-

<li ATLAS imaged the interstellar candidate on 1 July 2025, with precovery back to 14 June 2025, and it was designated C/2025 N1 (ATLAS) and later 3I/ATLAS as the third confirmed interstellar object after Oumuamua and Borisov.

<li A JPL orbital solution yields eccentricity e = 6.1 ± 0.1 and hyperbolic excess velocity V∞ ≈ 58 km/s, indicating an extrasolar origin from Galactic longitude about 5° toward the Galactic Center.

<li The object’s nucleus is estimated at 9–20 km in diameter, with a developing coma and tail already visible, including a compact coma at about 4.5 AU from the Sun.

<li Dynamical modelling of ~20 million synthetic trajectories gives a 66% probability that 3I/ATLAS originated in the Milky Way’s thick disk, implying an age of ≥7 billion years.

<li Perihelion will occur on 30 October 2025 at 1.4 AU, and the body will not come closer than about 1.6 AU to Earth.

<li By December 2025 the object brightens to around magnitude 11, making it accessible to mid-sized amateur telescopes, while professional campaigns with VLT, Gemini-S and JWST NIRSpec are planned around perihelion, and the Mars Reconnaissance Orbiter could image the coma during an 18‑million‑mile Mars flyby on 2 October.

<li The thick‑disc provenance makes 3I/ATLAS a rare probe of ancient, water‑rich ices and tests models of planet‑formation chemistry beyond the Solar System.

<li ESA’s Comet Interceptor, planned to launch in 2029, is designed to be ready at L2 to intercept future interstellar objects, underscoring the need for interstellar‑ready mission architectures.

<li Experts have described the onset of normal cometary activity and highlighted the event as a transformational opportunity for planetary science.

<li 3I/ATLAS is larger, faster and more compositionally intriguing than both Oumuamua and Borisov, with an eccentricity of 6.1 and a velocity of about 58 km/s, signaling a new era of interstellar studies ahead of 4I, 5I and 42I.

Key take‑aways (one‑paragraph executive summary)

In early July 2025 astronomers using the NASA‑funded ATLAS telescope in Chile discovered a hyper‑fast object now designated 3I/ATLAS (C/2025 N1)—only the third confirmed interstellar body to enter our Solar System after ’Oumuamua (2017) and Borisov (2019). Follow‑up astrometry shows an inbound velocity of ≈58 km s⁻¹ and an orbital eccentricity of ≈6.1, values far in excess of anything gravitationally bound to the Sun, proving an extrasolar origin. First photometric estimates put the nucleus at 9‑20 km—an order of magnitude larger than Borisov—and early images already reveal a developing coma and tail. Dynamical modelling by Oxford–Canterbury researchers traces its trajectory back to the Milky Way’s thick disc, implying the ice‑rich body may be ≥7 billion years old—much older than the Solar System itself. Although 3I/ATLAS will dive just inside Mars’ orbit on 30 October (1.4 au from the Sun), it never comes closer than 1.6 au to Earth and poses no hazard. Instead it offers an unprecedented laboratory for studying planet formation chemistry beyond our neighbourhood, and it is galvanising plans for rapid‑response spacecraft such as ESA’s 2029 Comet Interceptor.

1. Discovery, naming and first‑look observations

- Detection. ATLAS Rio Hurtado imaged the object on 1 July 2025; archival ATLAS and Zwicky Transient Facility frames push pre‑covery back to 14 June 2025 science.nasa.gov.

- Designation cascade. The Minor Planet Center’s confirmation list logged it as provisional A11pl3Z, upgraded to official cometary designation C/2025 N1 (ATLAS) and interstellar marker 3I/ATLAS within 24 h earthsky.org.

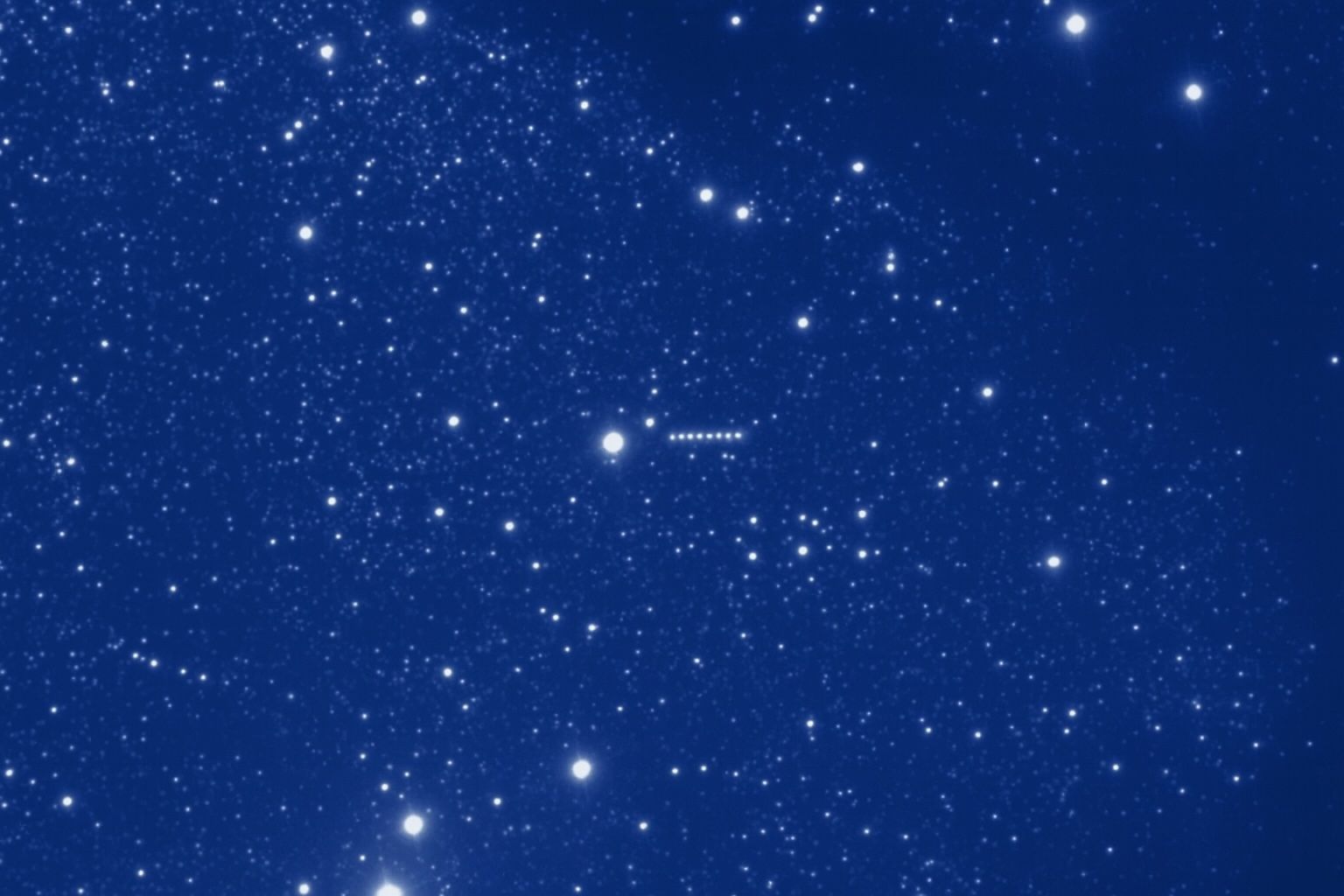

- Public debut. Virtual Telescope Project host Gianluca Masi streamed live images on 3 July, showing a faint 18.5‑mag fuzz amid Sagittarius stars virtualtelescope.eu.

2. Orbital dynamics prove an extrasolar origin

- A JPL solution gives eccentricity e = 6.1 ± 0.1 and hyperbolic excess velocity V∞ ≈ 58 km s⁻¹ arxiv.org—values impossible for native long‑period comets.

- The comet is inbound from Galactic longitude ≈5° toward the Galactic Centre; its steep 175° inclination shows it plunges through the ecliptic almost head‑on science.nasa.gov.

- Perihelion occurs 30 Oct 2025 at 1.4 au; it then exits south of the ecliptic, reaching 90 km s⁻¹ relative to Earth by April 2026 earthsky.org.

3. Size, activity and physical make‑up

- Early VLT stacks suggest a 9‑20 km nucleus and a reddish spectral slope reminiscent of Centaur objects rather than typical solar‑born comets iflscience.com.

- NASA notes a “compact coma” already visible at 4.5 au, implying abundant super‑volatile ices that sublimate far from the Sun science.nasa.gov.

- “The coma and tail may increase dramatically as the object comes closer to the Sun. We don’t know what will happen, so that’s exciting,” observes Larry Denneau (ATLAS co‑PI) reuters.com.

4. Where did it come from?

- Matthew Hopkins & Chris Lintott modelled ∼20 million synthetic trajectories and found a 66 % probability the comet originated around an ancient thick‑disc star, making it older than 7 Ga iflscience.com.

- “If that’s right, we’re seeing material processed by cosmic‑ray irradiation for billions of years,” Lintott tells IFLScience iflscience.com.

- ESA’s Richard Moissl adds that pre‑entry direction “came roughly from the Galactic Centre region,” stressing the object’s extragalactic‑scale journey dw.com.

5. Comparison with ’Oumuamua and Borisov

| Property | 1I/’Oumuamua (2017) | 2I/Borisov (2019) | 3I/ATLAS (2025) |

|---|---|---|---|

| Size | ~0.1 km | ~1 km | 9–20 km space.com |

| Eccentricity | 1.20 | 3.58 | 6.1 arxiv.org |

| Visible activity | None (asteroidal) | Strong coma/tail | Emerging coma now dw.com |

| V∞ (km s⁻¹) | 26 | 32 | 58 iflscience.com |

“3I/ATLAS is much larger … and vastly more hyperbolic than either predecessor,” notes ESO comet specialist Olivier Hainaut space.com.

6. Observation opportunities in 2025

- Amateur outlook. The comet brightens to ~mag 11 by December, accessible to mid‑sized backyard CCD rigs according to ESA’s Michael Küppers dw.com.

- Professional campaigns. Southern‑hemisphere 8‑10 m telescopes (VLT, Gemini‑South) and JWST’s NIRSpec plan time‑critical spectroscopy around perihelion.

- Mars Reconnaissance Orbiter may capture the coma during a 18 million‑mile Mars fly‑by on 2 Oct nature.com.

7. Science stakes and mission concepts

- Thick‑disk provenance means 3I/ATLAS could sample an ancient, water‑rich chemical environment, testing models that interstellar ices seeded early planet formation iflscience.com.

- ESA’s Comet Interceptor (launch 2029) is designed to park at L2 awaiting a future “4I‑type” target; 3I/ATLAS’s speed shows why on‑orbit readiness is crucial, says University of Leicester astrophysicist Martin Barstow space.com.

- Karen Meech predicts the upcoming Vera C. Rubin Observatory will uncover “several new interstellar objects over the next ten years,” transforming this once‑in‑a‑lifetime event into routine planetary‑science fodder news.ssbcrack.com.

8. Expert sound‑bites

- “We are seeing an onset of normal cometary activity,” — Richard Moissl, head of ESA Planetary Defence dw.com.

- “This little button push … has hundreds of astronomers and millions of people paying attention,” — Larry Denneau recalling the discovery frenzy nature.com.

- “This is fabulous … a transformational opportunity,” — Michele Bannister, University of Canterbury nature.com.

- “It’s from a part of the galaxy we’ve never sampled before,” — Prof. Chris Lintott, Oxford iflscience.com.

9. Conclusions

3I/ATLAS is bigger, faster and more compositionally intriguing than any interstellar visitor seen so far. Its thick‑disc trajectory implies an age predating the Sun, while its cometary activity offers a first‑hand probe of primordial ices from beyond our local bubble. With a safe fly‑through and months of visibility, the object is set to become 2025’s most studied celestial messenger—and a clarion call to accelerate “interstellar‑ready” mission architectures before 4I, 5I … and 42I arrive.

Sources

NASA Science page science.nasa.gov | Space.com news explainer space.com | DW interview with ESA dw.com | Reuters wire report reuters.com | Nature News feature nature.com | IFLScience analysis iflscience.com | EarthSky update earthsky.org | Virtual Telescope announcement virtualtelescope.eu | arXiv pre‑print (Hopkins et al.) arxiv.org | SpaceDaily AFP interview spacedaily.com | Forbes skywatching briefing forbes.com | Mint (India) CNEOS quote livemint.com | NY Post summary nypost.com | NASA Planetary‑Defense blog science.nasa.gov | ESA social‑media dispatch via EarthSky earthsky.org