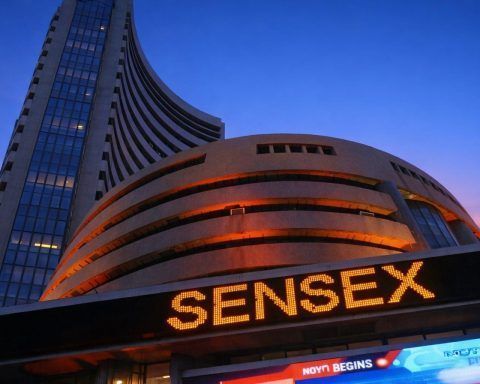

India stock market today: Sensex, Nifty snap 3-day run as IT and metals drag; RBI decision next

Nifty 50 fell 0.52% and Sensex dropped 0.60% on Thursday, ending a three-day rally as IT and metal stocks led declines. Fourteen of 16 sectors closed lower, with small-caps down 1.3%. Reliance, Hindalco, and Bharti Airtel weighed on the indexes. The rupee ended at 90.3550.