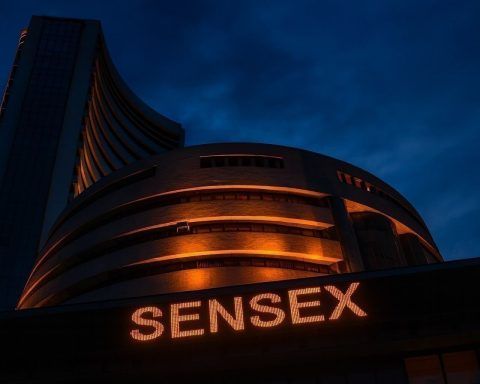

Sensex Crashes 610 Points, Nifty Slips Below 26,000 As Rupee Hits Record Lows – India Stock Market Close Today (8 December 2025)

Mumbai | 8 December 2025, After the Closing Bell Indian equities ended sharply lower on Monday as a cocktail of global jitters, a sliding rupee and persistent foreign selling knocked the Sensex and Nifty off recent highs. The sell-off was broad-based, with all major sectoral indices closing in the red and mid- and small-caps taking the heaviest hit. mint+1 Key Highlights from Dalal Street Today Headline Numbers: Sensex, Nifty and Broader Market After two days of gains powered by the Reserve Bank of India’s 25-basis-point repo rate cut on Friday, the rally abruptly reversed. NDTV Profit+1 Broader indices underperformed: BSE Midcap and