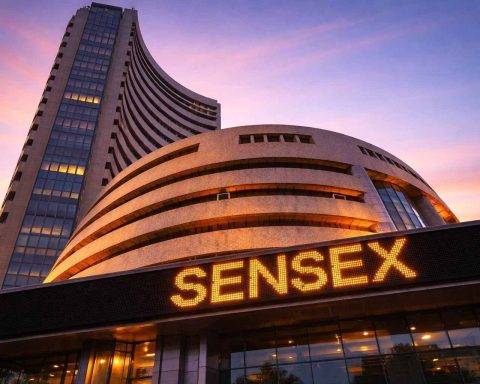

India stock market today: Sensex, Nifty end higher again as Budget week collides with a record-low rupee

Sensex closed up 0.27% at 82,566.37 and Nifty 50 gained 0.30% to 25,418.90, led by metals and private banks. The rupee ended at 91.95 against the dollar, down 16 paise. Markets recovered after the economic survey projected 6.8–7.2% growth for FY27. Attention now shifts to Sunday’s special Budget session.