Frankfurt, Dec. 16, 2025 — Rheinmetall shares are under pressure today as investors react to fresh optimism around Ukraine peace talks, a headline theme that has weighed on European defence stocks across the board. Even with multiple positive corporate developments in the background—including progress on a major German tank project and a new counter-drone showcase in Finland—the market’s focus on geopolitics is dominating price action in the short term. Reuters+2finanzen.net+2

Rheinmetall stock price today: the latest level and what it means

Rheinmetall (traded in Germany under RHM / RHMG.DE) was trading around €1,500 per share on Tuesday, down roughly 4–5% versus the prior close, putting the company among the weakest large caps in Germany’s blue-chip universe for a second session. MarketScreener+1

A quick snapshot of the moves investors are watching on 16.12.2025:

- Price: ~€1,500 (intraday quotes vary by venue and timing) MarketScreener+1

- Prior close reference: €1,573.50 (recent close shown on major quote pages) MarketScreener+1

- 52-week range: roughly €593 to €2,008, underscoring both the stock’s explosive run since 2022 and the depth of the pullback from autumn highs Investing.com+1

- Year-to-date performance: still well into triple-digit gains even after the recent selloff MarketScreener+1

In other words: today’s drop is sharp, but it’s happening after a period in which Rheinmetall became one of Europe’s most-followed defence names, and the stock is still far above last year’s lows. Investing.com+1

Why Rheinmetall shares are falling today: “peace trade” headlines hit defence stocks

The main driver behind Rheinmetall’s slide is sector-wide: European defence stocks fell after signs of progress in Ukraine peace talks, including discussion of U.S. “NATO-style” security guarantees for Kyiv as part of a proposed settlement framework. U.S. President Donald Trump said negotiations appeared closer to a resolution than before, even as key territorial issues remain unresolved. Reuters+1

Reuters reported that Rheinmetall and peers such as Saab and Leonardo dropped roughly 4% to 6%, pulling the broader European aerospace and defence index lower. Reuters

The logic behind the move is straightforward:

- If markets start to believe a ceasefire or settlement is more plausible, investors may assume future arms demand growth could cool, at least at the margin.

- After a multi-year rally in defence stocks, peace-related headlines can trigger fast profit-taking, even when long-term European rearmament remains intact.

Importantly, multiple market voices also stressed the counterpoint: European defence spending is widely expected to keep rising regardless of the outcome, because the war exposed structural capability gaps and drove a multi-year procurement cycle. Reuters+1

That tension—short-term peace-trade selling vs. long-cycle defence spending—is exactly what investors are debating today.

Today’s Germany-focused trading narrative: Rheinmetall at the bottom of the DAX

German market commentary echoed the same theme. A dpa-AFX market update carried by finanzen.net described Rheinmetall as the clear laggard in the DAX, down about 4.6% near €1,501, as defence names extended losses linked to the Ukraine negotiation headlines. finanzen.net

The same report also highlighted a key nuance for investors trying to separate headlines from fundamentals: even if negotiations progress, Europe may still bear much of the burden of future security guarantees, supporting continued high defence budgets—meaning a ceasefire may not automatically translate into a collapse in procurement. finanzen.net

Rheinmetall news today: tank “megaproject” momentum, but markets shrug

One reason the stock move stands out is that it’s happening despite genuinely significant industrial-policy news in the background: the German cartel office approved an expansion of the Rheinmetall–KNDS joint venture to develop and deliver a new battle tank for the Bundeswehr.

A Reuters summary carried by MarketScreener described the approval as clearing the way for closer cooperation, noting the regulator’s conclusion that neither company could meet the project requirements alone and that the expansion was not expected to impair competition. MarketScreener

The same Reuters summary also framed the planned tank as an interim solution until a German–French main battle tank project arrives much later (with a timeline referenced around the mid-2040s). MarketScreener

Meanwhile, an Index Radar technical note published via Focus on 16.12.2025 pointed out the disconnect between the strategic importance of the tank project approval and the share price weakness—arguing that investors are prioritizing peace-talk uncertainty over project headlines in the near term. Focus

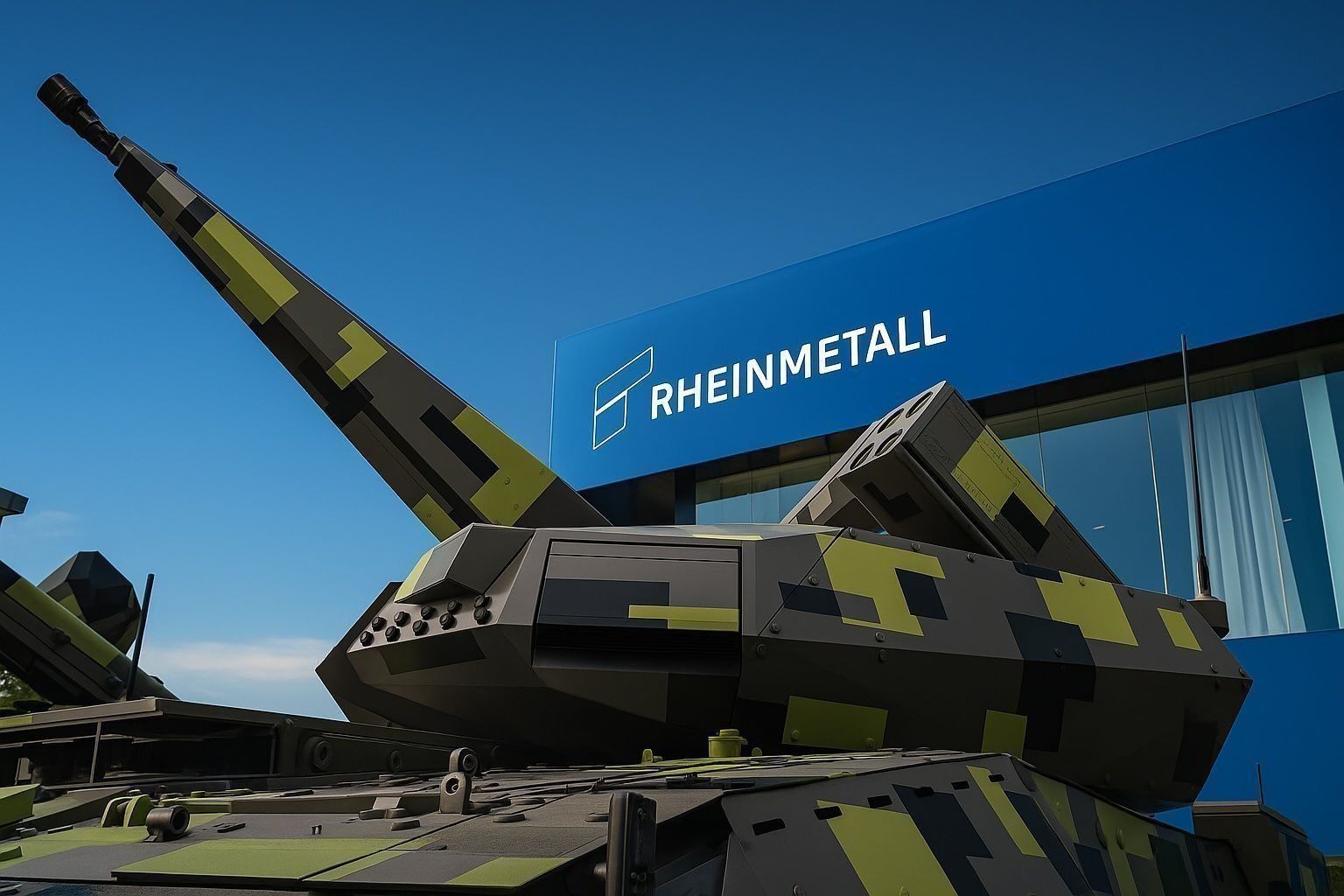

Rheinmetall corporate update today: counter-drone capability showcased in Finland

Rheinmetall also published a fresh corporate update dated 16/12/2025, announcing it successfully demonstrated counter-drone (c‑sUAS) capabilities at Finland’s GBAD Demo Days 2025 at the Lohtaja firing range.

In the company’s description, the demonstration focused on detecting, classifying, and tracking a range of drone threats, with Skyspotter (a multisensor early-warning and reconnaissance system) at the center of the presentation. Rheinmetall also highlighted a rapidly deployable configuration based on an HX truck platform and an integrated system approach combining sensors and command-and-control elements. Rheinmetall

This kind of announcement matters because drone and counter-drone defence has become one of the fastest-moving capability areas in Europe—yet, as today’s trading shows, macro geopolitics is overpowering company-specific positives in the short run.

The fundamentals behind the headlines: orders and backlog remain central

Even on a down day, investors continue to anchor on Rheinmetall’s order pipeline and production ramp:

- Netherlands Skyranger 30 order (Dec. 12, 2025): Rheinmetall said it won a major mobile air-defence orderwith an order value in the high triple-digit million euro range, with first deliveries before the end of 2028 and final deliveries by end 2029. Rheinmetall

- Bundeswehr tank ammunition order (Dec. 8, 2025): Rheinmetall announced a new order worth several hundred million euros for 120 mm tank ammunition, called off from a framework agreement that the company said had been increased to around €4 billion and runs to 2030. Rheinmetall

- Radar supply chain strengthening (Dec. 12, 2025): Reuters reported Hensoldt will supply SPEXER radars to Rheinmetall’s air-defence division, including for Skyranger 30 and the HoWiSM laser-based drone defence system, under an agreement expected to remain valid into the 2030s. Reuters

On the financial side, Reuters previously reported that Rheinmetall’s backlog grew to about €64 billion by the end of September 2025 and was expected to reach €80 billion by year-end, underscoring why many investors still view Rheinmetall as a multi-year growth story—even if the stock is volatile around political headlines. Reuters

Rheinmetall forecasts and analyst targets: what the Street is saying

Despite today’s weakness, the published analyst targets visible to retail investors remain high versus the current share price.

A finanzen.at compilation of analyst price targets shows multiple major banks with targets well above €2,000, including (as listed there):

- UBS: €2,500 (dated 03.12.25)

- JPMorgan: €2,250 (dated 10.12.25)

- Barclays: €2,060 (dated 08.12.25)

- Bernstein Research: €2,050 (dated 11.12.25) finanzen.at

Separately, a third-party consensus aggregation page listed an average 12-month target around €2,248.90 (with a stated forecast range from roughly €1,787.70 to €2,625.00) and a consensus “BUY” profile. Value Investing

Two important caveats for readers—especially in the context of a Google News–style stock update:

- Price targets are opinions, not promises. They can change quickly with geopolitics, budgets, and execution.

- Today’s move is a reminder that even “fundamental” defence stories can be traded like macro instruments when peace-war probabilities shift.

Technical analysis on 16.12.2025: levels traders are watching

Several daily market notes highlighted technical signals as the stock slides:

- A finanzen.net dpa-AFX report noted Rheinmetall fell back below its 21-day line, often used as a short-term trend indicator. finanzen.net

- A Focus/Index Radar technical piece said the stock was trading just below a 200-day moving average it placed around €1,665, and projected a four-week range between roughly €1,430 and €2,124, with a “most likely” level around €1,780 (model-based, not guaranteed). Focus+1

For market participants, these kinds of levels matter because Rheinmetall has increasingly become a high-liquidity proxy for European rearmament expectations—meaning technical flows can amplify moves when headlines hit.

What investors will watch next

Looking beyond “Rheinmetall stock price today,” the next catalysts likely fall into three buckets:

1) Ukraine diplomacy and security guarantees

Any confirmation, rejection, or stalling of the proposed security framework could keep the stock volatile day-to-day. Reuters+1

2) European procurement reality vs. market fear

Even if a ceasefire becomes more likely, the key question is whether Europe’s multi-year spending trajectory changes meaningfully—or whether governments double down on stockpiles, air defence, drones, and land systems anyway. Reuters

3) Rheinmetall execution and medium-term strategy

Rheinmetall has publicly guided to very ambitious long-term growth: Reuters reported the company aims to lift sales to around €50 billion by 2030 and target an operating margin above 20%, with a planned restructuring into new divisions starting in 2026. Reuters

Bottom line

Rheinmetall’s share price drop on 16 December 2025 is less about a sudden change in the company’s order pipeline and more about headline-driven repricing of “war premium” expectations across the European defence sector. At roughly €1,500, the stock is sharply off recent highs, yet still reflects a company with a large backlog, visible multi-year contracts, and an aggressive long-term growth plan. MarketScreener+2Reuters+2

This article is for informational purposes only and does not constitute investment advice.