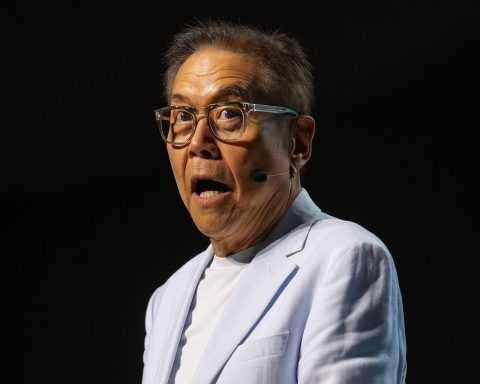

Robert Kiyosaki Warns ‘Biggest Crash in History’ Has Begun: What His 2025 Bitcoin, Ethereum, Gold and Silver Calls Mean After the $1.2 Trillion Crypto Meltdown

Published: November 30, 2025 – Global Markets Why Robert Kiyosaki Is Suddenly Everywhere Again On 30 November 2025, a fresh wave of coverage amplified Robert Kiyosaki’s long‑running warning that the “biggest crash in history” is no longer a distant threat but already underway. A Moneywise column syndicated on Yahoo Finance highlighted Kiyosaki’s latest post on X (formerly Twitter), where he claims that while “millions will lose everything”, prepared investors could come out richer and should pivot into tangible and scarce assets rather than rely on traditional portfolios. Yahoo Finance+1 That same day: At the same time, mainstream business media from