Micron stock slides as AI-chip rally cools, even after Piper Sandler’s fresh $400 target

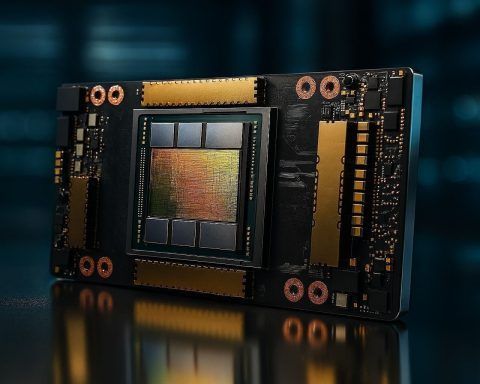

NEW YORK, Jan 8, 2026, 16:08 EST — After-hours Micron Technology (MU.O) shares ended Thursday down 3.8%, easing back after a strong early-year run that took the memory chipmaker to a record high earlier this week. The move matters now because Micron has turned into a handy proxy for what investors will pay for a memory upcycle linked to artificial-intelligence spending, where tighter supply can quickly flow through to higher contract prices. Wall Street has been buying into that story, rolling out fresh target hikes and talking up pricing power. Thursday’s drop was a reminder the trade can still take