Silver Price Today, 25 November 2025: XAG/USD Holds Above $51 as Fed Rate‑Cut Bets Fuel Rally

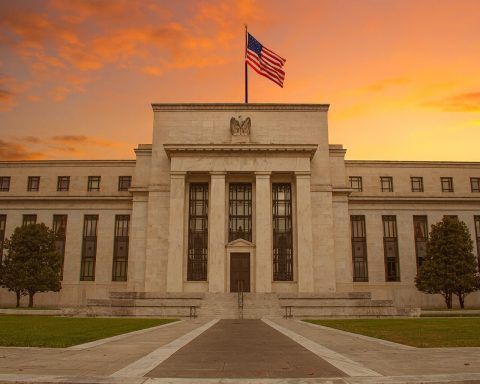

Spot silver is trading firmly above $51 per ounce on Tuesday, 25 November 2025, hovering near recent highs as growing expectations of a December US Federal Reserve rate cut push the dollar and bond yields lower, boosting precious metals. JM Bullion In India, silver rates are also higher, with all‑India prices around ₹167 per gram / ₹1,67,000 per kg and…