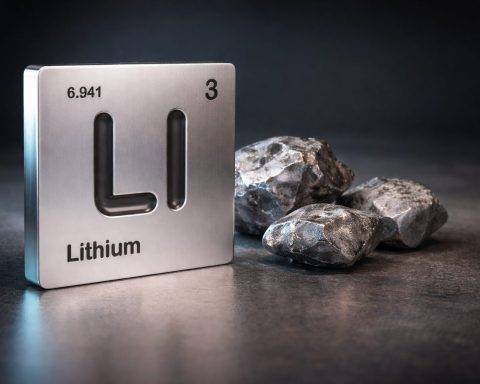

Lithium price slips in China as Albemarle, SQM stocks edge up premarket — what to watch next

New York, Jan 28, 2026, 07:12 (EST) — Premarket Before the opening bell on Wednesday, U.S.-listed lithium stocks climbed, despite lithium carbonate prices in China slipping once more following a volatile futures session. This shift is significant as lithium has jumped from a quiet niche in materials to a hot daily trading topic. Chinese prices are now driving battery input…