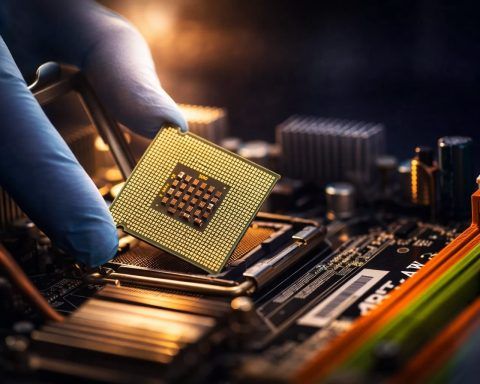

AMD stock jumps as Bernstein stays cautious on chipmaker and Wall Street frets Fed fight

AMD shares rose 2.6% to $208.44 by 10:31 a.m. EST Monday, outperforming a slightly lower Nasdaq 100. Analyst Stacy Rasgon kept AMD at “market perform,” citing Nvidia’s growing lead in AI chips. Nvidia was flat, Broadcom gained 1.9%, and Intel fell 1.1%. AMD reports quarterly results Feb. 3.