China Stocks Today (Nov 6, 2025): Shanghai Reclaims 4,000; CSI 300 +1.4%, Hang Seng +2.1% as Chip & AI Shares Lead

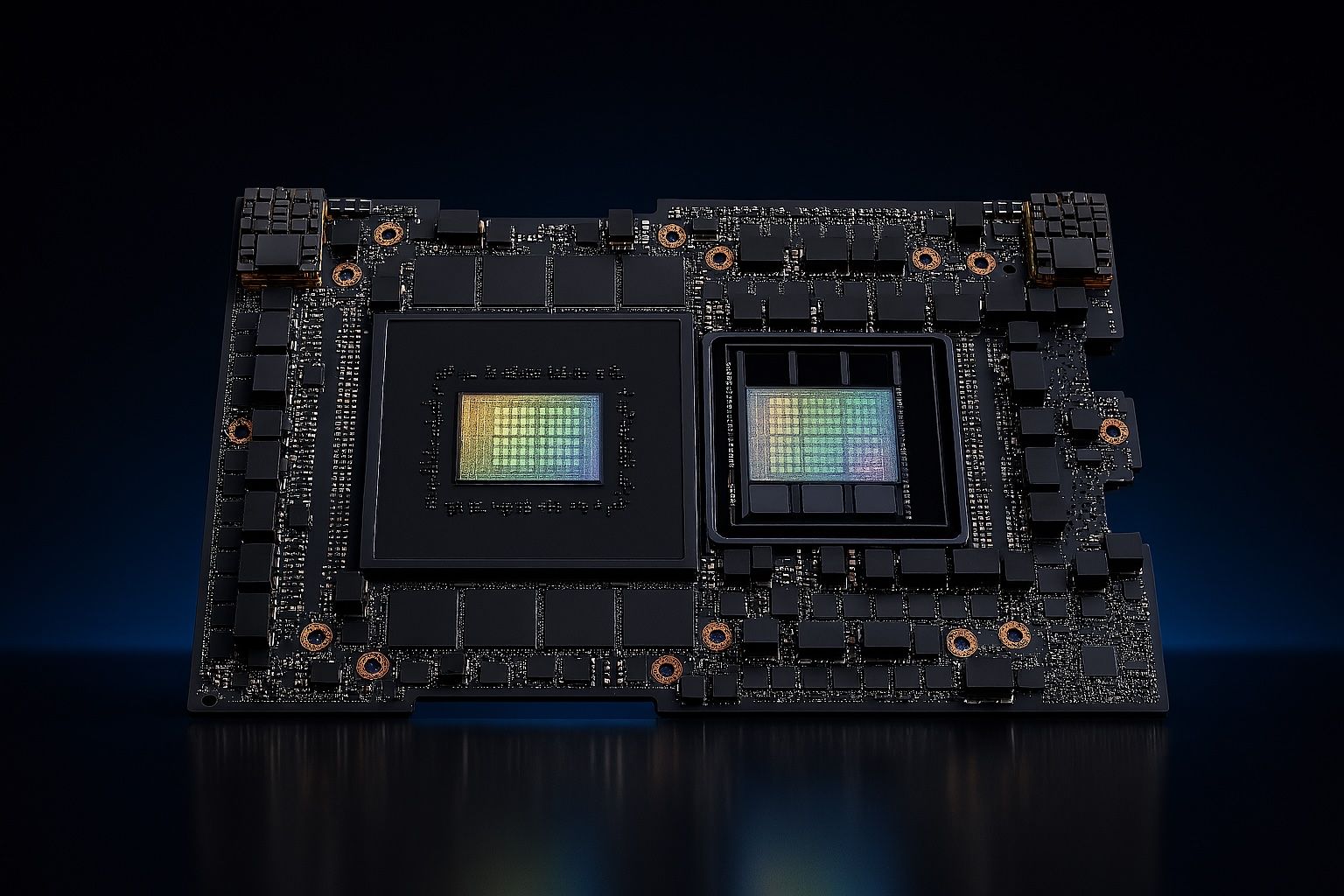

Published: November 6, 2025 Summary: Mainland Chinese equities advanced for a second session, with the Shanghai Composite closing back above 4,000 and the CSI 300 up 1.43%, led by semiconductors and AI-linked names. In Hong Kong, the Hang Seng Index jumped 2.12% as broader risk appetite improved despite weak debuts from high‑profile autonomous‑driving IPOs. Policy support chatter also underpinned sentiment. Xinhua News+3Reuters+3Reuters+3 Key market moves at the close What drove the rally 1) Tech self‑sufficiency theme back in focus.Investors rotated into semiconductors and AI‑related shares after headlines and strategist commentary pointed to continued support for China’s homegrown tech stack. That