Stock Market Today 01.12.2025

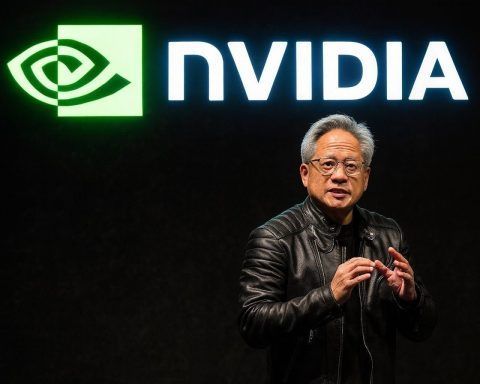

Analysts predict Nvidia and Apple could each reach a $8 trillion market cap by 2030, driven by AI demand and new product cycles. A trading note on LYCT:CA recommends buying near 10.49 with a stop loss at 10.44, citing strong short-term ratings and neutral outlooks for mid- and long-term. No short positions are suggested.