- On 13–14 June 2025 Israeli strikes hit Iranian nuclear and missile sites, driving Iran’s internet speeds below 15% of normal per NetBlocks, and within about 24 hours SpaceX activated Starlink in Iran with Elon Musk posting “The beams are on.”

- Starlink operates 6,300-plus satellites at roughly 550 km altitude, making Iran unable to sever fiber backhaul or submarine cables to block the service.

- An estimated 20,000 dishes were already scattered across Iran before the crisis due to underground smuggling networks.

- Recent direct-to-device tests let ordinary phones send SOS messages through Starlink even without a dish.

- Iranian state media warned citizens they could face espionage charges for using Starlink.

- Tehran filed a formal ITU complaint on 23 June demanding SpaceX disable unauthorized terminals on Iranian soil.

- Radio-astronomy monitors detected bursts on Ku-band frequencies near Tabriz on 20 June consistent with uplink jamming tests.

- Diaspora networks in Turkey and the UAE procured terminals, relabeled units as “solar inverters,” and smuggled them across the Bazargan crossing to Iran; Tehran technicians sold kits for about $900.

- U.S. sanctions risk penalties for operating Starlink inside Iran without Treasury approval, and SpaceX had previously sought licenses for Ukraine and Cuba.

- Analysts say Starlink’s Iranian coverage could trigger wider crackdowns in China or Russia, setting a precedent for wartime satellite connectivity, while an OFAC ruling is expected within weeks and SpaceX may deploy geo-fenced beam nulling to protect other markets.

The past ten days have seen an unprecedented collision between a Silicon Valley billionaire and one of the world’s most restrictive regimes. When Iranian authorities plunged the country into an almost total internet blackout after Israeli air-strikes on June 13 – 14, SpaceX CEO Elon Musk switched Starlink coverage on over Iran less than 24 hours later, tweeting simply: “The beams are on.” timesofindia.indiatimes.com What followed has been a fast-moving tug-of-war: tens of thousands of clandestine satellite dishes lighting up, desperate users scrambling for a lifeline, officials threatening jail, and digital-rights experts warning that the battle for connectivity in wartime Iran could redraw the global map of information control. Below is the most comprehensive deep-dive yet into what happened, why it matters, and what comes next.

1. Flash-Point Weekend: A Blow-by-Blow Timeline

| Date (2025) | Event |

|---|---|

| 13 Jun | Israeli strikes hit multiple Iranian nuclear and missile sites; fixed-line and mobile data speeds inside Iran collapse below 15 % of normal, according to NetBlocks. netblocks.org |

| 14 Jun, 10:17 UTC | The Washington Times breaks the story that Musk has “activated Starlink internet access in Iran.” washingtontimes.com |

| 14 Jun, 18:42 UTC | Iranian Ministry of Communications admits to “temporary restrictions” for “security reasons.” caliber.az |

| 15 Jun | Musk posts his three-word confirmation – “The beams are on.” timesofindia.indiatimes.com |

| 18 Jun | TechCrunch and Bloomberg document a “near-total collapse” of the domestic backbone; NetBlocks director Alp Toker warns it resembles the 2019 blackout. techcrunch.com bloomberg.com |

| 23 Jun | Tehran asks the International Telecommunication Union to force SpaceX to deactivate “unauthorised devices” and threatens citizens with prosecution for owning dishes. jpost.com |

2. How Starlink Pierced the Shutdown

- Low-Earth-Orbit blanket: Starlink’s 6,300-plus satellites orbit at 550 km, so Iran cannot sever fibre backhaul or cut submarine cables to stop them. news.satnews.com

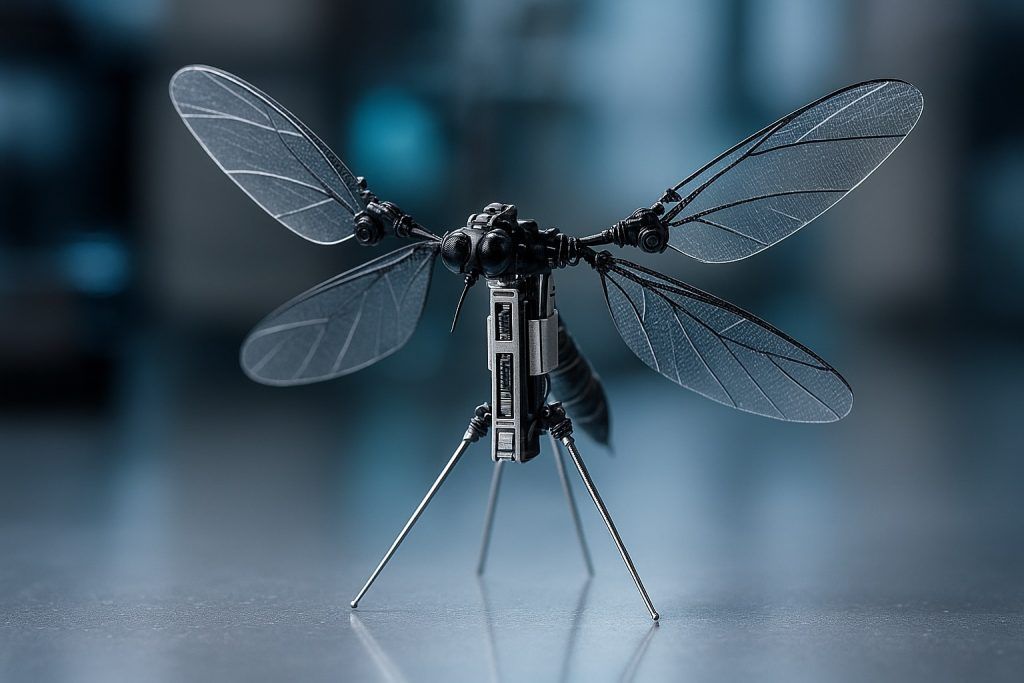

- Terminal stockpile: Years of underground smuggling mean an estimated 20,000 dishes were already scattered across Iran before the crisis erupted. ts2.tech

- Cell-to-satellite texting: Recent direct-to-device tests let ordinary phones send SOS messages through Starlink even without a dish, extending reach far beyond terminal owners. m.economictimes.com

Digital-rights researcher John Scott-Railton notes that “every new communications tool moves faster than the regime trying to track it down – but novel tech also creates fresh risks.” time.com

3. Tehran Strikes Back

- Legal threats: State media warn citizens they could face espionage charges for using Starlink and urge neighbours to report illegal dishes. apnews.com

- ITU appeal: Officials filed a complaint on 23 June demanding that SpaceX disable “unauthorised terminals” on Iranian soil. jpost.com

- Possible jamming: Radio-astronomy monitors detected bursts on Ku-band frequencies near Tabriz on 20 June, which experts say are consistent with uplink jamming tests. capacitymedia.com

Despite the threats, usage is still climbing. “Satellite beams are harder to censor than copper,” says Hadi Ghaemi of the Center for Human Rights in Iran, calling Starlink “a game-changer for civil society.” ts2.tech

4. The Smuggling Supply Chain

| Stage | Details |

|---|---|

| Procurement | Diaspora networks in Turkey and the UAE purchase terminals covertly, exploiting loopholes in U.S. re-export rules under General License D-2. home.treasury.gov |

| Transit | Units are broken into parts, relabelled as “solar inverters,” and driven across the mountainous Bazargan crossing hidden in fuel tankers. ts2.tech |

| Setup | Volunteer technicians in Tehran sell kits for ~$900 – three times the U.S. price – including camouflage tarps to foil rooftop spotters. ts2.tech |

5. Security & Sanctions Landmines

- U.S. sanctions: Operating Starlink inside Iran without Treasury approval risks penalties; SpaceX previously sought case-by-case licences for Ukraine and Cuba. reuters.com

- Kinetic risk: Scott-Railton reminds users that high-gain antennas “become beacons” for missile targeting, citing Russia’s track record in Ukraine. reuters.com

- Escalation cycle: Iranian hard-liners argue the network could relay targeting data to Israel, framing Starlink as a “military asset.” jpost.com

6. Human Impact on the Ground

First-hand accounts compiled by ABC News Australia describe families driving hundreds of kilometres to share a single dish and upload evacuation videos. abc.net.au The Guardian reports cancer patients arranging chemo appointments via Starlink-powered WhatsApp groups after landlines failed. theguardian.com NetBlocks graphs show traffic bursts each night as clandestine dishes come online under cover of darkness. x.com

7. What Experts Say

- Alp Toker (NetBlocks): “We’re witnessing a backbone shutdown similar to 2019, but Starlink has blunted its impact.” bloomberg.com

- Hadi Ghaemi (CHRI): “Iran’s intranet becomes obsolete the moment a satellite dish powers up.” ts2.tech

- Mahsa Alimardani (Oxford Internet Institute): warns that “terminal triangulation tech is improving; users must assume the regime can locate a dish within metres within minutes.” capacitymedia.com

8. Geopolitical Ripple Effects

- Digital Iron Curtain vs. Satellite Silk Road: Analysts at Israel’s JISS think widespread Starlink adoption could inspire similar crackdowns in China or Russia. jiss.org.il

- Precedent for wartime connectivity: AP notes that only a “small number” of terminals in Iran were active before Musk’s move, making this the first time a foreign satellite operator has unilaterally expanded service into a sanctioned war zone. apnews.com

- Markets & investors: Bloomberg warns future Starlink licences could face blowback in other jurisdictions if Musk is seen as choosing sides. bloomberg.com

9. What Happens Next?

- OFAC ruling: Treasury officials must decide whether Starlink’s Iranian coverage violates sanctions or qualifies as humanitarian tech. A decision is expected “within weeks,” according to Reuters sources on Capitol Hill. reuters.com

- Technical arms race: Expect more sophisticated Iranian jammers and possible geo-fenced beam nulling by SpaceX to protect other markets. capacitymedia.com

- Grass-roots adoption: SatNews predicts dish numbers could double by August if smuggling routes stay open. news.satnews.com

10. Bottom Line

Starlink’s sudden illumination over Iran has already cracked Tehran’s information blockade and shown every authoritarian government that killing the internet now requires shooting satellites out of the sky. The next moves—by U.S. regulators, Iranian censors, and SpaceX engineers—will determine whether this becomes a fleeting flash of freedom or the dawn of a truly un-censorable global web.

Sources used in this report include original coverage by The Washington Times, TechCrunch, NetBlocks, Bloomberg, SatNews, The Economic Times, The Jerusalem Post, ABC News, The Associated Press, The Guardian, Reuters, Time Magazine, TS2 Space, Capacity Media and Caliber.az,