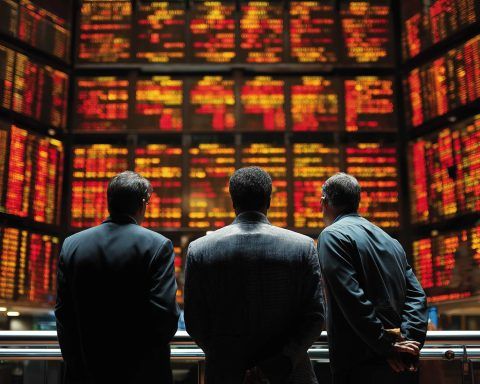

Dow Futures Soar as Fed Rate Cut Looms, Trade Deal Advances – Tech Earnings Fuel Record Rally

Dow Futures Extend Rally After Record Week U.S. stock index futures rose strongly early Monday, extending Wall Street’s bullish momentum after a record-breaking finish last week. Dow Jones Industrial Average futures gained roughly 337 points (about +0.7%) in pre-market tradingwatcher.guru, while S&P 500 futures added ~0.7% and Nasdaq 100 futures outpaced with a +2.3% surgewatcher.guru. The rally comes on the heels of Friday’s powerful upswing, when cooler inflation data ignited broad buying. The Dow jumped ~400 points (≈+0.8%) Friday to close at an all-time high, with the S&P 500 and Nasdaq Composite each climbing ~0.8–1.0% to their own record levelsts2.tech.