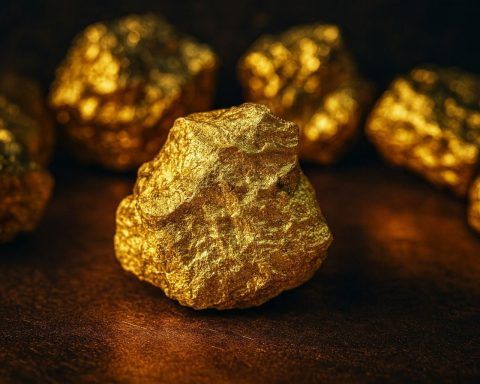

Gold Price Today (Dec. 18, 2025, 09:55): XAU/USD Holds Near $4,330 as Softer U.S. CPI Revives Fed-Cut Bets

Gold hovered near record highs on December 18, with spot prices down 0.4% at $4,323.57 an ounce by 12:10 GMT. U.S. November CPI rose 2.7% year-on-year, below the 3.1% forecast, fueling bets on lower interest rates. The dollar index slipped after the data. Thin trading kept gold in a narrow range.