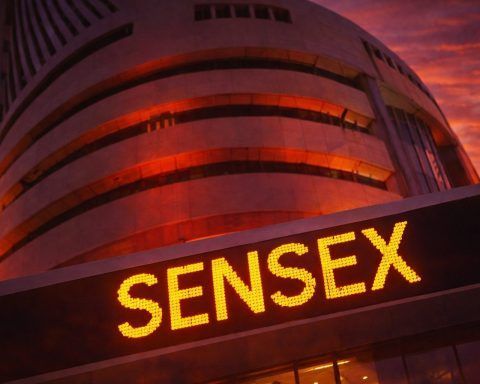

BSE Ltd Share Price Today (Dec 18, 2025): Stock Rises Near ₹2,690 as Fresh Filings Flag GST Order, Social Stock Exchange Move; What Analysts Forecast Next

BSE Ltd shares rose about 2% to ₹2,688.40 on Thursday, outperforming a mixed broader market. The company disclosed a ₹7.25 crore GST demand order and said it will appeal. BSE’s board also approved a ₹1.6 lakh stake in a new Section 8 company tied to the Social Stock Exchange framework. Year-to-date, BSE shares are up roughly 48%.