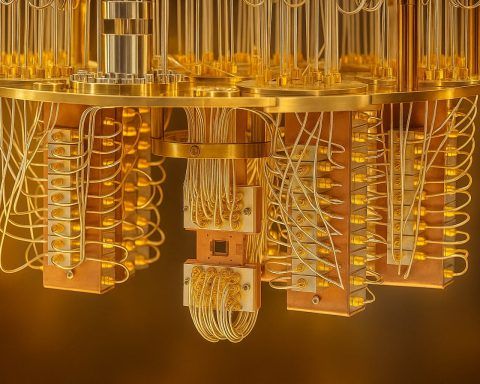

Quantum Computing Inc. (QUBT) Stock Today, Nov. 19, 2025: Neurawave Debut, Q3 Beat and $1.5B Cash Pile Fuel Volatile Rally

Quantum Computing Inc. (QUBT) traded around $12.48 on Nov. 19, up 1.1%, extending a three-day surge after unveiling its Neurawave photonic reservoir computer at SuperCompute25 and posting a surprise Q3 profit. The company reported $384,000 in Q3 revenue, $2.4 million net income, and over $1.5 billion in cash. Wall Street remains divided, citing high valuation and heavy insider selling.