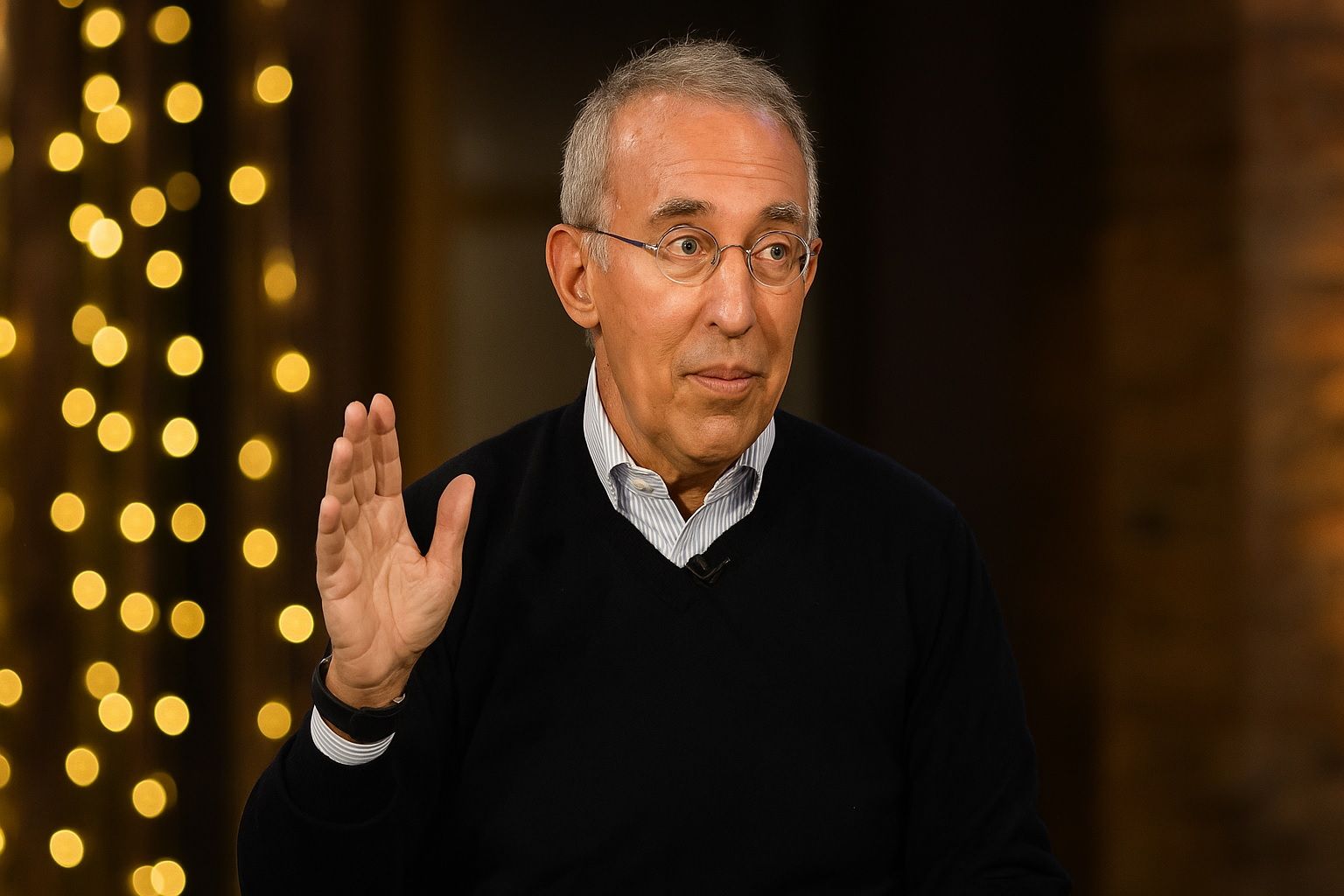

Billionaire investor Ron Baron is once again staking his reputation — and a huge chunk of his fortune — on Elon Musk.

In a fresh appearance on CNBC’s Squawk Box this morning, Baron said he does not expect to sell his personal Tesla (TSLA) or SpaceX shares during his lifetime, underscoring just how long-term his conviction really is. The interview, which is being widely syndicated through outlets including MSN and YouTube, also touched on the broader stock market, Musk’s record-breaking $1 trillion Tesla pay package, and what investors can expect from today’s 32nd Annual Baron Investment Conference in New York. StockAnalysis+2YouTube+2

The timing is no accident. Baron’s comments arrive:

- Days after Tesla shareholders approved Musk’s unprecedented $1 trillion equity-based compensation plan, a vote that drew global attention from regulators, governance experts and retail investors alike. TradingView+2Reuters+2

- As Tesla stock remains volatile and heavily debated ahead of a crucial AI- and robotics-driven growth phase. Nasdaq

- On the very day Baron hosts thousands of clients at Lincoln Center, where Musk will join him on stage for a “Starman” fireside chat about the future of AI, autonomous vehicles and space. baroncapitalgroup.com+1

Here’s what’s behind Baron’s “never sell” stance, how it connects to the Musk pay debate, and what lessons he wants investors to take from today’s markets.

Who Is Ron Baron — and Why His View Still Moves Markets

Ron Baron is the founder, chairman and CEO of Baron Capital, a growth-focused asset manager overseeing roughly $45 billion in assets. baroncapitalgroup.com

For four decades, Baron has built his brand on a simple playbook:

- Buy a small number of high‑quality, founder-led growth businesses

- Hold them for decades, so long as the underlying business keeps compounding

- Treat market volatility as an opportunity, not a threat

Tesla and SpaceX are the purest expression of that philosophy. In a recent firm statement supporting Musk’s 2025 CEO performance award, Baron detailed how deeply intertwined his firm has become with the “Musk ecosystem”:

- About $400 million in Tesla shares bought between 2014–2016, at prices roughly 13x higher than the IPO level

- Roughly $1.3 billion invested in SpaceX since 2017

- A newer $338 million investment in Musk’s AI venture xAI

Those bets have produced about $8 billion in profits from Tesla, another $4 billion from SpaceX, and roughly $340 million from xAI — together representing about 24% of the $52 billion in profits Baron Capital says it has generated since 1992. Musk-linked holdings now make up around 26% of the firm’s total assets under management, and Baron believes profits from this ecosystem could still be five times higher by 2035. baroncapitalgroup.com

In other words, Baron isn’t just casually bullish on Musk; his firm’s track record and future projections are tightly bound up with Tesla, SpaceX and xAI.

“I Don’t Expect to Sell” – What Baron Really Means

In today’s Squawk Box segment, Baron reiterated that he doesn’t expect to sell his own Tesla or SpaceX shares during his lifetime, emphasizing that these are personal, long‑term ownership stakes rather than trading positions. StockAnalysis+1

That stance is consistent with how he’s framed these holdings in recent letters and public comments:

- Generational horizon: In his Q2 2025 shareholder letter, Baron encouraged investors to think in decades, not quarters, highlighting Tesla’s mission to “accelerate the world’s transition to sustainable energy” and suggesting shareholders would feel proud to be long‑term owners after reading the company’s 2024 Impact Report. baroncapitalgroup.com

- Concentration by design: Baron Partners Fund and other Baron strategies deliberately run concentrated positions in a handful of high‑conviction names. Tesla alone accounts for roughly 31% of Baron Partners Fund’s long positions, according to recent firm disclosures. baroncapitalgroup.com

- Compounding, not flipping: Baron often describes his approach as buying pieces of businesses to hold as they grow larger, not renting stocks for near‑term price moves.

By explicitly saying he doesn’t expect to sell his personal Tesla and SpaceX holdings while he’s alive, Baron is sending three clear messages:

- He believes Tesla and SpaceX are still early in their growth runway, especially in AI, robotics and global energy infrastructure.

- He’s comfortable with extreme volatility — including drawdowns — as the price of capturing multi-decade compounding.

- He wants clients and retail investors to align their expectations with that time frame, rather than trading headlines around quarterly deliveries.

The Musk $1 Trillion Pay Package: Why Baron Is All‑In

Baron’s latest comments can’t be separated from the controversial Tesla CEO pay plan that shareholders just approved.

At Tesla’s recent annual meeting in Texas, investors voted to grant Elon Musk a potential $1 trillion performance-based equity award. Around three‑quarters of shareholder votes supported the deal, which could lift Musk’s ownership by up to 12% if a series of long-term milestones are met. TradingView

Those milestones are jaw‑dropping:

- Boost Tesla’s market capitalization to $8.5 trillion, roughly six times its recent level

- Lift annual earnings to $400 billion

- Deliver 20 million vehicles

- Deploy 1 million robotaxis and 1 million humanoid “Optimus” robots by 2035 TradingView+2CBS News+2

Governance critics and major institutions including Norway’s $2.1 trillion sovereign wealth fund opposed the plan, citing its enormous size, potential shareholder dilution and the risk of making Tesla even more dependent on a single individual. Reuters+1

Baron Capital went the other way. In both firm communications and external commentary, Baron has argued that: baroncapitalgroup.com+2TradingView+2

- Musk is Tesla’s most important strategic asset

- The award is entirely performance-based — Musk gets nothing unless ambitious targets are met

- If Tesla does hit those targets, the resulting value creation for shareholders would dwarf the cost of the package

In that context, Baron’s refusal to sell personal Tesla or SpaceX shares reads as a public vote of confidence in Musk just as the pay debate reaches its climax.

Market Volatility and “Taking Advantage of Opportunities When They Arise”

The second segment of Baron’s new CNBC appearance focuses on the broader market, under the title: “Billionaire investor Ron Baron on the market: Take advantage of opportunities when they arise.” YouTube

That theme lines up neatly with the current investing environment:

- U.S. indices like the Dow Jones Industrial Average are hitting fresh records — the Dow recently closed above 48,000 for the first time — even as pockets of the market, particularly high‑growth tech and EVs, remain volatile. BizToc+1

- Tesla itself has been a case study in whiplash: deliveries hit 497,099 vehicles in Q3 2025, a record, yet earnings estimates for 2025 point to a 32.6% year‑over‑year EPS decline and a modest drop in revenue, reflecting margin pressure and intensifying competition. Nasdaq

In analysis from Nasdaq and Zacks tied to this week’s Tesla shareholder meeting, analysts highlight: Nasdaq

- Slower EV demand in key markets like Europe and China

- Heavy pricing pressure from rivals

- Bright spots in Tesla’s energy storage business and early but promising progress in robotaxis and AI-driven software

Baron’s message to investors has been consistent for years and is echoed again in today’s discussion:

- Short-term noise vs. long-term value: Corrections and negative headlines are not reasons to abandon quality growth stories; they’re chances to buy more at better prices.

- Owning transformation, not just tickers: In Tesla’s case, Baron is betting on the company’s transition from an auto manufacturer to a platform spanning EVs, energy, robotics and AI.

For investors watching Tesla’s swings or nervously eyeing market records, Baron’s call to “take advantage of opportunities when they arise” is essentially an invitation to zoom out.

Inside Today’s Baron Conference: Musk, AI and the “Starman” Fireside Chat

All of this is playing out against the backdrop of the 32nd Annual Baron Investment Conference, held today at New York’s Lincoln Center, with thousands of Baron fund shareholders and advisors in attendance. baroncapitalgroup.com+1

According to the official agenda: baroncapitalgroup.com+1

- The day begins with CEO roundtables featuring leaders from Morningstar, Gartner, On Holding and Shopify.

- In the afternoon, at 1:05 p.m. ET, Ron Baron and Elon Musk sit down for a headline fireside chat titled “Starman: Elon Musk and Ron Baron Discuss the Future”, covering Tesla, SpaceX and xAI.

- A separate livestreamed “fireside chat” on X (formerly Twitter) is also scheduled around 1 p.m. ET, where Baron will interview Musk on artificial intelligence, Tesla’s autonomous driving push and SpaceX’s use of machine learning. Blockchain News

Coverage from AI and crypto outlet Blockchain.News notes that the conversation is expected to touch on: Blockchain News

- xAI’s rapid growth and its Grok models

- Tesla’s Full Self‑Driving software, which has posted a roughly 10x improvement in miles per intervention after recent updates

- The role of massive AI compute clusters — such as xAI’s Colossus supercomputer — in staying competitive

For Baron, this isn’t just star power for his conference; it’s a live demonstration of why he’s comfortable tying so much of his career to Musk’s projects. If AI, robotaxis and humanoid robots become the economic engines many expect, Tesla and SpaceX could justify both the rich valuation and the enormous CEO pay package that just passed. TradingView+2Nasdaq+2

What Baron’s Stance Means for Everyday Investors

You don’t need to agree with Baron — or be willing to hold one stock for life — to take away practical lessons from today’s news. His approach highlights several core ideas:

1. Time Horizon Is a Competitive Edge

Baron is playing a game that lasts decades, not months. Whether or not Tesla ultimately hits an $8.5 trillion market cap, this mindset alone differentiates him from traders reacting to each quarterly miss.

For individual investors, simply lengthening your holding period — provided the underlying business continues to execute — can be a powerful advantage.

2. Concentration Cuts Both Ways

With Musk-linked companies making up roughly a quarter of Baron Capital’s total assets and more than 30% of some flagship funds, Baron has concentrated conviction risk. baroncapitalgroup.com+1

If Musk delivers on AI, robotaxis, and energy storage, that concentration could be a career-defining win. If he doesn’t, it could materially drag on Baron’s long-term numbers.

For most investors, that level of concentration may be uncomfortable. The lesson isn’t “copy his allocation,” but rather understand how much of your portfolio depends on a single leader, company or theme, and be sure you’re genuinely comfortable with it.

3. Volatility Is the Toll for Growth

Zacks currently rates Tesla as a “Hold,” noting that execution risks remain high and that near-term earnings are under pressure even as ambitious AI and robotics projects consume capital. Nasdaq

Baron’s choice to lean into, rather than away from, that volatility underscores a core trade‑off:

- Want stability? Stick with diversified, mature businesses.

- Want potential “Musk-level” upside? You’re signing up for deep drawdowns and years of uncertainty.

4. Narrative and Fundamentals Must Eventually Meet

Tesla’s story today touches almost every hot buzzword: AI, humanoid robots, robotaxis, supercomputing, space infrastructure. But the $1 trillion pay package ties Musk’s reward to hard metrics — cash flow, vehicles, robots, and market value — not just headlines. TradingView+2CBS News+2

Investors inspired by Baron’s conviction should remember that great narratives still have to show up in the numbers. Watching the pace of robotaxi rollouts, Optimus deployments and energy-storage profitability over the next decade will be crucial in judging whether today’s bets were rational or euphoric.

The Bottom Line

On November 14, 2025, Ron Baron is doing three things at once:

- Telling Squawk Box viewers he doesn’t plan to sell his personal Tesla or SpaceX shares in his lifetime

- Publicly backing Elon Musk’s historic $1 trillion pay package as a fair price for visionary execution

- Hosting Elon Musk at his flagship Baron Investment Conference for a high-profile conversation about AI, autonomous vehicles and the future of growth investing Blockchain News+4StockAnalysis+4YouTube+4

For investors, the message is clear:

Long-term conviction, especially in transformative technologies, requires living with short-term discomfort — sometimes in very large doses.

Whether you share Baron’s faith in Elon Musk or not, his “never sell” declaration is a vivid reminder that the biggest fortunes in markets are often built not just by identifying great companies, but by holding on to them far longer than feels comfortable.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, an offer, or a recommendation to buy or sell any securities. Always do your own research and consider speaking with a qualified financial advisor before making investment decisions.