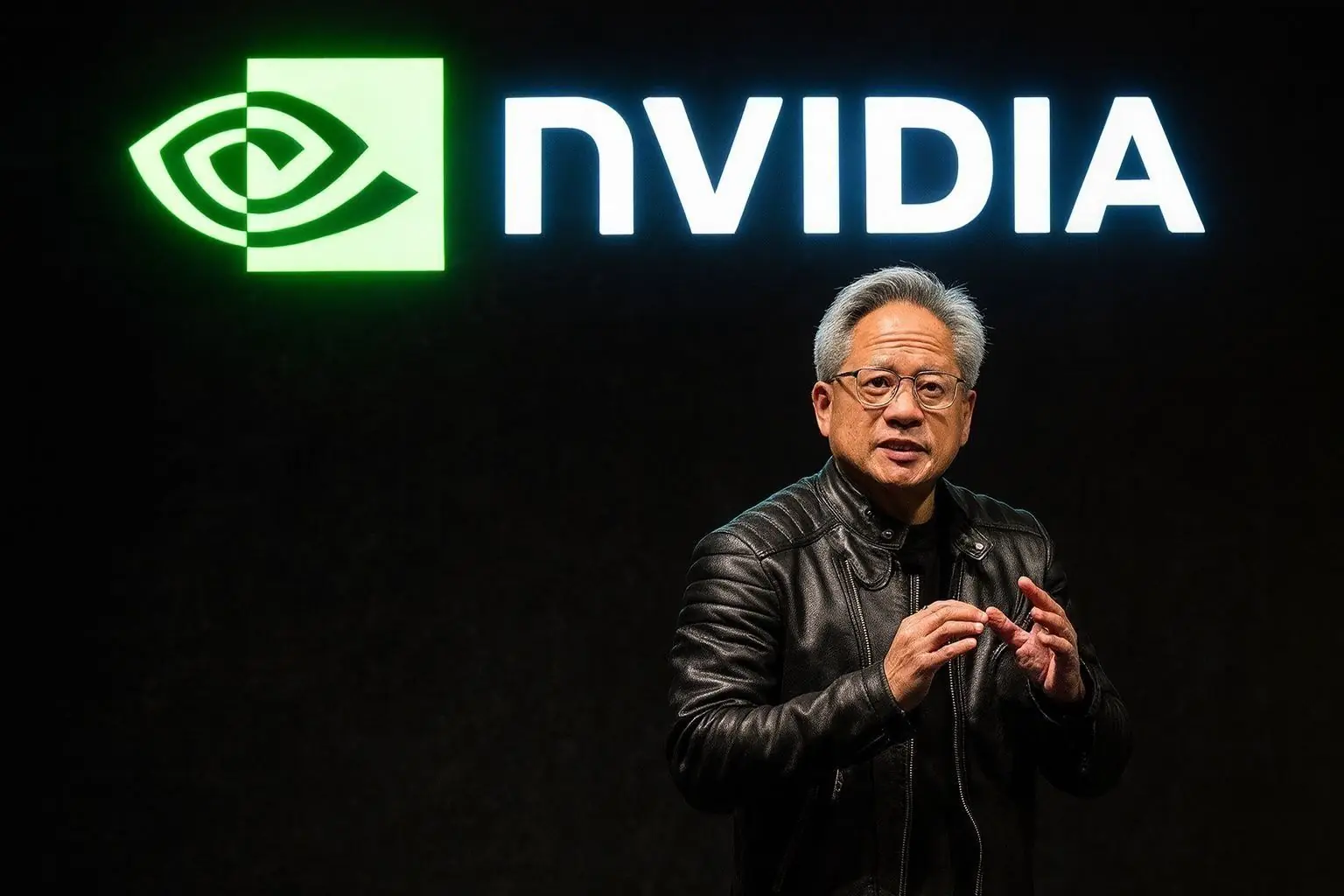

“Not a Bubble” — Jensen Huang’s Case for a Trillion‑Dollar Computing Shift

At the U.S.–Saudi Investment Forum and in Nvidia’s earnings call, CEO Jensen Huang has repeatedly pushed back on the “AI bubble” narrative. In a widely covered answer to the bubble question, he framed today’s environment not as speculative froth, but as a tipping point in computing. Reuters+1

From his perspective, three overlapping shifts justify the scale of spending:

- From CPUs to accelerated computing

Non‑AI workloads like engineering simulations, data science, and analytics are moving off traditional CPUs and onto GPU‑based systems that can deliver more performance per dollar and per watt. - A new class of AI‑native software

Tools like coding assistants and AI copilots represent software that simply didn’t exist before — applications that are already generating revenue and productivity gains across industries. - From virtual to physical AI

Huang and other executives see AI moving into robots, cars, logistics, and industrial automation, extending demand for compute far beyond the data center. Reuters+1

In Reuters coverage, Huang is quoted as saying Nvidia is witnessing something “very different” from a bubble, arguing that AI has reached a point where its outputs are valuable enough that organizations are willing to pay for them — and that Nvidia’s single architecture can power all three of these transitions. Reuters+1

This is also the logic behind Nvidia’s aggressive roadmap: Blackwell today, Rubin and Feynman architectures tomorrow, and long‑term partnerships to deploy gigawatts of AI infrastructure with OpenAI, Anthropic, Microsoft, Google, Oracle, and xAI. Upstox – Online Stock and Share Trading+1

The Skeptics: Short Sellers, Circular Deals, and Concentrated Risk

While Huang talks about an era‑defining technology shift, skeptics are watching the plumbing of the AI economy — and they don’t like what they see.

Michael Burry and the “Too Much, Too Fast” Camp

“The Big Short” investor Michael Burry has reportedly bet more than $1 billion against Nvidia and Palantir, warning that AI chip spending and related valuations have detached from underlying profitability. The Times of India+1

Coverage of Burry’s thesis emphasizes several red flags:

- Massive up‑front capex for data centers and chips, with limited near‑term profits from AI applications.

- Heavy use of depreciation, which can obscure the true economic cost of hardware.

- The risk that AI customers and vendors are propping each other up through exotic financing and vendor credits.

An editorial in FinTech Weekly frames this as the “Burry–Nvidia divide”: Nvidia sees virtuous‑cycle growth; Burry sees a credit‑fuelled boom that could end abruptly if revenue doesn’t catch up to spending. FinTech Weekly – Home Page+1

Circular Financing and Customer Concentration

A major theme in late‑November reporting is “circular financing” — complex deals where Nvidia invests in AI startups or partners that, in turn, become major customers for its chips.

- Reuters notes that 61% of Nvidia’s Q3 revenue came from just four unnamed customers, up from 56% the prior quarter, likely including Microsoft, Meta, Oracle and others. Reuters

- The company has doubled the value of long‑term contracts renting its own chips back from cloud providers to about $26 billion, with agreements stretching into the next decade. Reuters+1

- Nvidia has committed up to $100 billion to OpenAI and $10 billion to Anthropic via multi‑year infrastructure deals and equity investments. Reuters+1

Critics argue that if much of the demand comes from loss‑making startups or projects, the cycle could end badly unless customers suddenly decide to prioritize profits over growth — a coordinated pullback that seems unlikely. Reuters+1

Analysts at outlets like Seeking Alpha now openly ask whether Nvidia is nearing the top of the AI cycle, downgrading the stock on worries about valuation, customer concentration, and the sustainability of these capital‑intensive deals. Seeking Alpha

Nvidia as Macro Variable: How the AI Build‑Out Is Propping Up Growth

One reason the bubble debate is so intense: Nvidia is no longer “just” a chip stock. It’s become a macro indicator.

A recent Vox episode on the AI economy notes that:

- Nvidia’s weight in the S&P 500 is approaching 8%, an extraordinary concentration for a single stock.

- The company is responsible for roughly one‑fifth of the index’s gains this year.

- AI‑related investment accounts for around 40% of recent U.S. GDP growth, largely through data center spending and associated construction. Vox+1

In other words, Nvidia’s earnings days now function like macroeconomic events — closer to jobs or inflation reports than a typical corporate update.

ABC News, citing Pantheon Macroeconomics, adds that AI spending boosted annualized U.S. GDP growth by about 0.5 percentage points in the first half of 2025, roughly one‑third of total economic growth over that period. ABC News

That’s why Wall Street’s reaction to Nvidia’s November results mattered so much:

- Earnings beat: Q3 numbers easily topped expectations, briefly calming fears of a bubble and triggering a global stock rally. Upstox – Online Stock and Share Trading+1

- Follow‑through doubts: Within days, indexes slipped again as investors weighed whether AI capex can keep scaling at this pace — and what happens if it doesn’t. The Guardian+1

The core tension: AI spending is currently propping up both the stock market and the real economy, but much of the payoff remains in the future.

Energy, Land, and the Physical Limits of the AI Data Center Boom

Even if you accept Huang’s thesis that AI is a once‑in‑a‑generation shift, there are hard physical constraints to consider.

According to the International Energy Agency, data centers already consume about 1.5% of global electricity (roughly 415 TWh in 2024), and that share could more than double to around 945 TWh by 2030, or just under 3% of total demand, driven largely by AI workloads. Wikipedia

Projected CO₂ emissions from data centers could climb from ~220 million tonnes in 2024 to as much as 300–320 million tonnes by 2035, unless power generation rapidly decarbonizes. Wikipedia+1

Even some Nvidia bulls are worried. The Reuters piece on Huang’s comments quotes investors who point out that realizing his vision will require enormous amounts of land and power, plus large‑scale financing, just to keep up with GPU‑driven demand. Reuters

McKinsey research, cited in recent energy‑economy analysis, estimates that the global race to scale AI data centers could require several trillion dollars of investment in compute, power, and cooling infrastructure over the coming decade. National Center for Energy Analytics+1

The risk here isn’t just environmental. If AI revenues disappoint, many of those data centers and power projects could end up as stranded assets — with losses borne not only by tech investors, but also by utilities, local governments, and banks.

Are We in an AI Bubble? The Expert Split

So is this a bubble or a justified re‑rating of the global economy around AI?

The answer, as of December 1, 2025, depends on whom you ask.

The “Yes, It’s a Bubble — But…” Crowd

A Business Insider roundup of 16 business leaders captures a common nuance:

- OpenAI CEO Sam Altman and Microsoft co‑founder Bill Gates both see clear bubble dynamics — overexcited investors, frothy valuations, and plenty of doomed projects — but still believe AI will ultimately transform the economy. Business Insider+1

- JPMorgan vice‑chair Daniel Pinto and OpenAI chair Bret Taylor also see a correction coming, arguing that the market is pricing in productivity gains faster than they can realistically arrive. Business Insider

Academic voices echo that nuance. In ABC’s coverage, University of Pennsylvania professor Lynn Wu argues that AI is a general‑purpose technology akin to electricity or the internet — and that, yes, we are likely in a bubble phase, but one that could still net positive for society once the winners and losers shake out. ABC News+1

The “Not a Bubble, Just a Super‑Cycle” Camp

On the other side:

- Nvidia’s Jensen Huang and AMD’s Lisa Su repeatedly describe today’s market as a natural transition from general‑purpose to accelerated computing, not a speculative mania. Business Insider+1

- Former Google CEO Eric Schmidt argues that the scale of hardware investment is being matched by software innovation, and that historically, capacity like this does get used. Business Insider+1

- Alibaba CEO Eddie Wu says his company is seeing real demand that it can’t fully meet, and plans to invest “aggressively,” even while acknowledging that some bubble‑like excess exists. Business Insider

This divergence is reflected in research on the AI bubble itself. A recent overview notes that prominent investors like Ray Dalio see parallels to the dot‑com era, while others at Goldman Sachs argue that rising valuations can be justified by sustained profit growth. Wikipedia

In short: many agree there are bubble characteristics in pockets of AI, but they disagree on whether Nvidia — with huge current cash flows and dominant market share — is at the center of that bubble or simply the primary beneficiary of a real technological super‑cycle.

What to Watch in December 2025

For readers tracking this story through December and into 2026, several signposts will determine whether the AI boom looks more like the early internet — or the late‑stage dot‑com era.

- Cloud Giants’ Capex Guidance

Microsoft, Amazon, Alphabet, Meta, and Apple are collectively committing hundreds of billions of dollars to AI‑related infrastructure. The path of that spending — accelerating, flattening, or rolling over — will be the clearest near‑term signal on whether AI demand is keeping pace with supply. Investors.com+1 - Evidence of Profitable AI Use Cases

Right now, many flagship AI products are either free or lightly monetized. The faster we see tangible revenue and cost savings from AI copilots, agents, and automation, the less the market will look like a bubble built solely on hopes. - The Circular Financing Question

Regulators and investors are likely to scrutinize Nvidia’s equity stakes, vendor financing, and long‑term purchase agreements with AI startups and cloud providers. If these deals start to unwind or get restructured, that would be an early warning sign. Reuters+1 - Data Center Bottlenecks: Power and Land

Watch for stories about delayed or cancelled data center projects due to energy constraints, community pushback, or cost overruns. Those are the real‑world friction points that could cap AI growth even if demand remains strong. Wikipedia+1 - Macro Dependence on Nvidia

With AI spending responsible for such a large share of recent U.S. GDP growth, any sustained slowdown in Nvidia’s orders could show up first in construction, utilities, and local labor markets around major data‑center hubs. Vox+1

The Bottom Line: A “Joyless Tech Revolution”?

One of the most striking descriptions in recent coverage comes from a Wall Street Journal column, cited by Vox, calling the current AI boom a “joyless tech revolution.” The idea:

- A small set of companies — Nvidia, the hyperscale cloud providers, leading AI labs — capture most of the upside.

- The downside, if things go wrong, is socialized through retirement accounts tied to index funds, stressed power grids, and communities that bet on data centers as their economic future. Vox+1

As of December 1, 2025, Nvidia sits right at the center of that tension:

- Fundamentals: Record revenues, sky‑high margins, and a product roadmap that still looks years ahead of the competition.

- Risks: Customer concentration, circular financing, enormous capital needs, and a macro environment increasingly reliant on a single company’s continued hyper‑growth.

- Narrative: A world split between those who fear an AI bubble and those who believe we’re simply rewiring the global economy around accelerated computing.

Whether Nvidia in 2025 looks more like Cisco in 1999 or Microsoft in the early 2000s will only be clear in hindsight. For now, the one thing almost everyone agrees on is that the stakes — for markets, for workers, and for energy systems — have never been higher.