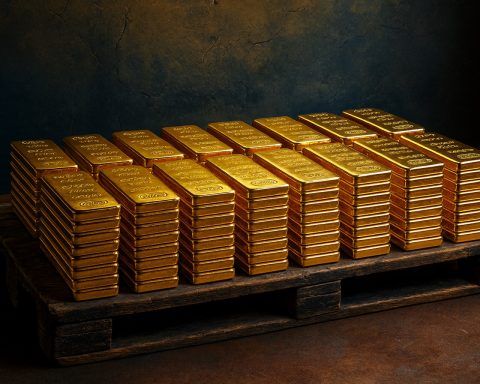

Gold Soars Near $4,000: Inside 2025’s Record Rally and What Comes Next

Spot gold traded at $3,984 per ounce on November 3, 2025, near record highs after hitting an all-time peak of $4,381 on October 20. Prices remain up over 50% year-to-date, the strongest annual gain since 1979. Central banks are set to buy around 1,000 tons this year, while gold ETF inflows have reached a record $64 billion. Silver briefly topped $51 per ounce, up more than 70% in 2025.