No-Revenue Biotech Soars 64,000% – Is Regencell (RGC) a Breakthrough or a Bubble?

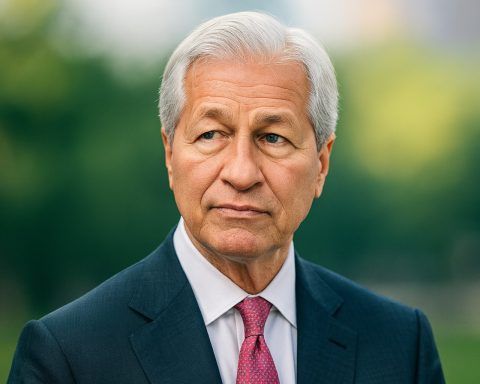

Company Profile and Mission Regencell Bioscience is an early-stage biotech company focused on Traditional Chinese Medicine. Headquartered in Causeway Bay, Hong Kong, Regencell researches, develops, and aims to commercialize herbal treatment formulae for neurocognitive disorders – primarily Attention Deficit Hyperactivity Disorder (ADHD) and Autism Spectrum Disorder (ASD) Marketbeat Insidermonkey. The company’s approach is based on the “Sik-Kee Au TCM Brain Theory,” a proprietary herbal methodology developed by the CEO’s father ts2.tech. Founded in 2014 by CEO Yat-Gai Au, Regencell went public on NASDAQ in July 2021 Stockanalysis. The firm positions itself as a socially responsible, mission-driven enterprise: “Our goal is to save and improve the lives of