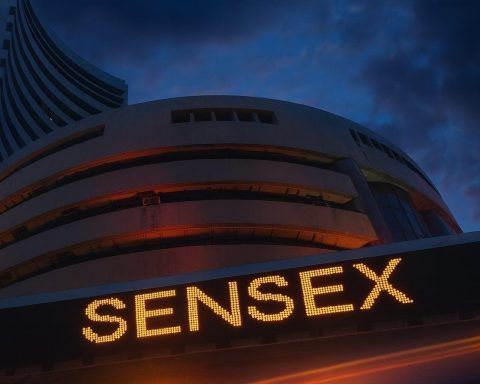

India VIX Slips as Sensex, Nifty Rebound After Fed Cut: Indian Stock Market Today (11 December 2025)

Mumbai, December 11, 2025 — Indian equities snapped a three‑day losing streak on Thursday as global risk sentiment improved after the US Federal Reserve delivered a widely expected 25-basis-point rate cut. The BSE Sensex closed around 84,730, up about 0.4%, while the Nifty 50 settled near 25,881, gaining roughly 0.5% over Wednesday’s close. Investing.com+1 At the same time, India VIX (ticker: INDIAVIX / INDIAV) — the market’s “fear gauge” — cooled sharply to the 10.5–10.8 zone, near the lower end of its 52‑week range, signalling a calm but potentially complacent options market. Zerodha+3Investing.com+3Business Standard+3 The day’s relief rally came even