Vertiv Stock (VRT) in December 2025: AI Data Center Supercycle, New Deals, and Wall Street Forecasts

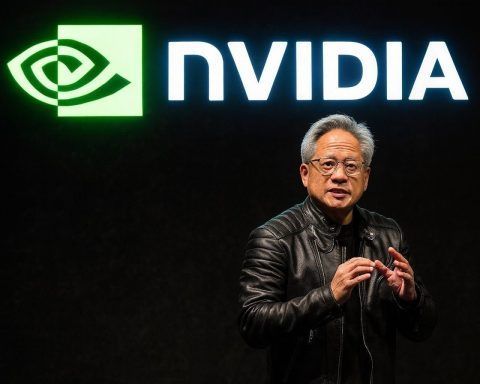

Vertiv Holdings shares traded near $189 in early December, close to their 52-week high, with a market cap around $68–72 billion. The company reported Q3 2025 net sales of $2.676 billion and announced an AI-focused acquisition, a power alliance with Caterpillar, and expanded collaboration with NVIDIA. The stock is up over 50% year-to-date, outpacing major indices.