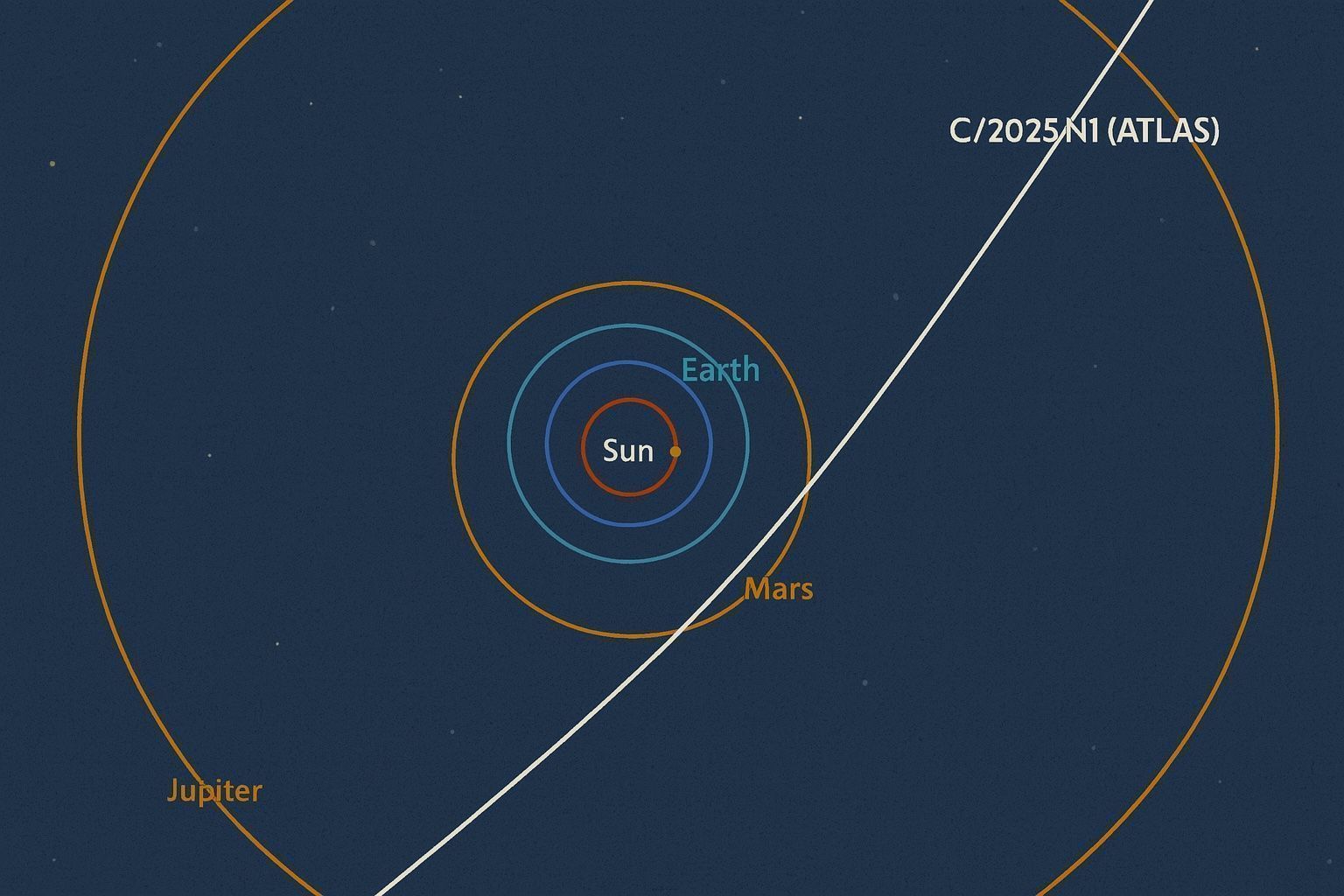

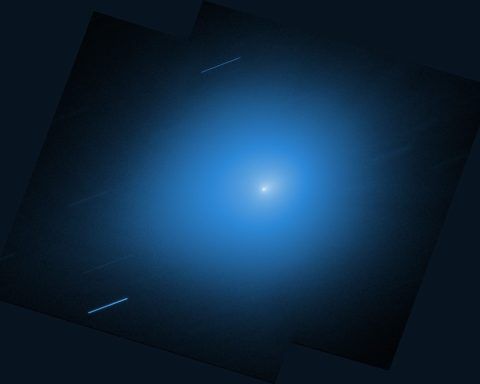

Interstellar Comet 3I/ATLAS Lights Up December Skies: New Images, ‘Ice Volcanoes’ and Life‑Linked Molecules

Published December 7, 2025 Interstellar comet 3I/ATLAS – only the third confirmed visitor ever seen passing through our Solar System from another star – is putting on its biggest show yet this December. As it brightens again after looping behind the Sun,