New York, Jan 25, 2026, 13:33 EST — The market has closed.

- The Materials Select Sector SPDR Fund (XLB) closed Friday roughly 0.9% higher, hovering close to its 52-week peak.

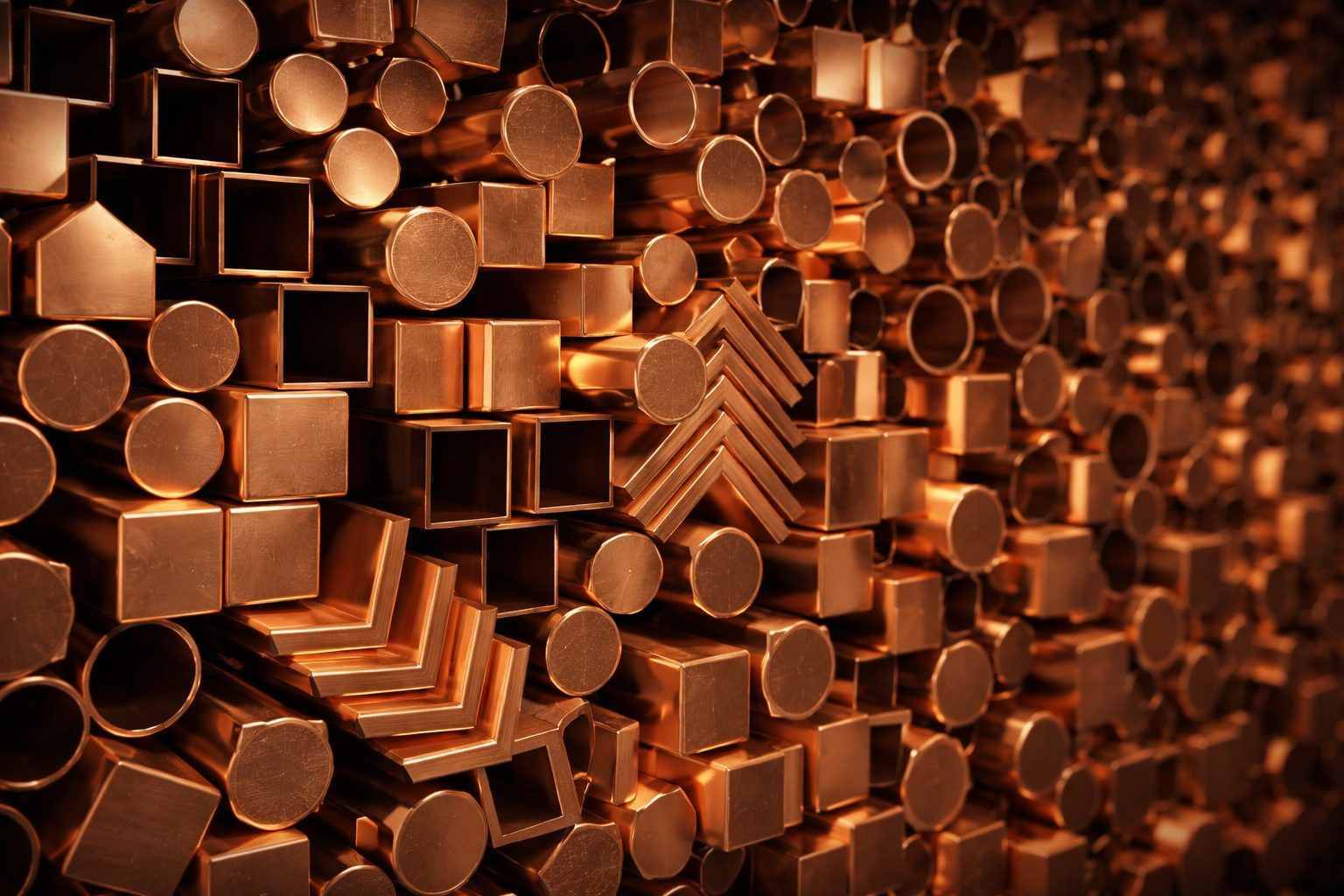

- Metals’ strength and U.S. critical-minerals policy return to the spotlight as Monday approaches.

- The Federal Reserve meets on Jan. 27–28, while China’s PMI figures will also draw attention next.

U.S. basic materials stocks ended last week on a strong note. The sector reopens Monday with renewed focus on critical minerals, following news of a U.S. government-backed rare earths agreement that emerged over the weekend.

This matters now because materials have become a key barometer for two tough-to-value factors: real-economy demand for industrial inputs and the policy risks around supply chains. When either changes, the sector usually reacts sharply.

The calendar isn’t helping. The Fed’s initial rate decision for 2026 hits midweek, followed by China’s factory data—both set to shake the dollar and influence demand forecasts crucial to miners, steelmakers, and chemical stocks.

The Materials Select Sector SPDR Fund (XLB) gained 0.9%, closing Friday at $49.97 after hitting a session high of $49.99. StockAnalysis

The S&P 500 materials index climbed 0.9% during the day, despite the broader market finishing mixed. Major players like Freeport-McMoRan jumped around 2.6%, Newmont increased by about 2.2%, and Linde was up roughly 1.3%. Reuters

Metal prices played a key role near the close. Doug Porter, chief economist at BMO Capital Markets, noted Friday that “the latest surge in metals prices provided support for materials,” with gold climbing toward $5,000 an ounce and silver topping $100 for the first time. Reuters

Early momentum hits the market. The Trump administration is set to acquire a 10% stake in USA Rare Earth through a $1.6 billion debt-and-equity deal, according to two sources familiar with the arrangement who spoke to Reuters. An official announcement and investor call are scheduled for Monday. The package would hand Washington 16.1 million shares, plus warrants for an additional 17.6 million at $17.17 each, the sources added. Reuters

Macro risk hangs over everything. The Fed’s FOMC gathers Jan. 27–28, with the rate announcement scheduled for 2:00 p.m. ET on Jan. 28, followed by a press briefing at 2:30 p.m. Federal Reserve

Next up is China. The official purchasing managers’ index (PMI), a key survey tracking factory output, will be published on Jan. 31. Materials traders keep a sharp eye on this number for signals about demand in construction and manufacturing. FXStreet

But the setup is double-edged. Should the Fed take a hawkish stance or the dollar strengthen, metals could lose steam fast, dragging down materials ETFs as quickly as they rose. Deals driven by policy also carry execution risks, from funding conditions to timing hurdles.

Monday kicks off with USA Rare Earth’s announcement and conference call. Then, all eyes shift to Wednesday’s Fed statement and Powell’s press briefing. The week wraps up with China’s PMI release.