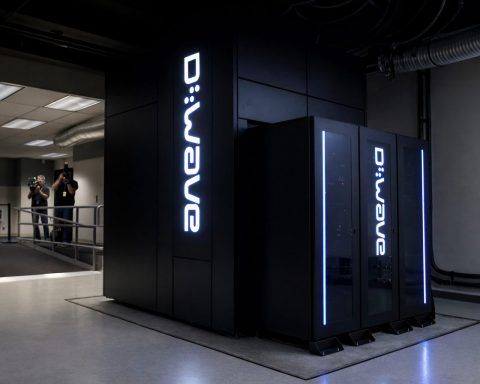

D-Wave Quantum stock (QBTS) slides after $550 million Quantum Circuits deal puts dilution in focus

D-Wave Quantum shares fell 3.4% to $30.20 after announcing a $550 million deal to acquire Quantum Circuits, split between $250 million cash and $300 million in stock. The agreement uses a VWAP collar to set share count and requires antitrust and NYSE approval. The deal aims to bring superconducting gate-model systems to market in 2026. Trading volume reached 36.5 million shares.