Rio Tinto share price slips from fresh high as Glencore deal talk runs into China risk

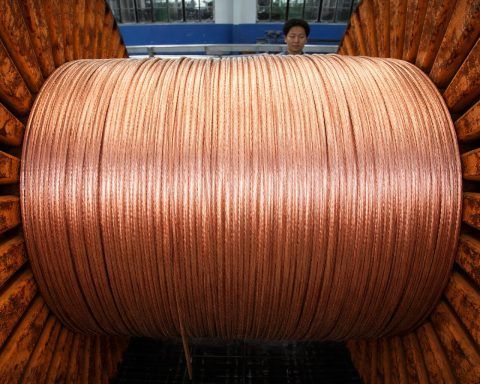

Rio Tinto shares fell 1.87% to 6,347 pence in London on Friday, retreating from a 52-week high as miners were hit by concerns over Chinese copper demand. The potential merger with Glencore faces uncertainty, with analysts warning Chinese approval may require asset sales. Iron ore futures also slipped, and inventories at Chinese ports reached a record 165.6 million tons.