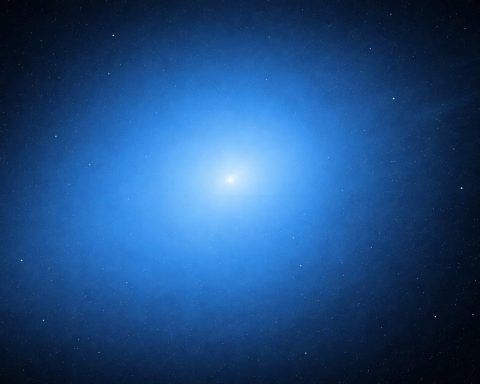

Comet 3I/ATLAS Today (Dec. 25, 2025): Latest Updates, Skywatching Forecast, and What Scientists Expect Next

On December 25, 2025, Comet 3I/ATLAS is already on its way out—yet it remains one of the most intensively monitored visitors of the year. After making its closest approach to Earth on Dec. 19, the rare interstellar comet continues to recede, but the science is accelerating: new analyses of its dust jets, multiple NASA and ESA spacecraft observations, and fresh radio results have sharpened the picture of what this object is (and what it isn’t). seti.org As of 06:01 UTC on Dec. 25, NASA/JPL ephemerides show 3I/ATLAS is about 1.814 AU from Earth and 2.463 AU from the Sun, with