SpaceX’s valuation has vaulted to a new headline number: about $800 billion, after an insider share sale was set at $421 per share—a price outlined in a Dec. 12 letter from Chief Financial Officer Bret Johnsen that was reviewed by Reuters. The arrangement allows new and existing investors (and SpaceX itself) to purchase up to $2.56 billion worth of shares from eligible shareholders, giving employees and insiders a fresh liquidity window while also resetting expectations for what SpaceX could command if it enters public markets. Reuters+2Reuters+2

The timing is not an accident. Over the past week, a tight cluster of reports—from secondary-sale chatter to IPO “target window” briefings—has turned SpaceX valuation into one of the most searched private-market topics in tech and aerospace. Depending on which report you follow, the range being discussed for a future listing stretches from “$1 trillion-plus” to an eye-watering “$1.5 trillion” target. DIE WELT+3Reuters+3TechCrunch+3

Below is what’s new as of Dec. 14, 2025, what the number actually means (and what it doesn’t), and what investors are watching next.

SpaceX valuation today: the $800 billion benchmark, explained

The most concrete data point this week is the secondary transaction price.

According to Reuters, SpaceX’s CFO told shareholders the company approved a structure where investors and SpaceX would buy up to $2.56 billion in shares at $421 each, implying a company valuation of roughly $800 billion. The same communication said SpaceX is preparing for a possible IPO in 2026, while emphasizing uncertainty around the final timing and valuation. Reuters+1

That $800 billion figure also marks a dramatic step-up from the last widely reported private-market marker earlier this year. Reuters reported last week that a potential $800 billion valuation would be double the $400 billion SpaceX fetched in a prior secondary share sale. Reuters+1

And it lands amid a broader “most valuable private company” arms race—especially after OpenAI’s secondary transaction cycle earlier this fall. Several reports have framed this as a private-market tug-of-war for the top slot. Reuters+1

Why the headlines can be misleading: secondary sales are not IPO pricing

It’s tempting to treat “SpaceX is worth $800 billion” as a single, definitive truth. In reality, private-company valuations are snapshots—often anchored to one transaction type, one buyer set, and one moment in market sentiment.

A secondary share sale like this typically has very different dynamics than an IPO:

- It’s limited access (eligible employees/holders, select investors).

- It’s negotiated pricing (not continuous price discovery like a stock exchange).

- It can include constraints (transfer restrictions, tender limits, company approvals).

- It may reflect scarcity (high demand for a hard-to-buy private name can push price up).

In short: the $421-per-share tender price is a major signal, but it’s not the same thing as a public-market clearing price on day one of an IPO. Reuters+1

The “IPO in 2026” drumbeat: what’s being reported right now

Over the last several days, multiple outlets have converged on a 2026 listing path—though the proposed scale and timing differ by report.

Reuters: SpaceX discussed raising more than $25 billion at a $1T+ valuation

Reuters reported on Dec. 10 that SpaceX is looking to raise more than $25 billion in an IPO in 2026, and that a listing could lift SpaceX’s valuation to over $1 trillion, according to a person familiar with the matter. Reuters also reported the company had started discussions with banks about launching the offering around June or July (timing still fluid). Reuters+1

Bloomberg-sourced reporting: a $1.5 trillion valuation target has been floated

TechCrunch (citing Bloomberg) reported SpaceX is planning to go public in mid-to-late 2026, seeking to raise $30 billion at a valuation of around $1.5 trillion—which would put it in “largest IPO ever” territory. TechCrunch

Space.com’s coverage similarly summarized the swirl of reporting and noted that a Bloomberg story suggested a $1.5 trillion valuation, with proceeds linked to building data centers in space—a theme that’s increasingly central to the bullish narrative. Space

Reuters analysis: investors love the upside—but the Mars ambition adds risk

A separate Reuters analysis published Dec. 12 framed the coming debate clearly: a public-market SpaceX would likely be pulled between revenue-rich Starlink and Musk’s high-risk Mars/Starship agenda. It noted that potential IPO optimism is real, but so is the concern that SpaceX’s “mission-first” culture could clash with public-market expectations. Reuters

What’s driving SpaceX valuation: Starlink is the engine, and it’s getting bigger

Across essentially every credible valuation discussion this week, one conclusion repeats: Starlink is the main reason SpaceX can command mega-cap numbers.

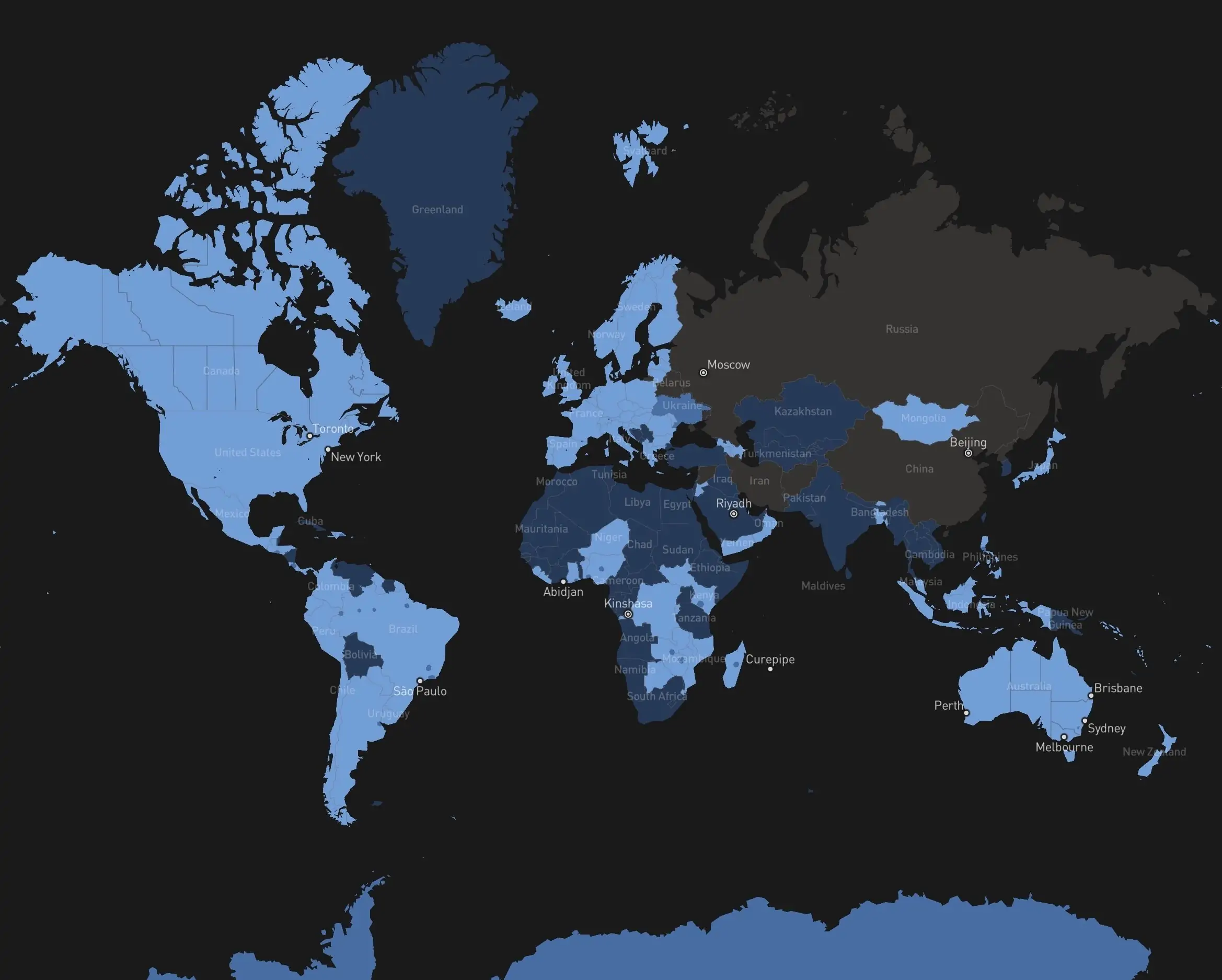

Reuters reported that Starlink has roughly 10,000 satellites in space and more than 6 million customers across at least 140 countries and territories—a scale that’s hard to match and a key reason investors view SpaceX as more than a launch provider. Reuters

Two specific Starlink growth threads are getting outsized attention right now:

- Direct-to-cell / direct-to-mobile services

Reuters noted SpaceX is pushing Starlink toward satellite-to-phone service expansion, and reported the company said its direct-to-cell service is active in Canada. Reuters - New market access (notably India)

Reuters reported Starlink is nearing regulatory approval to operate in India, and cited a Deloitte estimate that India’s satellite broadband market will be worth $1.9 billion by 2030. Reuters

These aren’t just product updates—they’re valuation levers. Markets tend to pay up for businesses that look like global infrastructure, particularly when growth is subscription-like and scalable.

Starship, Mars, and “space-based data centers”: the moonshot premium (and the moonshot risk)

The $800 billion valuation isn’t being justified purely on current broadband subscribers. A meaningful part of the premium is tied to what SpaceX could become if it keeps delivering step-changes in launch costs and orbital capacity.

The CFO letter described ambitions that go well beyond today’s business mix. Reuters reported SpaceX intends to use capital to increase Starship’s flight rate, deploy AI data centers in space, and support projects including Moonbase Alpha and crewed and uncrewed missions to Mars. Reuters+1

Space.com added helpful color on the “data centers in space” storyline, highlighting reporting that SpaceX wants public-market-scale funding to push orbital computing infrastructure—and noted that Musk publicly endorsed reporting by Ars Technica’s Eric Berger about the company’s rationale. Space

But Reuters’ Dec. 12 analysis also underlined the tension: public investors may buy the “frontier tech” vision, yet they will also demand a coherent roadmap, especially if Starship setbacks pile up. Reuters

The valuation math: what $800B, $1T, and $1.5T imply at today’s reported revenue levels

One reason SpaceX’s valuation has become such a lightning rod is that the numbers imply extraordinary multiples—and those multiples depend heavily on which revenue trajectory you believe.

Reuters noted that some analysts question SpaceX’s lofty valuation assumptions, referencing uncertainty around the market size for satellite-to-cell services and the feasibility of space-based data centers, even as the company generates about $15 billion in annual revenue. Reuters

Meanwhile, Germany’s WELT (citing Bloomberg) reported SpaceX planned $15 billion in revenue for 2025 and $22–$24 billion in 2026. DIE WELT

Using those reported revenue figures, here’s what the headline valuations translate to in rough price-to-sales terms (a simple yardstick, not a profitability measure):

- $800B valuation

- ~53× sales on $15B

- ~33–36× sales on $22–$24B

- $1T valuation

- ~67× sales on $15B

- ~42–45× sales on $22–$24B

- $1.5T valuation

- 100× sales on $15B

- ~63–68× sales on $22–$24B

Those are “frontier-tech” multiples, not mature-aerospace multiples—which is exactly why the debate is so polarized. The bull case is that SpaceX is building a new category of global communications + launch + defense infrastructure. The bear case is that the market is pricing in multiple moonshots at once.

Key risks highlighted in the latest analysis

The biggest near-term risk isn’t whether SpaceX can launch rockets. It’s whether the story public investors are being asked to buy is too complex—and too dependent on long-horizon bets.

Reuters’ analysis laid out several pressure points that could matter more in an IPO setting than in private markets:

1) Musk’s Mars-first priorities vs. Starlink’s cash machine

Reuters noted Musk’s lifelong ambition to send humans to Mars could temper expectations that a public SpaceX would narrow its focus to predictable revenue initiatives like Starlink expansion. Reuters

2) Starship ambition is enormous—and still technically and regulatorily demanding

Reuters reported Musk has suggested an uncrewed Starship mission to Mars could happen as soon as next year, while noting analysts view that as ambitious given Starship’s development and testing realities. Reuters

3) “R&D-heavy” DNA may clash with public-market patience

Reuters quoted industry voices emphasizing that SpaceX has historically invested billions into risky ventures that may pay off only after long experimentation cycles. Reuters+1

4) The “Musk premium” can also become a “Musk discount”

Reuters also pointed to investor concerns about Musk’s ability to run multiple mega-cap public companies simultaneously—an issue that routinely surfaces in Tesla discourse and would likely intensify with a SpaceX listing. Reuters+1

A fast timeline of the last week’s SpaceX valuation news

If you’re trying to understand why SpaceX valuation is suddenly everywhere, this is the compressed sequence:

- Dec. 5–6: Reports emerge that SpaceX is exploring or briefing around a secondary sale that could value it at $800B, and investor communications point to a late-2026 IPO window. Reuters+1

- Dec. 10: Reuters reports SpaceX could raise $25B+ in a 2026 IPO and could be valued at $1T+, with bank discussions said to have started. Reuters

- Dec. 11: Space.com summarizes the wave of reporting and highlights the “$1.5T IPO valuation” chatter tied to space-based data center ambitions. Space

- Dec. 12: Reuters publishes a deeper analysis on the upside and the risks—especially the Mars focus vs. Starlink’s revenue-driven appeal. Reuters

- Dec. 13: Reuters reports the clearest figure yet: $421 per share, implying ~$800B valuation, in a letter from CFO Bret Johnsen. Reuters

- Dec. 14 (today): Ongoing commentary frames the valuation move as part of a broader private-market boom and a rivalry for “most valuable private company.” Business Insider

What to watch next: the signals that could move SpaceX valuation again

If you’re tracking where SpaceX valuation goes from here, these are the next practical markers:

- Completion terms of the $421/share tender (final participation levels, size, and whether pricing holds in follow-on liquidity windows). Reuters

- Bank mandates and IPO timeline clarity (reports have floated June/July 2026 and mid-to-late 2026 windows). Reuters+1

- Starlink direct-to-cell expansion beyond Canada and progress toward higher-bandwidth services. Reuters

- Regulatory progress in major markets (India is one of the most watched). Reuters

- Starship cadence and reliability—because Starship is not just a Mars vehicle; it underpins plans for larger satellites and “space infrastructure” scaling. Reuters+1

- Credibility of the “data centers in space” roadmap, including whether investors view it as a near-term business line or a long-horizon option value. Reuters+2Reuters+2

Bottom line: SpaceX is being priced like a future mega-cap—before it even lists

As of Dec. 14, 2025, the most defensible headline is straightforward: SpaceX’s latest insider share sale price implies a valuation of about $800 billion. Reuters

But the bigger story is the widening gap between what’s priced today and what’s being forecast for an IPO. Reuters has reported IPO scenarios that could push SpaceX over $1 trillion, while Bloomberg-sourced reporting discussed by TechCrunch and Space.com has floated targets near $1.5 trillion. DIE WELT+3Reuters+3TechCrunch+3

Whether that gap closes upward (through Starlink scale and new services) or snaps back (through execution risk, market conditions, or the sheer difficulty of SpaceX’s ambitions) is exactly what makes “SpaceX valuation” the private-market headline of the week—and a potential defining IPO story for 2026. Reuters+1