Key facts (as of Friday, Sept. 26, 2025)

- Headline PCE inflation: +0.3% month‑over‑month; +2.7% year‑over‑year for August (up from 2.6% YoY in July). Core PCE (ex‑food & energy): +0.2% m/m; +2.9% YoY (unchanged). Bureau of Economic Analysis

- Spending & income: Nominal consumer spending rose 0.6% and personal income rose 0.4% in August; after inflation, real consumer spending rose ~0.4% (goods +0.7%, services +0.2%). Bureau of Economic Analysis+1

- Market reaction (morning): S&P 500 futures up ~0.3%, Treasury yields edged lower, and the dollar softened on the in‑line inflation print. Reuters

- Policy backdrop: The Fed cut rates 25 bps on Sept. 17 to a 4.00%–4.25% target range and signaled the door is open to more cuts if the labor market weakens. Reuters+1

- How it compares: August CPI inflation is 2.9% YoY (core CPI 3.1%), while producer (PPI) inflation is 2.6% YoY (core PPI proxy 2.8%). PCE generally runs cooler than CPI because of broader coverage and different weights. Bureau of Labor Statistics+2Bureau of Labo…

- “Underlying” gauges: The Dallas Fed’s trimmed mean PCE stood at 2.65% YoY in July (August update pending), a cross‑check that suggests underlying inflation is still above 2%. FRED

- What the pros say: “This should give some reassurances particularly on the inflation side,” said Wells Fargo’s Doug Beath. TD Securities’ Gennadiy Goldberg: “Net‑net, the data is showing that consumers continue to spend.” Reuters

The in‑depth read

1) What today’s PCE report actually said

The Bureau of Economic Analysis reported that headline PCE prices rose 0.3% in August, nudging the yearly rate to 2.7%. Core PCE—the measure the Fed emphasizes—rose 0.2% on the month and held at 2.9% year‑over‑year. The monthly pace is consistent with ~2½–3% annualized inflation, not yet back to 2%, but notably not re‑accelerating. Bureau of Economic Analysis

Under the hood, the same release shows nominal personal income up 0.4% and nominal consumer spending up 0.6%. After adjusting for inflation, real spending advanced ~0.4%, with goods outpacing services in August—useful context as households digest higher borrowing costs. Bureau of Economic Analysis+1

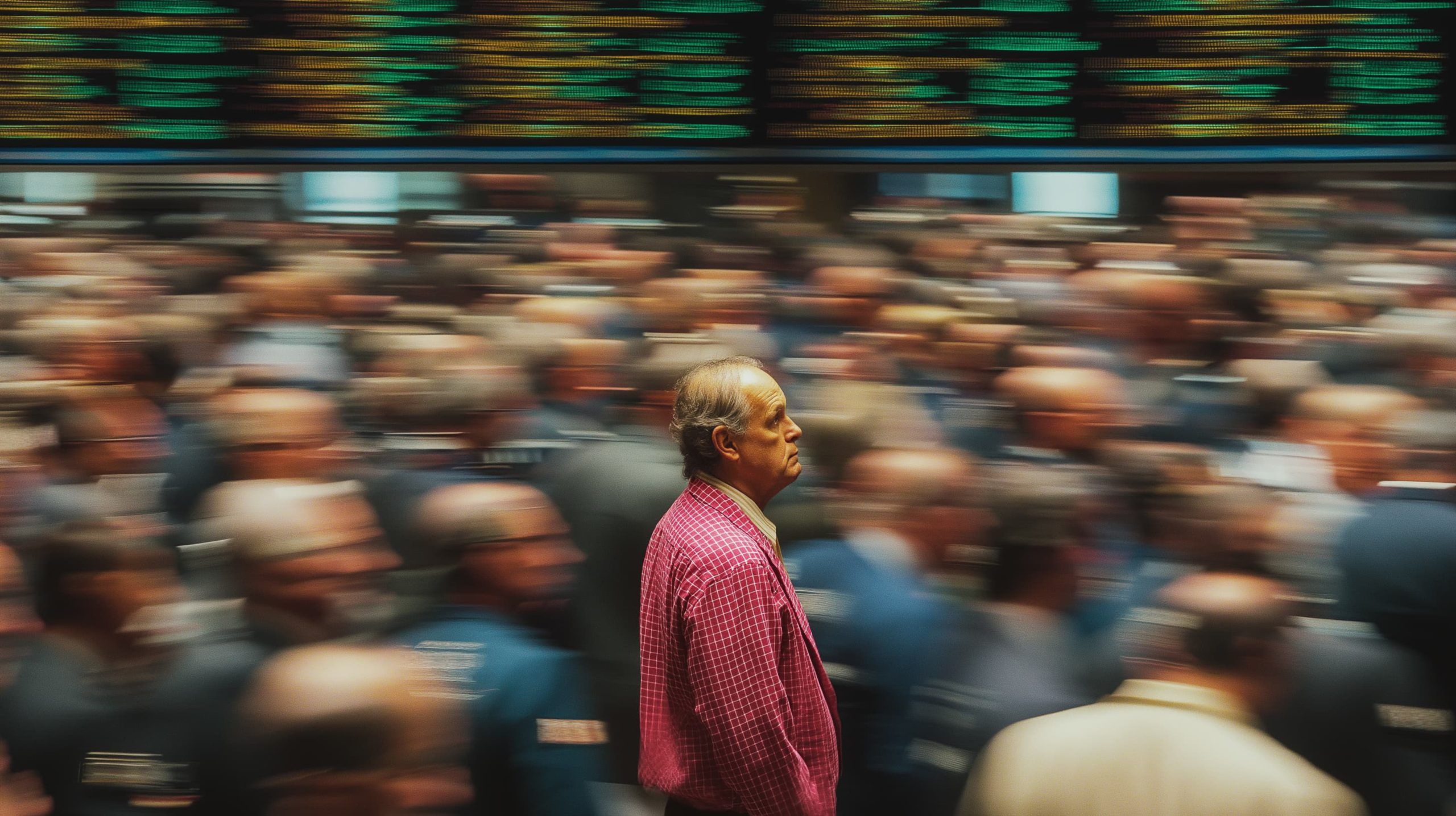

2) Markets: Relief beats fear—at least for a day

Because the data matched consensus, investors leaned into a moderate “risk‑on” stance: equity futures rose, Treasury yields dipped, and the dollar eased—a classic “in‑line inflation” reaction that keeps rate‑cut hopes on the table. Reuters

3) What experts are saying (quick quotes)

- Doug Beath, Wells Fargo Investment Institute: “This should give some reassurances particularly on the inflation side.” Reuters

- Gennadiy Goldberg, TD Securities: “Net‑net, the data is showing that consumers continue to spend.” Reuters

- Peter Cardillo, Spartan Capital: “Bottom line is that inflation remains sticky, but it’s showing no signs of accelerating.” Reuters

- Kim Forrest, Bokeh Capital: “The big question is if the Fed [is]…overweighted on concern about employment” versus inflation. Reuters

- Chair Jerome Powell this week called it a “challenging situation” with upside inflation risks and downside employment risks—a neat summary of the trade‑offs guiding policy. Reuters

TL;DR from the Street: Inflation isn’t reaccelerating, consumers are still spending, and the Fed can keep easing—carefully.

4) Where PCE fits among the “competing products” of inflation

Think of CPI, PCE, and PPI as competing gauges—each with its design trade‑offs:

| Feature | PCE (today’s report) | CPI (Aug) | PPI (Aug) |

|---|---|---|---|

| Latest YoY | 2.7% (core 2.9%) | 2.9% (core 3.1%) | 2.6% (core proxy 2.8%) |

| What it measures | Prices paid by/for consumers, broader scope (includes employer/insurer‑paid items) | Out‑of‑pocket urban consumer prices, narrower scope | Producer/wholesale prices upstream |

| Why it differs | Different weights & broader coverage; tends to run cooler than CPI | Heavier weight to shelter & direct pay items | Signals pipeline price pressures |

Sources: BEA; BLS CPI and PPI releases; BEA explainer on PCE methodology. Bureau of Economic Analysis+3Bureau of Eco…

Bottom line: Today’s PCE sits below CPI but above where the Fed wants to be. Pipeline inflation (PPI) has cooled YoY, which—if sustained—supports the case that consumer inflation can grind lower in coming months. Bureau of Labor Statistics

5) “Underlying” inflation checks

Because monthly core prints can be noisy, economists track alternative gauges:

- Dallas Fed trimmed‑mean PCE: 2.65% YoY (July); it trims extreme outliers to capture the trend. August update typically posts with the PCE release. FRED

- Cleveland Fed median/nowcast tools: Provide daily estimates and “median PCE” concepts to cross‑check breadth; useful for spotting persistence. Cleveland Fed+1

6) What this means for the Fed’s next move

After the Sept. 17 rate cut to 4.00%–4.25%, policymakers signaled openness to more if the labor market softens and inflation continues to edge toward 2%. Futures pricing after today’s PCE kept odds of another cut alive for October, consistent with post‑meeting commentary. Reuters+2Federal Reserve+2

Two cross‑currents to watch:

- Tariffs & supply frictions (which could lift goods prices) vs.

- Slowing labor demand (which could restrain services inflation and wages).

Both themes surfaced in recent Fed remarks and news flow. Reuters+1

7) What it means for households & investors

- Paychecks vs. prices: With incomes +0.4% and prices +0.3% in August, real purchasing power inched up—helpful for discretionary spending. Bureau of Economic Analysis

- Borrowers: A still‑elevated but stable core PCE keeps gradual rate‑cut hopes intact, supporting mortgage and auto affordability over time—conditional on labor data not breaking bad. Federal Reserve

- Investors: In‑line inflation and resilient spending historically support risk assets while bonds benefit if disinflation progresses; today’s price action echoed that playbook. Reuters

8) Dates & data to watch next

- Next PCE (September data): Fri., Oct. 31, 2025. Bureau of Economic Analysis

- Next CPI (September): Wed., Oct. 15, 2025. Bureau of Labor Statistics

- Fed communications: Follow speeches/interviews for hints on how officials are balancing employment risks vs. inflation progress. Reuters+2Reuters+2

Why PCE < CPI most of the time (quick explainer)

PCE gives more weight to health care and other services paid on consumers’ behalf (e.g., by insurers/employers) and draws on a wider set of data sources. CPI leans more on out‑of‑pocket spending (with a heavier shelter weight). Different recipes = different readings—which is exactly why the Fed targets PCE. Bureau of Economic Analysis

Today’s storyline in one paragraph

Inflation didn’t surprise: headline PCE ticked to 2.7% YoY while core held at 2.9%. Consumers still opened their wallets, and markets took the print as reassuring, not alarming. With the Fed having just cut rates and describing a “challenging” mix of upside inflation risk and downside employment risk, the path ahead likely features measuredeasing, data‑dependent and sensitive to any tariff‑ or energy‑driven flare‑ups. Reuters+3Bureau of Economic Analysis+3Reut…

Sources & further reading (selected)

- Official release: BEA Personal Income and Outlays, August 2025. Bureau of Economic Analysis

- Methodology: BEA explainer on the PCE price index. Bureau of Economic Analysis

- Market reaction & expert quotes: Reuters coverage. Reuters+1

- Cross‑checks: BLS CPI & PPI (August). Bureau of Labor Statistics+1

- Policy context: Fed FOMC statement (Sept. 17) and post‑cut coverage. Federal Reserve+1

- Underlying inflation: Dallas Fed trimmed‑mean PCE; Cleveland Fed nowcasts/median PCE.