Skywatch Alert: Meteor Shower, Planet Parade & Auroras Dazzle This Weekend (Aug 30–31, 2025)

Dark Skies and Meteor Showers: Perseids Fade, Aurigids Arrive Late August 2025 brings wonderfully dark night skies thanks to the Moon’s phase. August 23 was a rare “Black Moon” (a third new moon in a season), so evenings around Aug 27–30 have had little moonlight ts2.tech. By this weekend the Moon is only about 7–8 days old (first quarter phase), setting around midnight and leaving most of the night moonless ts2.tech. These dark conditions are ideal for spotting faint meteors, the Milky Way, and other dim celestial sights without glare ts2.tech. Meteor activity this weekend comes from two sources: the tail

30 August 2025

Moonshots, Rocket Records & Cosmic Cat Videos: Epic Space News Roundup (Aug 29–30, 2025)

Key Facts In-Depth Report Launch Events & Spaceflight Milestones SpaceX’s Record-Breaking Launches: SpaceX achieved back-to-back historic feats with its workhorse Falcon 9. In the pre-dawn hours of Aug. 28, a Falcon 9 lifted off from Kennedy Space Center carrying 28 Starlink satellites – notably, it was the 30th launch and landing of booster B1067, setting a new rocket reuse record space.com space.com. About 8.5 minutes after liftoff, the veteran first stage nailed its landing on the drone ship A Shortfall of Gravitas, making it “the first orbital-class rocket to successfully launch and land 30 times,” SpaceX announced space.com space.com. Just a day earlier, another

30 August 2025

Tech Turbulence: Billion-Dollar Deals, Cyber Strikes & Space Feats – Global Tech Roundup (Aug 29–30, 2025)

Key Facts (More details and expert insights on these developments below.) Consumer Tech & Gadgets Google’s Pixel 10 Debuts: Google’s latest flagship phones, the Pixel 10 series, hit store shelves this week after an official unveiling. The 10th-gen Pixels sport a refreshed design with a satin-finish aluminum frame, polished glass back, and the signature camera bar in four new colors blog.google. A bright 6.3-inch OLED display (up to 3000 nits) and improved stereo speakers aim to elevate media viewing blog.google. Notably, the standard Pixel 10 gains a 5× telephoto lens for the first time, enabling up to 10× optical-quality zoom and 20×

30 August 2025

Global AI News: Flirty Chatbot Scandal, Major Breakthroughs & Big Tech Showdowns (Aug 29–30, 2025)

Key Facts Business and Industry Developments Meta’s AI strategy – build, buy, or partner: Meta Platforms pursued a multi-pronged approach to AI. It signed a deal to license Midjourney’s image-generation technology, integrating the startup’s “aesthetic” imaging tools into Meta’s future products reuters.com reuters.com. At the same time, Meta’s new Superintelligence Labs team has explored partnerships with rivals: internal discussions considered using Google’s Gemini and even OpenAI’s models to power Meta’s AI assistant features reuters.com reuters.com. A Meta spokesperson confirmed an “all-of-the-above” approach – developing its own world-class models (like the upcoming Llama 5) while also collaborating externally and open-sourcing when

30 August 2025

Guyana’s Internet Boom: From Slow Starts to a Surging 2025 Connectivity Revolution

Overview of Internet Infrastructure in Guyana Guyana’s internet infrastructure has evolved from rudimentary beginnings into a more robust, modern network. The country – sparsely populated and covered in rainforest outside its coastal strip – long relied on a limited telecommunications setup. Until the 2000s, most Guyanese accessed the internet via dial-up or very slow broadband over copper phone lines. Today, that picture is dramatically different. Fiber-Optic Backbone: Guyana now boasts multiple fiber-optic cables carrying data domestically and internationally. One Communications (formerly GTT) and other operators have laid fiber routes along the populated coast and across parts of the interior. Notably,

30 August 2025

Nikon Z5II Shocks the Camera World: A Budget Full-Frame That Punches Above Its Weight

A Bold “Entry-Level” That Redefines Full-Frame Value When Nikon pulled the wraps off the Nikon Z5II in April 2025, photographers were shocked at how far an “entry-level” full-frame camera could go. Succeeding 2020’s original Z5, the Mark II isn’t just a mild refresh – it’s a major leap that blurs the line between beginner and enthusiast models. Nikon officially bills it as an “intermediate-level” Z-mount mirrorless petapixel.com, but in practice the Z5II behaves like a higher-tier camera. It inherits tech from Nikon’s flagships (the Z8 and Z9) and even challenges mid-range competitors, all while hitting a price point that appeals

30 August 2025

Canon EOS R50 V: Canon’s New Budget Vlogging Beast or Bust?

Key Facts about the Canon EOS R50 V Meet the EOS R50 V – Canon’s Video-Optimized Tiny Camera Canon’s EOS R50 V is essentially Canon’s answer to Sony’s ZV series and other “creator” cameras. It takes the beginner-friendly EOS R50 and retools it for video creators. The result is a small mirrorless camera built for vloggers and consumers focused on video dpreview.com. It retains what made the original R50 appealing (proven 24MP sensor, compact size, flip-out touchscreen), but introduces significant video upgrades and design changes to court the YouTube/TikTok crowd. Canon officially announced the R50 V in March 2025 alongside

30 August 2025

Fujifilm X-E5 Review & Comparison: 40MP Retro Revolution or Pricey Upgrade?

Key Facts at a Glance Fujifilm X-E5 Feature Overview Sensor and Image Quality At the heart of the X-E5 is the 40.2MP X-Trans CMOS 5 HR sensor – the same high-resolution APS-C sensor used in Fuji’s flagship X-T5 and X-H2. This chip delivers outstanding detail and dynamic range for stills, while also enabling a lower base ISO of 125 for cleaner images nofilmschool.com. In practical terms, images are noticeably more detailed than the 26MP X-E4’s, yet high-ISO noise remains well-controlled and on par with other current APS-C cameras dpreview.com. The X-Trans color filter array (unique to Fujifilm) continues to produce

30 August 2025

Sony RX1R III: The $5,000 Compact Powerhouse That Has Photographers Buzzing

Key Facts at a Glance Camera Specifications and Design Features Sony’s RX1R III is essentially a miniaturized full-frame camera built into a fixed-lens compact. At its heart is a 61-megapixel Exmor R CMOS sensor (35mm format) with no optical low-pass filter dpreview.com. This is the same ultra-high-resolution chip used in Sony’s latest a7R series bodies, now squeezed into a coat-pocketable form factor. The sensor’s BSI (backside-illuminated) design and updated microlenses help it achieve wide dynamic range (~15 stops) and low noise, despite the pixel-dense resolution bhphotovideo.com cms.article-factory.ai. In practice, detail rendering is outstanding – photographers can heavily crop images and

30 August 2025

OM System OM‑3 Review: Retro Style Meets Cutting‑Edge Performance in a Travel Powerhouse

Key Facts Meet the OM System OM‑3: Vintage Vibes, Modern Tech The OM System OM‑3 is the latest mirrorless camera from OM Digital Solutions (the successor to Olympus’s camera division). Announced in early 2025, the OM‑3 immediately turned heads with its retro-inspired styling and advanced internals. Unlike the earlier OM‑1 and OM‑5 which continued Olympus’s DSLR-style designs, the OM‑3 carves out a new niche in OM’s lineup dpreview.com. It clearly draws on the classic Olympus OM film cameras – from the silver top plate and leatherette wrap to the distinct prism hump – giving it a vintage look that photographers

30 August 2025

Nikon Coolpix P1100 Superzoom Announced: 125× Zoom Beast Unveiled – Specs, Rumors & Expert Insight

Key Facts Specs and Features: The Superzoom Returns (Mostly Unchanged) Lens & Zoom: At the heart of the Coolpix P1100 is its monster 125× NIKKOR zoom lens, 24–3000mm (35mm-equivalent). This is the same lens unit used in the P1000, featuring 17 elements in 12 groups (including 5 ED and 1 Super ED element for chromatic aberration control) petapixel.com petapixel.com. The lens has a maximum aperture of f/2.8 at the wide 24mm end, which narrows to f/8.0 at the 3000mm telephoto end petapixel.com imaging.nikon.com. Such a small aperture at full zoom means it needs a lot of light or higher ISO

30 August 2025

DJI Matrice 400 RTK vs Matrice 350 RTK: 59-Minute LiDAR Powerhouse Faces the Trusted Workhorse

Key Facts & Highlights Introduction Professional drone operators face a pivotal choice in 2025: stick with the proven Matrice 350 RTK or upgrade to DJI’s new flagship, the Matrice 400 RTK. The M350 RTK earned its reputation as an industrial workhorse – a reliable, 55-minute flyer with solid payload capacity and rugged build. DJI’s Matrice 400 RTK, however, promises to redefine what an enterprise drone can do, with nearly an hour of airtime, double the payload, and a suite of smart features previously unseen on DJI platforms Advexure Advexure. This report provides a comprehensive comparison of the M400 and M350,

30 August 2025

Snore Wars: Soundcore Sleep A30 Takes on Bose Sleepbuds & the Future of Quiet Nights

Key Facts Overview: What Are the Soundcore Sleep A30 Earbuds? The Soundcore Sleep A30 (by Anker) are a new breed of “sleep earbuds” – tiny wireless earphones designed exclusively to help you sleep better rather than pump out hi-fi music. Launched in 2025 as the third generation of Soundcore’s sleep-focused earbuds, the A30s are most notable for being the first in this category to include Active Noise Cancellation. Soundcore claims the Smart ANC can block up to 30 dB of external noise by combining dual microphones and noise-canceling circuitry with the physical seal of the earbud in your ear theverge.com. In

30 August 2025

Framework Laptop 12 Review: A Modular, Colorful 2‑in‑1 Redefining Repairable Laptops

Key Facts Summary Overview and Design The Framework Laptop 12 is a fresh entrant in the ultraportable scene, combining a compact 12-inch form factor with Framework’s signature modular design philosophy. Announced in early 2025 and now shipping (as of mid-2025), it represents Framework’s push into a more affordable, student-friendly device without sacrificing repairability community.frame.work community.frame.work. Visually, it breaks the mold: the Laptop 12 comes in a range of playful two-tone colorways (Black, Gray, Sage, Lavender, or Bubblegum) instead of the plain metal finish of its predecessors reddit.com. Each has a contrasting top vs. bottom casing – for example, the Bubblegum

30 August 2025

This Tiny 4.5L PC Has 128GB of RAM – Meet the Framework Desktop, 2025’s Modular Mini-ITX Monster

Key Facts at a Glance Overview of the Framework Desktop (Features, Specs, Build) The Framework Desktop’s front panel is composed of 21 swappable tiles (one removed here), allowing personal customization of color and design. Two front Expansion Card slots (bottom left) let you choose I/O ports (USB-C, USB-A, audio jack, SD reader, etc.) using the same modular card system as Framework’s laptops community.frame.work tomshardware.com. A Small Form Factor Beast: The Framework Desktop is a 4.5 L mini workstation that punches above its weight. At roughly 96.8 × 205.5 × 226.1 mm in size (and ~3.1 kg weight) frame.work frame.work, it’s

30 August 2025

Huawei Pura 80 Ultra Dominates – A Deep Dive into Huawei’s Pura 80 Series Flagships

Introduction Huawei’s Pura 80 series has burst onto the smartphone scene as 2025’s most talked-about flagships. After years of setbacks from US trade bans, Huawei is mounting a comeback with these photography-focused phones, boldly challenging Samsung, Apple, and other rivals. The lineup – comprising the Huawei Pura 80, Pura 80 Pro, Pura 80 Pro+ (China-only), and the range-topping Pura 80 Ultra – pushes cutting-edge hardware, especially in camera tech. The Pura 80 Ultra in particular is turning heads worldwide, topping camera rankings and prompting comparisons to Samsung’s Galaxy S25 Ultra and Apple’s latest iPhones. But as we’ll explore, these phones

30 August 2025

OnePlus Watch 3 Shocks the Smartwatch World with a 120‑Hour Battery (Is It 2025’s Best Wearable?)

Key Facts Design and Build Quality The OnePlus Watch 3 makes a bold first impression as a sleek yet substantial timepiece. It retains the round, classic look of its predecessor, resembling a traditional dress watch more than a sporty gadget techradar.com. OnePlus has doubled down on premium materials: the Watch 3’s frame is stainless steel, now accented by a harder titanium bezel for extra durability (an upgrade from the all-steel bezel on the Watch 2) techradar.com. Covering the 1.5-inch AMOLED display is a sapphire crystal lens, rated 8 on the Mohs hardness scale, which significantly boosts scratch resistance oneplus.com techradar.com. These high-end materials

29 August 2025

Motorola Razr Ultra 2025 Shakes Up the Flip Phone Game with Ultra Power, Style & Innovation

Key Facts: Pricing and Availability The Razr Ultra 2025 hit the market in April 2025 as Motorola’s ultra-premium offering, priced at $1,299 (USD) for 512 GB storage Techradar. A 1 TB variant is available for $1,499 (primarily sold unlocked via Motorola.com) Techradar. In the UK it launched at £1,099 (512 GB) Techradar. Notably, the Ultra is not officially sold in Australia Techradar, marking a limited regional release. This phone is expensive – one reviewer quips it’s “Galaxy Ultra territory” and a “heaped helping of substance” to justify the cost Techradar Theverge. Major U.S. carriers offer the Razr Ultra, often with

29 August 2025

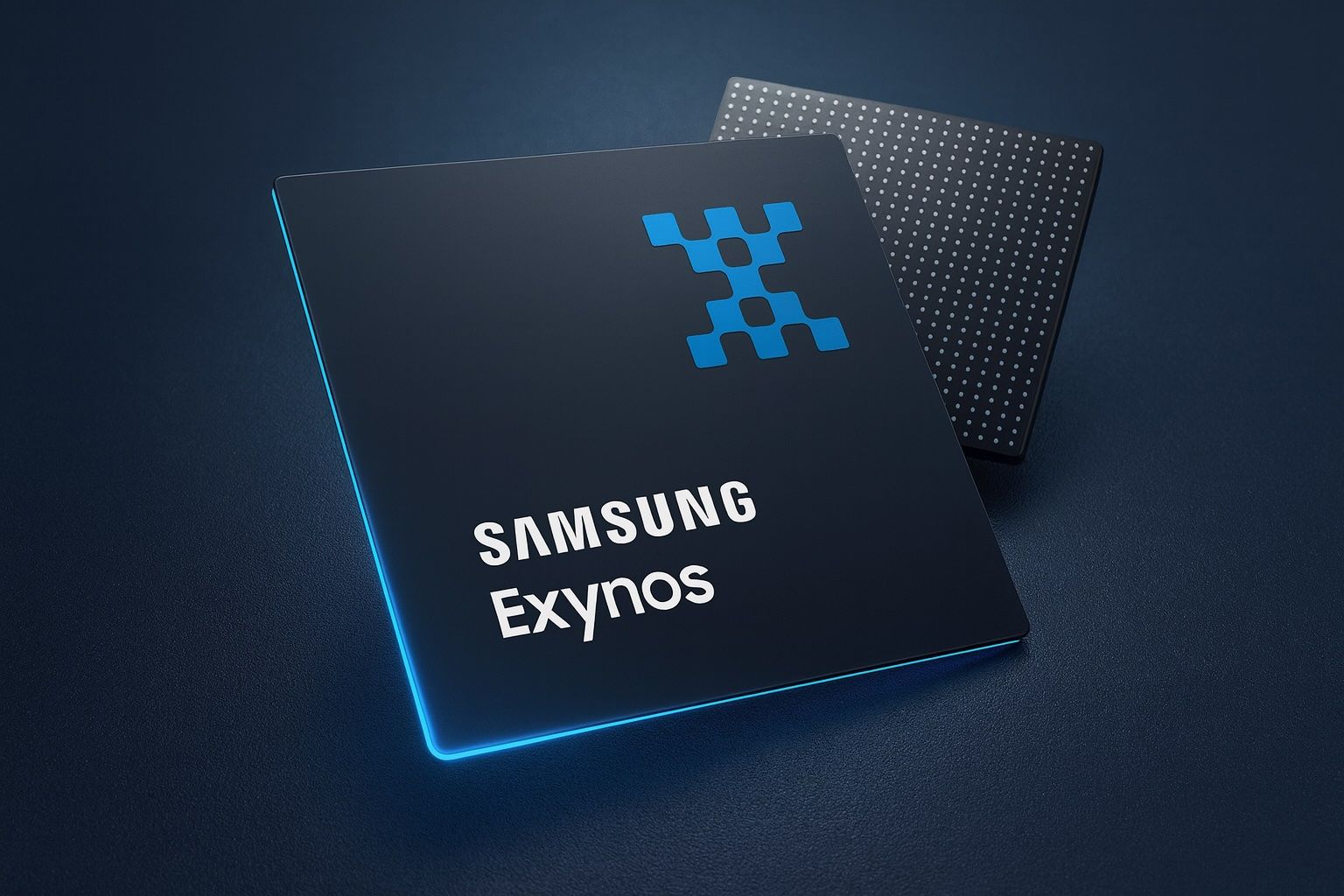

Exynos 2600 vs Snapdragon vs Apple A17 Pro: Samsung’s 2nm Comeback Chip Shocks the Smartphone World

Sources: Samsung/SamMobile news sammobile.com sammobile.com sammobile.com sammobile.com sammobile.com; Wccftech leaks wccftech.com wccftech.com wccftech.com; NotebookCheck analysis notebookcheck.net notebookcheck.net notebookcheck.net; Android Authority and AnandTech data androidauthority.com androidauthority.com androidauthority.com; Patsnap/Eureka research eureka.patsnap.com eureka.patsnap.com; HotHardware/Videocardz industry insights hothardware.com hothardware.com; SamMobile reports and editorials sammobile.com sammobile.com sammobile.com sammobile.com.

29 August 2025

Stock Market Today

Tower Semiconductor stock jumps again on Nvidia optics tie-up as earnings near

8 February 2026

Tower Semiconductor shares rose 7.7% to $139.04 Friday after announcing a collaboration with Nvidia on AI data-center networking. The stock touched $141 intraday and gained another 1% after hours. Investors await Tower’s Feb. 11 earnings for details on its silicon photonics work. No financial terms or shipment timeline were disclosed.

Longsys Electronics stock heads into Monday after new guarantees; what 301308 investors watch next

8 February 2026

Longsys disclosed new guarantees for a 100 million yuan Hong Kong loan and a $9 million Brazil credit line, bringing its total approved guarantee quota to 11 billion yuan and outstanding guarantees to 5.81 billion yuan. The company said all guarantees are for consolidated subsidiaries and within approved limits. Shares closed at 288 yuan Friday, down 1.6%. China inflation and credit data are due this week.

MACOM stock price steadies near highs into Monday after earnings pop and fresh filings

8 February 2026

MACOM shares rose 3.5% to $235.87 Friday after the company reported fiscal Q1 revenue of $271.6 million and raised its full-year data center growth outlook to 35–40%. Fidelity’s FMR LLC disclosed a 10.7% stake, while shareholder Susan Ocampo filed to potentially sell up to 100,000 shares. Stifel raised its price target to $255. MACOM expects to repay $161 million in convertible notes in March.

LONGi Green Energy stock in focus: 1.65 bln yuan patent fee signals higher costs as China solar outlook softens

8 February 2026

LONGi Green Energy’s Shanghai A-shares closed up 0.7% at 18.36 yuan on Friday after a 1.65 billion yuan BC solar patent licensing deal was disclosed this week. The agreement, involving Aiko Solar and Maxeon, set a price for key solar IP as industry forecasts point to a drop in China’s 2026 new solar installations.