US stock futures are pointing to a cautiously higher open on Tuesday, December 9, 2025, as Wall Street digests a modest pullback from record territory and looks ahead to a pivotal Federal Reserve meeting and a major policy shift on AI chips. After the S&P 500, Dow Jones Industrial Average and Nasdaq Composite all slipped on Monday, they remained just below all‑time highs, setting the stage for a key “Fed week” that could define the year’s final stretch.Reuters+ 2KPRC+ 2

Investors are overwhelmingly expecting the Fed to deliver a quarter‑point rate cut on Wednesday — the third cut this year — but markets are far less certain about how aggressively policymakers will ease in 2026. Futures and economist surveys put the odds of a 25‑basis‑point move at roughly 85–90%, with the target range for the federal funds rate seen dropping to 3.50%–3.75%.Morningstar+ 3Reuters+ 3Reuters+ 3

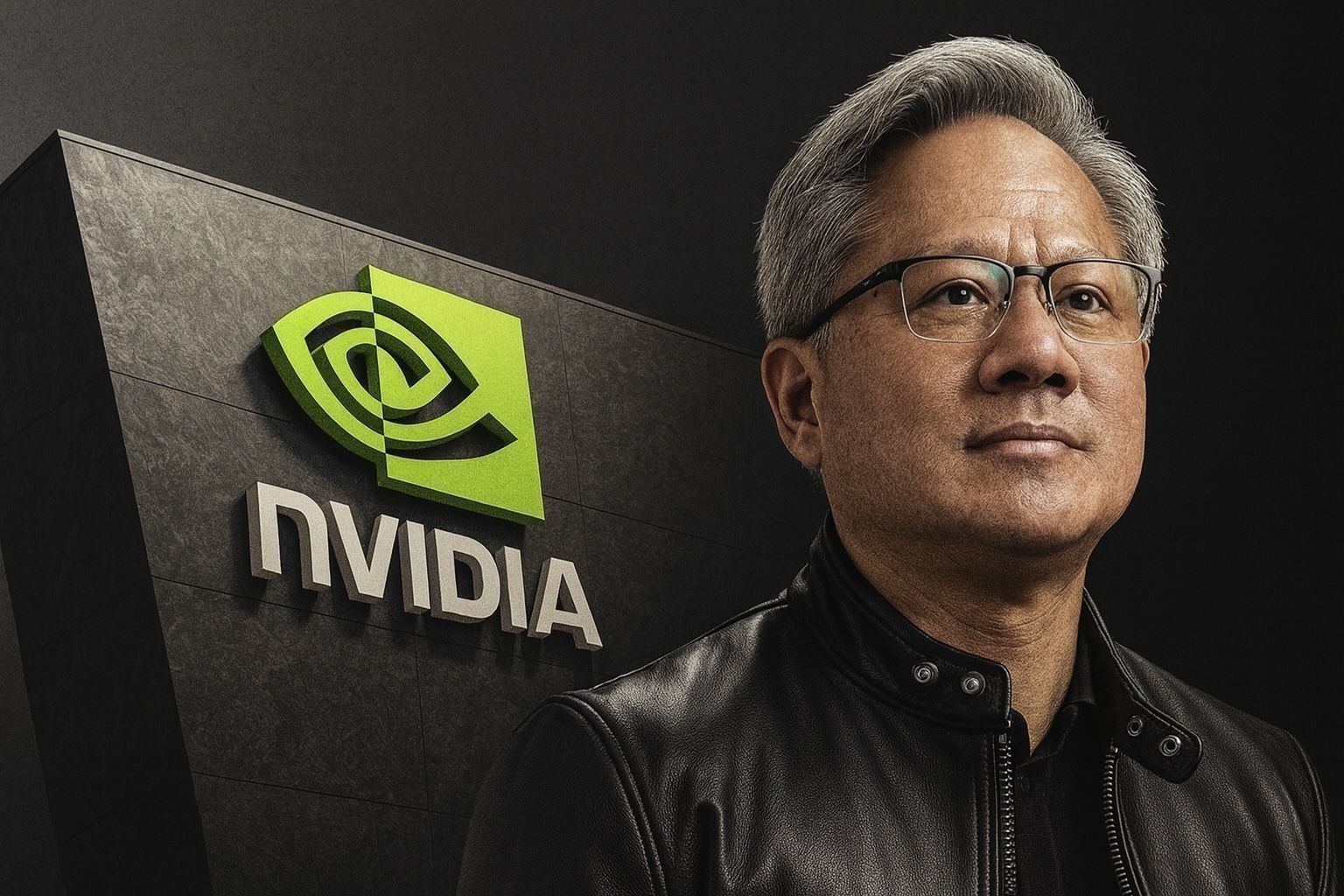

At the same time, Washington’s decision to allow Nvidia to sell its powerful H200 AI chips to “approved” customers in China — in exchange for a 25% fee on those exports — has injected fresh momentum into the technology trade and lifted tech futures ahead of the US open.KPRC+ 3Reuters+ 3Global Banking | Finance+…

Below is a detailed look at how US markets are positioned today, what’s driving sentiment, and what strategists are forecasting for 2026.

Wall Street Recap: Monday’s Pullback From Record Levels

On Monday, December 8, the major US stock indexes finally exhaled after a strong multi‑week run:

- S&P 500 fell 23.89 points, about 0.35% , to 6,846.51 .

- Dow Jones Industrial Average lost 0.45% to 47,739.32 .

- Nasdaq Composite slipped 0.14% to 23,545.90 .Reuters+ 2KPRC+ 2

Despite the dip, the S&P 500 remains up roughly 16% year‑to‑date and sits less than 1% below its record high set in late October, underscoring how modest Monday’s pullback was in the context of a powerful 2025 rally.Reuters+ 1

Under the surface, the move was very much “risk‑off”:

- Technology was the only S&P 500 sector to finish higher, gaining about 0.9% .

- Communication services was the biggest laggard, dropping roughly 1.8% .

- Most of the index’s 11 sectors closed in the red as rising Treasury yields and pre-Fed nervousness weighed on equities.Reuters+ 2BusinessToday+ 2

US 10‑year Treasury yields climbed to around 4.19% , their highest level since late September, partly in response to a major earthquake in Japan that pushed investors toward safe‑haven assets and raised questions about the Bank of Japan’s next move. Higher yields added to pressure on US stocks.Reuters+ 1

Tuesday, December 9: Futures Edge Higher Ahead of the Fed

Heading into today’s session, futures suggest Wall Street will try to claw back some of Monday’s losses:

- S&P 500 futures were up roughly 0.1% in early trading, after the index halted a four-day rally on Monday.Bloomberg+ 1

- Dow and Nasdaq futures were also modestly higher, with investors eyeing both Wednesday’s Fed decision and NVIDIA‑led strength in tech.Barron’s+ 2TipRanks+ 2

Overnight, Asian shares mostly fell , tracking Wall Street’s pullback from record highs, while US futures “edged higher” as traders positioned for the Fed.Reuters+ 3KPRC+ 3Yahoo Finance+ 3

European stocks were similarly muted on Tuesday, with the region’s broad Stoxx 600 little changed as investors waited for the Fed’s verdict and monitored a softening in oil prices.Reuters+ 2Reuters+ 2

Fed Focus: Markets Price a “Hawkish Cut”

The Federal Open Market Committee (FOMC) begins its two-day meeting today, with a policy statement and press conference scheduled for Wednesday afternoon (2:00 pm and 2:30 pm ET, respectively).Federal Reserve

Key points on Fed expectations:

- A Reuters poll of more than 100 economists shows a strong majority expecting a 25‑basis‑point cut at the December 9–10 meeting to support a cooling labor market.Reuters

- Futures tracked by the CME FedWatch Tool put the probability of that moving in the 87–90% range.Reuters+ 4Reuters+ 4Reuters+ 4

- The Fed is expected to lower the fed‑funds target from 3.75%–4.00% to 3.50%–3.75% , marking the third consecutive cut this year.Reuters+ 2Reuters+ 2

What’s less clear — and what markets care about most — is the path for 2026 :

- Reuters reporting and strategist commentary suggest investors are bracing for a “hawkish cut” : a rate reduction coupled with guidance that future easing will be limited unless the economy slows more sharply.Reuters+ 1

- Poll medians point to two additional cuts by the end of 2026 , but there is no clear consensus on timing, and FOMC members appear unusually split.Reuters

- Analysts also highlight the risk of multiple dissents at this week’s meeting — something the Fed has not seen since 2019 — underscoring internal divisions over how aggressively to respond to sticky inflation and mixed growth data.Reuters+ 2Reuters+ 2

As BMO Private Wealth’s Carol Schleif noted in comments reported by Reuters, with earnings season largely behind the market and the Fed decision looming, it’s “hard for the market to find a direction” until policymakers lay out their roadmap.Reuters+ 1

Beyond the Fed, investors will also get October JOLTS job-openings data later today at 10:00 am ET and November CPI next week on December 18 — data points that could either validate or challenge the Fed’s evolving narrative.Investing.com+ 3Bureau of Labor Statistics…

AI and Nvidia: Washington’s H200 Green Light Lifts Tech

Tech is once again at the center of the story — and not just because it was Monday’s lone winning S&P 500 sector.

On Monday, President Donald Trump said the United States will allow Nvidia’s H200 AI processors — its second‑most‑advanced AI chips — to be exported to China, subject to a 25% fee on each sale and vetting of “approved” commercial customers. More advanced Blackwell and Rubin chips remain restricted.The Indian Express+ 3Reuters+ 3Global Bank…

Why it matters for the market:

- Nvidia had already climbed about 3% during Monday’s regular session on reports that such a deal was in the works, then added another 1–2% in after‑hours and Asian trading once the announcement was confirmed.KPRC+ 2Global Banking | Finance+ 2

- The news gives Nvidia a potential path to regain billions in AI-chip sales to China while the US government takes a cut and claims it is preserving national security.Reuters+ 2Global Banking | Finance+ 2

- Pre‑market coverage from financial outlets shows US tech futures outperforming broader indexes , supported by Nvidia’s jump.Yahoo Finance+ 2TipRanks+ 2

Economists and China specialists warn the move could also accelerate China’s AI build‑out , narrowing the performance gap between Chinese and American AI models, as noted in analysis cited by the Associated Press.KPRC+ 1

For US markets, though, the near‑term takeaway is simple: AI remains a core pillar of the bull case for equities , and policy decisions that favor Nvidia and other chipmakers continue to have outsized impact on index‑level performance.

Media Megadeal Drama: Paramount vs. Netflix Weighs on Communication Services

If AI is the upside story, traditional media is the messy one.

A high‑stakes takeover battle for Warner Bros. Discovery helped drag down the S&P 500 communication services sector on Monday:

- The group fell around 1.8% , making it the worst‑performing sector in the index.KPRC+ 3Reuters+ 3BusinessToday+ 3

The backdrop:

- Paramount Skydance launched a hostile $108.4 billion all‑cash bid for all of Warner Bros. Discovery, offering $30 per share and directly challenging an earlier $72 billion cash‑and‑stock deal from Netflix for select assets.https://www.weau.com+ 3Reuters+ 3The Daily…

- The move is backed by deep‑pocketed investors, including Middle Eastern sovereign wealth funds and other major financiers, according to Reuters and other reports.Reuters+ 1

- If Warner Bros walks away from Netflix’s agreement, it faces a $2.8 billion breakup fee , while Netflix would owe $5.8 billion if its deal collapses, underscoring the financial stakes.Reuters+ 1

Market reaction has been sharp:

- Warner Bros. Discovery shares rose about 4–5% , reflecting hopes of a richer payout.

- Paramount Skydance rallied roughly 9% on speculation it could transform itself into a Hollywood super-power.

- Netflix slid about 3.4% , as investors questioned whether the company might overpay or face tougher antitrust scrutiny if it wins.https://www.weau.com+ 3Reuters+ 3KPRC+ 3

President Trump has also flagged antitrust concerns, suggesting a Netflix–Warner combination “could be a problem”, adding a political layer of uncertainty that markets dislike.KPRC+ 2Reuters+ 2

For the broader market, this saga underscores two themes:

- Deal risk can quickly pressure big index components and entire sectors.

- Regulatory and political scrutiny over media concentration remains a real overhang for investors.

Beyond the Headlines: Flows Show Caution Beneath the Surface

Even as indexes hover near records, money flows tell a more cautious story.

In the week to December 3 , US investors:

- Poured about $104.75 billion into money market funds , the largest weekly inflow since early November.

- Pulled around $3.52 billion from US equity funds , marking a second straight week of net outflows.Reuters

Breaking it down further:

- Mid‑cap equity funds recorded a seventh consecutive week of outflows (~$495 million), while small‑cap and large‑cap funds lost roughly $1.18 billion and $476 million , respectively.Reuters

- Sector funds still drew money, with industrials and gold/precious-metals equity funds attracting about $510 million and $293 million in net inflows.Reuters

- Bond funds saw only about $314 million in inflows — the smallest weekly gain since October — as investors favored short‑to‑intermediate investment‑grade and municipal debt while pulling $1.58 billion from government and Treasury funds.Reuters

The pattern is clear:

Investors are parking cash in safe assets , selectively adding to sectors like industrials and gold, and treading carefully in broad equities — a classic pre-Fed, late-cycle positioning shift.

What Strategists Expect for 2026: Bullish Targets vs. Volatility Bets

Even with near‑term caution, many Wall Street strategists remain optimistic about the multi‑year outlook for US stocks.

Oppenheimer’s Street‑High S&P 500 Target

Oppenheimer has emerged as one of the most bullish houses on Wall Street , boosting its year‑end 2026 S&P 500 target to 8,100 — a Street‑high forecast.oppenheimer.com+ 2Morningstar+ 2

According to the firm’s latest strategy note:

- The new target implies roughly 18% upside from recent levels near 6,870 and about 14% above its 2025 year-end target of 7,100.oppenheimer.com+ 1

- Oppenheimer argues that the 2025 rally has broadened beyond mega-cap tech , strengthening the foundation for further gains.

- With Q3 2025 S&P 500 earnings up about 12.9% on 8.2% revenue growth , and 10 of 11 sectors delivering positive earnings growth (led by technology, financials and materials), the firm sees fundamentals as supportive of higher valuations.Investing.com

Other strategists are also constructive. One widely cited forecast expects S&P 500 earnings per share to grow about 14% in 2026 , reaching roughly $320 , compared with growth of around 10% in 2025.Yahoo Finance

Volatility as an Asset Class

Not everyone is simply “long stocks.” A separate Reuters report highlights how hedge funds and state-backed investors are ramping up volatility strategies for 2026, betting that geopolitical tensions, tariff disputes and diverging interest-rate paths will keep markets choppy.Yahoo Finance+ 1

Key takeaways from that theme:

- Volatility‑linked products and options strategies are attracting more institutional capital.

- Fed uncertainty — especially around how far and how fast rates may fall — is encouraging investors to hedge downside risk even as they maintain equity exposure.Reuters+ 2Reuters+ 2

The combination of bullish long‑term targets and rising demand for volatility hedges paints a nuanced picture: markets may still trend higher, but the path could be far less smooth than in 2025.

Consumer and Macro Backdrop: Households Nervous, Jobs Still Solid

Fresh data from the New York Fed’s Survey of Consumer Expectations shows that:

- US households became more worried about their personal finances in November.

- Yet inflation expectations held steady at about 3.2% over one year and 3% over three years, while perceptions of the job market actually improved , with lower expected job-loss probabilities.Reuters

This mixed backdrop — softer confidence but decent labor-market views and inflation still above the Fed’s 2% target — helps explain why policymakers are likely to cut rates again this week but may emphasize caution about further easing.Reuters+ 2Reuters+ 2

What to Watch Next

For traders and longer‑term investors alike, here are the key catalysts on the US market calendar:

- Fed Decision – Wednesday, December 10

- 2:00 pm ET: FOMC statement and updated projections.

- 2:30 pm ET: Chair Jerome Powell’s press conference.Federal Reserve+ 2Reuters+ 2

- Labor and Inflation Data

- Today: October JOLTS job-openings report (10:00 am ET), giving a fresh look at labor-market tightness.Bureau of Labor Statistics

- December 18: November CPI — critical for confirming whether inflation is drifting sustainably toward target.Bureau of Labor Statistics+ 2Bureau of Lab…

- Earnings From AI and Cloud Bellwethers

- Broadcom (AVGO) reports fiscal Q4 2025 results after the close on Thursday, December 11 , with analysts expecting revenue growth above 20% year-over-year.Future+ 2Yahoo Finance+ 2

- Oracle is also scheduled to report this week, with investors focused on cloud and AI infrastructure spending, especially given concerns about debt‑funded AI investment.Reuters+ 1

- Regulatory and Policy Developments

- Market reaction to the Nvidia H200 export approval and any follow‑up on AI regulation, including a potential executive order on a unified national AI rulebook.Reuters+ 2Global Banking | Finance+ 2

- Ongoing scrutiny of the Paramount–Netflix–Warner Bros bidding war and associated antitrust commentary.Reuters+ 2Barron’s+ 2

Bottom Line for US Stock Market Today

As of Tuesday, December 9, 2025, the US stock market sits at a crossroads :

- Indexes are near record highs , powered by AI, resilient earnings and an economy that has slowed but not stalled.Reuters+ 2Investing.com+ 2

- Short‑term bail is evident in flows into money market funds and the market’s sensitivity to every Fed headline.Reuters+ 2Reuters+ 2

- Policy decisions — from rate cuts to chip‑export rules and media‑merger scrutiny — are exerting an unusually strong influence on sector winners and losers.Reuters+ 3Reuters+ 3Reuters+ 3