US Stock Market Today: S&P 500 Near Record as Santa Rally Watch Begins; AI Stocks Rebound and 2026 Forecasts Split

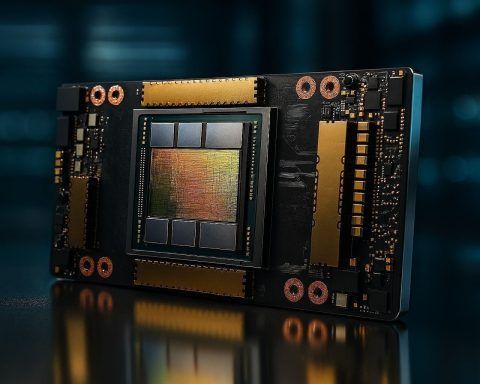

NEW YORK — Dec. 20, 2025 — The U.S. stock market heads into the final stretch of 2025 with a familiar mix of optimism, anxiety, and thin holiday liquidity. On Friday, the S&P 500 rose 0.9% to 6,834.50, the Dow Jones Industrial Average gained 0.4% to 48,134.89, and the Nasdaq Composite climbed 1.3% to 23,307.62, as investors rotated back into technology and AI-linked names after a volatile mid-December pullback. AP News+2MarketWatch+2 For the week, the S&P 500 managed a slim 0.1% gain and the Nasdaq ended 0.5% higher, while the Dow and Russell 2000 finished lower—an encapsulation of late-2025 trading: