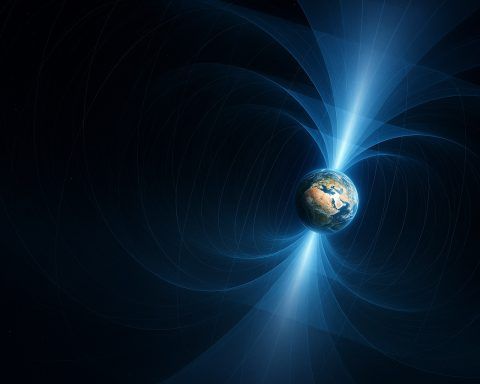

Earth’s Magnetic Field Today (Nov. 11, 2025): Equatorial Polarity Twist, South Atlantic Anomaly Expands, and NOAA Issues G2–G3 Geomagnetic Storm Watches

Updated: November 11, 2025 Key points What’s new today Geomagnetic storm watches (Nov. 11–13): The U.S. National Oceanic and Atmospheric Administration (NOAA) says several coronal mass ejections are expected to begin arriving later today, prompting watches for G2 (Moderate) on Nov. 11, G3 (Strong) on Nov. 12, and G1 (Minor) on Nov. 13. Forecast uncertainty remains because of how the CMEs may interact en route, but storm‑time impacts can include stronger auroras, intermittent HF radio issues, and navigation disturbances. NOAA Space Weather Prediction Center Fresh research spotlighting a growing weak spot: A new study synthesizing 11 years of ESA’s Swarm