AMD Stock News Today (Dec. 18, 2025): AI Funding Jitters Hit Semiconductors, While “Helios” Keeps the Long-Term AMD Bull Case Alive

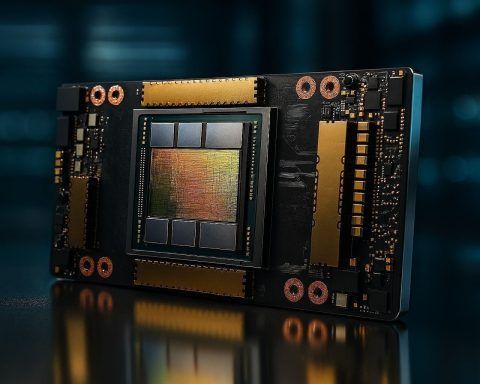

Advanced Micro Devices, Inc. (NASDAQ: AMD) enters Thursday, December 18, 2025 with its stock caught in a familiar 2025 tug-of-war: near-term market anxiety about how the AI buildout gets financed versus longer-term optimism that AMD is building a credible, end-to-end alternative to Nvidia in data-center compute. As of early Thursday, AMD shares last traded around $198.11, down roughly 5.3% versus the prior close—reflecting Wednesday’s sharp risk-off move in AI-linked tech and semiconductors. Below is a comprehensive roundup of what’s moving AMD stock right now, the key headlines shaping sentiment on 18/12/2025, and where major forecasts and analyst targets sit as