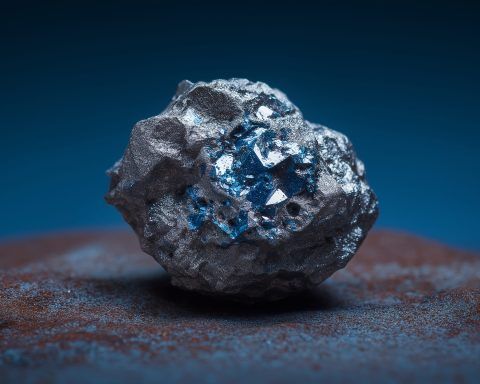

Silver Rockets Toward $50: 2025 Price Surge, Drivers & What’s Next

Spot silver price (USD/oz) at its highest levels since 2011. The chart shows silver’s 2000s bull run peaking near $49.51 in 2011 and the 2025 surge approaching that historic high.reuters.com Silver Nears $50 – Highest Prices in 14 Years Silver’s price has exploded in 2025, approaching the vaunted $50-per-ounce threshold that has held firm since 1980 and 2011. As of October 5, 2025, spot silver trades around $47.9 per troy ouncereuters.com. Just a few days ago, it touched $47.83, the loftiest price since May 2011reuters.com. This puts the all-time nominal high of $49.51/oz (set in April 2011) within striking distance.