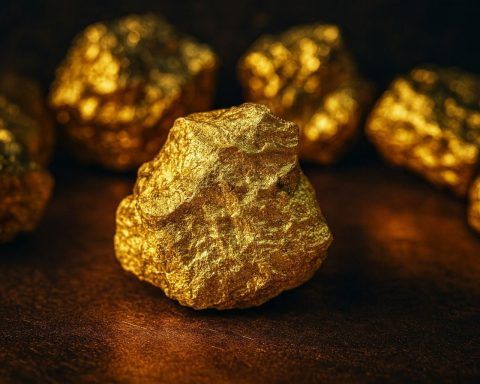

Gold Price Today, December 9, 2025: XAU/USD Steadies Above $4,200 as Markets Brace for Fed Rate Cut

Gold traded at $4,211–$4,227 per ounce Tuesday afternoon in New York, up about 0.4–0.7% on the day and near October’s record high of $4,398. The price held steady as traders awaited the U.S. Federal Reserve’s policy decision Wednesday, with markets pricing in an 85–90% chance of a 25-basis-point rate cut. Gold has gained nearly 60% over the past year.