New York, January 11, 2026, 09:01 EST — Market closed.

- Fluence Energy shares last closed up about 9.4% at $23.20 on Friday.

- The move came as U.S. stocks hit a record close and utilities led sector gains.

- Next near-term swing factor is Tuesday’s U.S. CPI release, followed by retail sales midweek.

Fluence Energy (FLNC) shares surged 9.4% on Friday to $23.20, their latest sharp move in a stock that has been whipping around with sentiment on power and clean-energy names. About 4.4 million shares traded, according to market data. https://www.nasdaq.com/market-activity/stocks/flnc

The rally matters now because macro data have started to run the tape again. For companies tied to big capital projects, small shifts in rate bets can change the math fast — not on the balance sheet, but on what customers can finance.

Tuesday is the first big test. The Bureau of Labor Statistics is set to publish December CPI at 8:30 a.m. ET, while the Census Bureau’s schedule shows November retail sales due Wednesday, also at 8:30 a.m. ET. https://www.bls.gov/cpi/ https://www.census.gov/retail/release_schedule.html

Stocks, broadly, had a tailwind going into the weekend. The S&P 500 closed at a record on Friday and utilities were among the stronger groups, after a weaker-than-expected jobs report kept attention on potential Federal Reserve rate cuts. “Investors are getting granular” inside the AI trade, said Zachary Hill, head of portfolio management at Horizon Investments. Reuters https://www.reuters.com/business/us-stock-futures-subdued-ahead-crucial-jobs-report-tariff-ruling-2026-01-09/

Power-linked names also moved. Vistra jumped about 10.5% on Friday after Meta Platforms agreed to buy power from its nuclear plants, while energy-storage software firm Stem rose about 4.2%, market data showed. Reuters

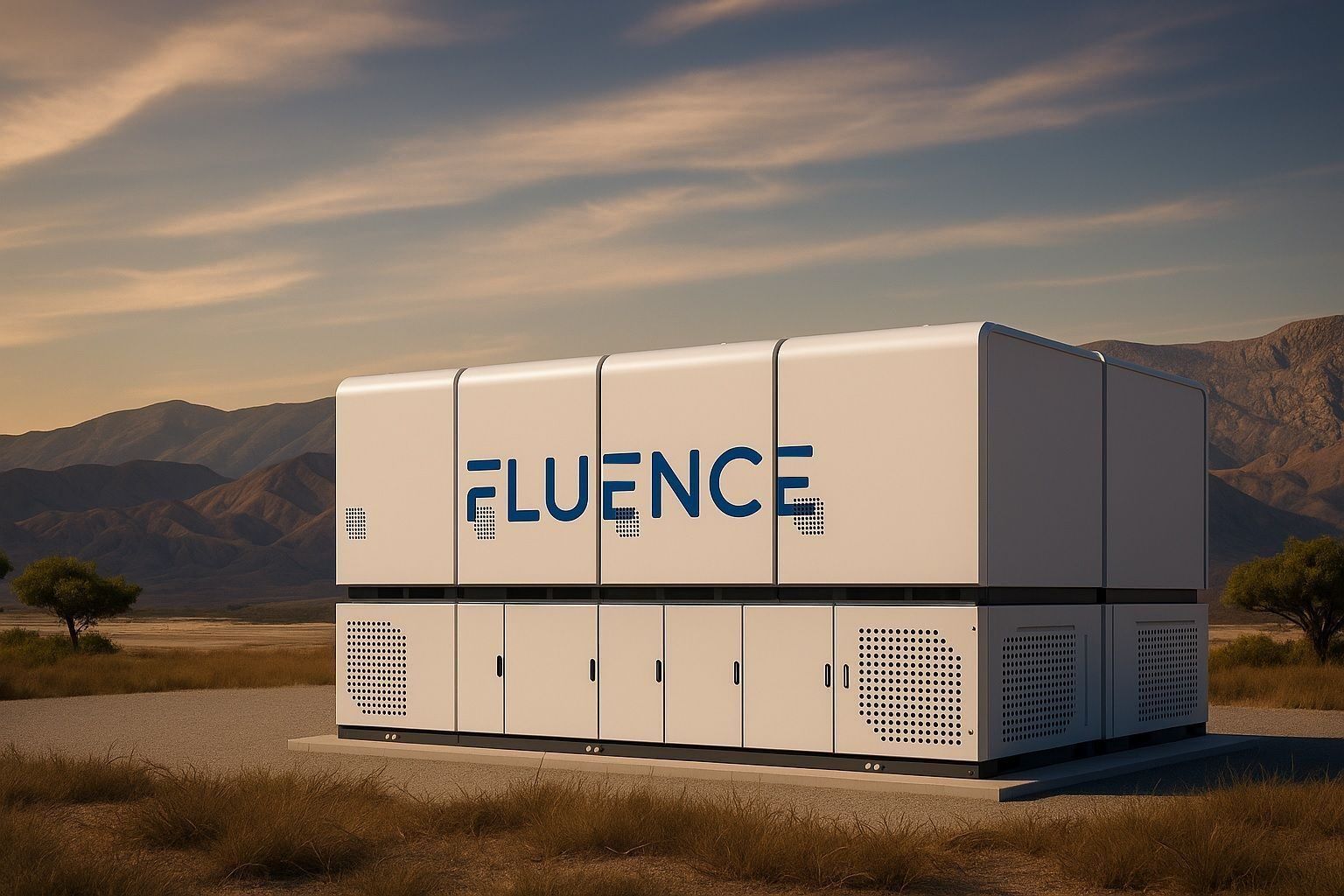

Fluence sells utility-scale battery storage systems and software that help utilities and developers store electricity and manage renewable output. Storage projects often live or die on timing, delivery and financing, which is why the stock can react hard to any shift in rates or power-demand narratives.

The company’s latest major update came in late November, when it initiated fiscal 2026 revenue guidance of $3.2 billion to $3.6 billion and adjusted EBITDA of $40 million to $60 million. (Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization, adjusted for certain items.) Fluence also reported backlog of about $5.3 billion and total cash and liquidity of about $1.3 billion; CEO Julian Nebreda said the firm saw “accelerating demand for energy storage,” while CFO Ahmed Pasha said the company navigated “production delays in the U.S.” as it delivered results. https://www.nasdaq.com/press-release/fluence-energy-inc-reports-2025-financial-results-and-initiates-2026-guidance-2025-11

What investors want next is simpler: proof, quarter by quarter, that orders convert into revenue and margins don’t slide. Annual recurring revenue (ARR) — mainly software and services that repeat — is also a focus because it can steady results when project timing gets messy.

The next scheduled catalyst is earnings, but the company has not posted a confirmed date yet. Nasdaq’s earnings page shows the next report date is “not available,” with an estimated timing around Feb. 9, 2026. Nasdaq https://www.nasdaq.com/market-activity/stocks/flnc/earnings

But Friday’s bounce cuts both ways. If CPI comes in hot and bond yields rise, rate-sensitive pockets can give back gains quickly, and storage providers still face execution risk — delays, quality issues, and pricing pressure when competition heats up — even when backlog looks strong.

For now, traders come back Monday with one clear clock on the wall: Tuesday’s 8:30 a.m. ET CPI print. If it shifts the rate path, FLNC is the kind of stock that can feel it before lunch, well ahead of its next earnings update.