Broadcom stock (AVGO) set for key week after 3D-stacked chip push, earnings next

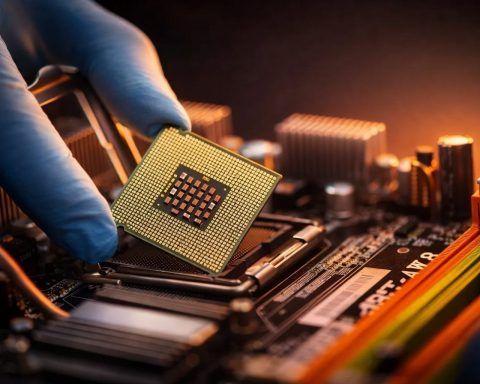

Broadcom has begun shipping a 2-nanometer custom compute chip to Fujitsu, calling it the industry's first on its 3.5D packaging platform. The company set a 2027 sales target of at least 1 million chips using its 3D-stacked design. Broadcom stock closed down 0.67% at $319.55 on Friday. Quarterly results are due March 4.