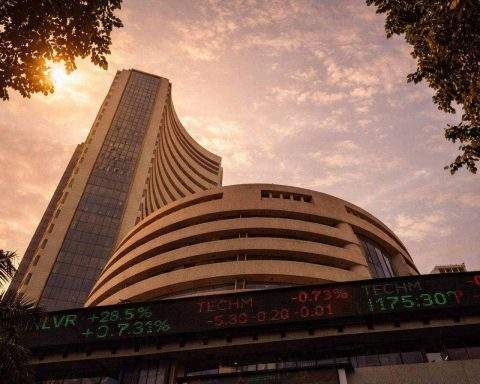

NGX Group stock at ₦122: audited results and a CBN rate call set the week’s mood

Nigerian Exchange Group’s board will review 2025 audited financials on Feb. 24, according to a company filing. Shares closed flat at ₦122 on Feb. 20, with 5.95 million shares traded. The NGX All-Share Index rose 6.95% for the week, while market turnover reached 7.66 billion shares. Investors are also watching the central bank’s Feb. 23–24 policy meeting for signals on interest rates.