NEW YORK, December 30, 2025, 08:23 ET

- Copper rose as much as 2.2% to $12,493 a ton, putting it on track for a 10th straight day of gains.

- LME copper spiked to a record $12,960 a ton on Monday before paring gains; it is up 41% in 2025.

- U.S. Comex copper hit $5.8395 per lb and Shanghai futures touched a record as traders shifted stock toward the U.S. ahead of tariff decisions.

Copper prices extended a year-end rally on Tuesday, on track for the longest winning streak since 2017 as traders pointed to tight supply and tariff-linked buying.

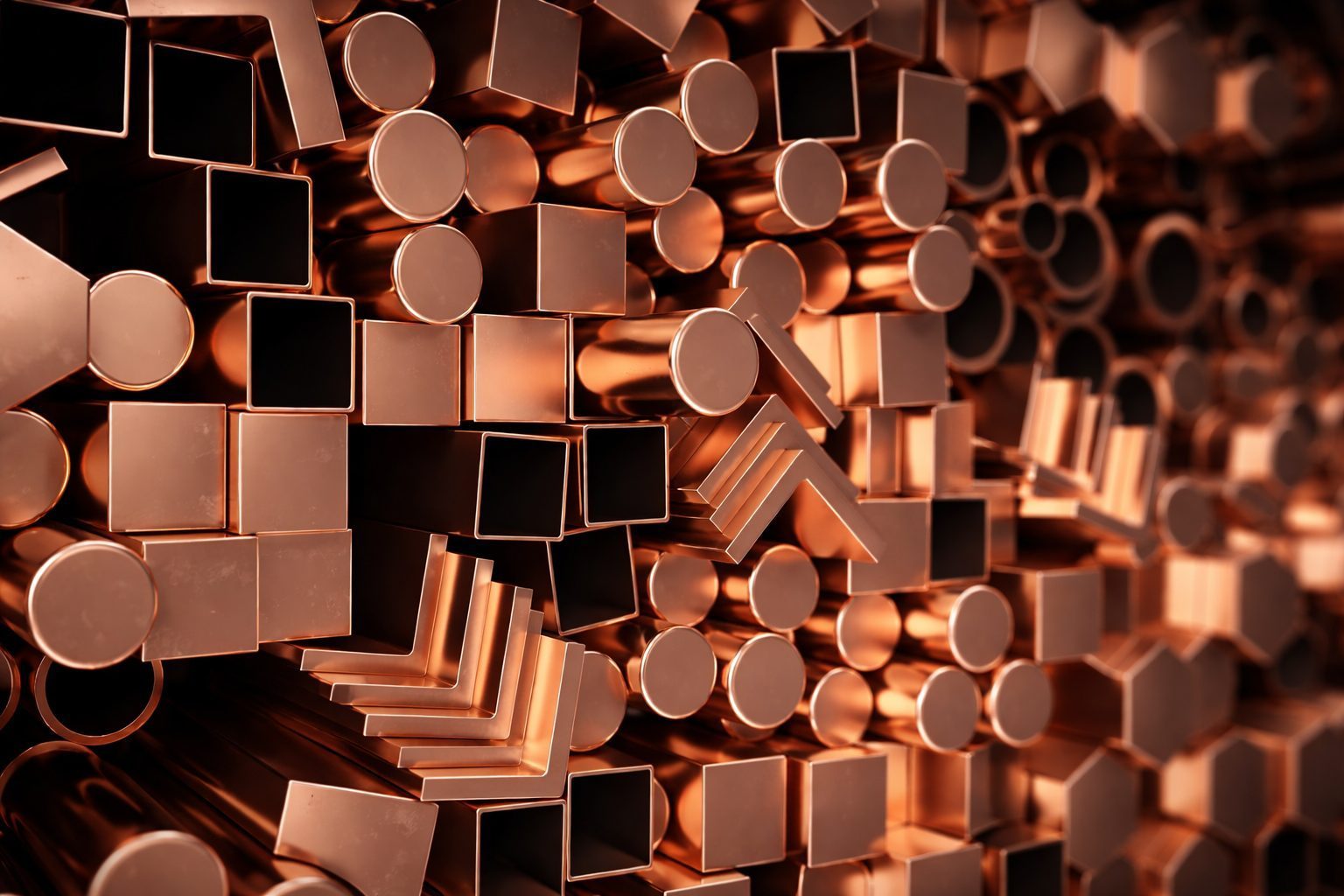

The red metal is used in wiring, construction and electronics, making it a key cost line for manufacturers. Record prices can raise input costs at a time when power-grid upgrades and data center buildouts are soaking up material.

The run-up is also reshaping flows, with metal moving to the United States to capture higher prices there. That can leave less copper available in other regions and lift benchmark prices on the London Metal Exchange, a key venue for industrial metals.

Copper rose as much as 2.2% to $12,493 a ton, putting it on track for a 10th session of gains, according to Bloomberg News. Bulls have argued that more metal will be drawn into the United States to beat potential tariffs, forcing buyers to pay more. 1

On Monday, three-month copper on the LME jumped 6.6% to a record $12,960 a ton before easing to $12,415 by 1030 GMT, still up 2.1% and leaving it up 41% for the year. “Comex led on Boxing Day,” said Robert Montefusco at broker Sucden Financial, as U.S. futures rallied while London was closed, with Comex copper hitting $5.8395 per lb on Friday and Shanghai futures touching a record 102,660 yuan a ton. 2

A Bloomberg report carried by Yahoo Finance described a volatile reopening in London, with prices briefly jumping nearly 7% to near $13,000 a ton before finishing 0.5% higher. It said New York futures fell, erasing much of Friday’s gain as London caught up after the holiday closure. 3

Politics is likely to remain a major driver for commodities into 2026, with tariff headlines capable of shifting stockpiles faster than end-use demand. A Reuters commodities review said copper’s tariff-driven stockpiling could reverse next year if tariffs change and inventories are drawn down. 4

Other base metals were mixed, with aluminum and zinc firmer while tin eased, reflecting thin year-end trading rather than a broad-based demand surge.

Copper’s rally has been fueled by tight inventories and supply disruptions that can quickly translate into higher premiums for immediate delivery. Those signals tend to pull in short-term trading, amplifying swings between regions.

Longer term, investors continue to focus on electrification trends that require large volumes of copper for grids, energy infrastructure and manufacturing. Demand from data center construction has also become a key theme because those facilities require heavy cabling and power equipment.