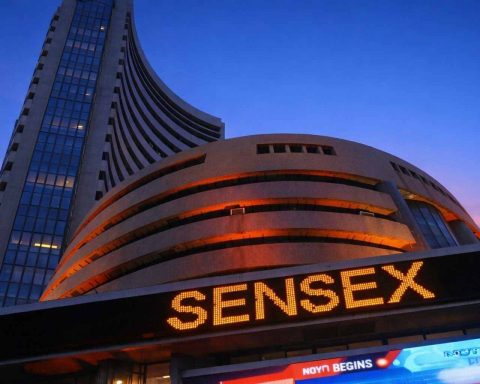

India stock market today: Nifty ends flat near 25,500 as HDFC Bank drags; GDP reset in focus Friday

Indian stocks ended flat Thursday, with the Nifty 50 up 0.06% and the Sensex down 0.03%, as HDFC Bank losses offset gains in public sector banks and pharma. The IT index has dropped nearly 20% in February. Sanofi India fell 3.5% after weak quarterly profits. Markets await Friday’s GDP data release under a new base year.