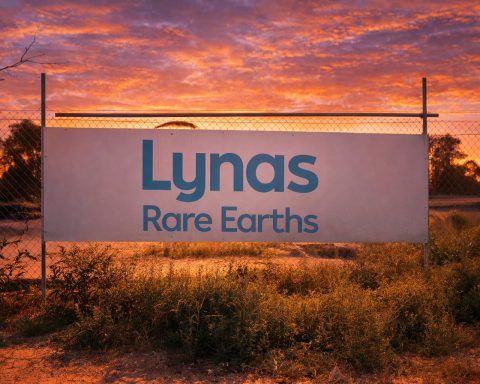

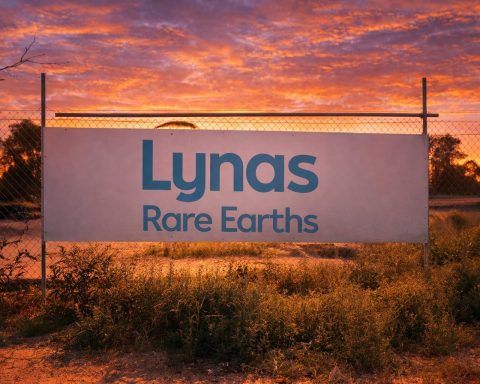

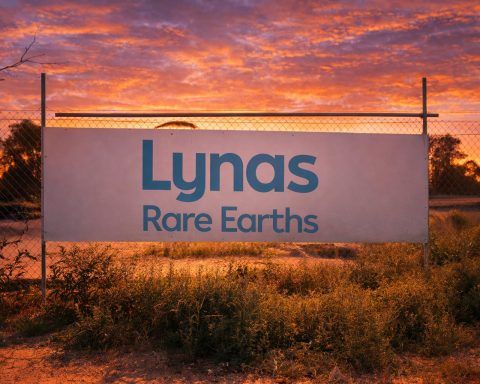

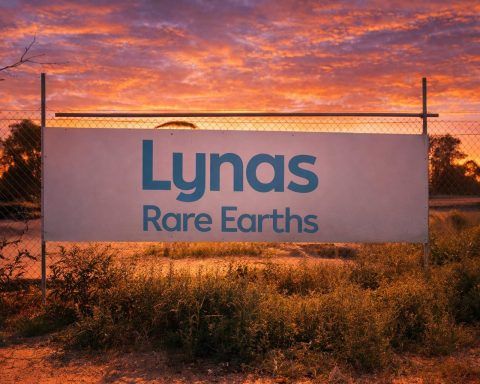

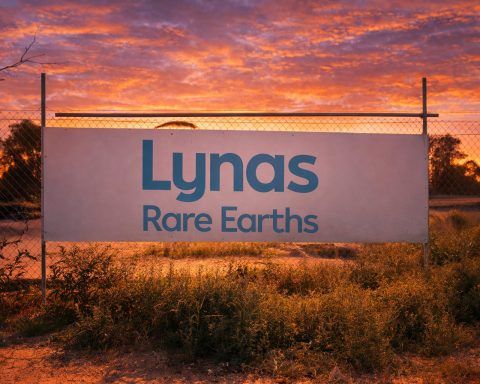

Lynas Rare Earths stock rises on CEO exit plan — what ASX:LYC investors watch next

Lynas Rare Earths shares closed up 2.5% at A$15.15 after CEO Amanda Lacaze announced plans to retire at the end of the financial year. The board has begun searching for her successor. The move comes as Australia and G7 partners discuss ways to stabilize rare earth supplies and Canberra launches a A$1.2 billion strategic reserve for critical minerals.